Opinion pieces and speeches by EPI staff and associates.

[ THIS TESTIMONY WAS GIVEN BEFORE THE U.S. SENATE COMMITTEE ON FINANCE ON JANUARY 10, 2007. ]

Tax Incentives for Businesses in Response to a Minimum Wage Increase

By Jared Bernstein

Introduction

Chairman Baucus, Ranking Member Grassley, members of the Finance Committee, I thank you for this opportunity to testify on the proposed legislation to raise the Federal minimum wage. This is a critically important issue to millions of low-wage working Americans, many of whom have seen their economic fortunes dwindle in recent years, even as our nation’s economy has prospered.

I urge you to speed Congressional passage of the proposed minimum wage increase and to do so without potentially expensive and poorly targeted tax provisions. Such provisions are unwarranted given the extensive tax cuts to business both small and large over the past decade, the relatively small magnitude of the current minimum wage proposal, difficulty targeting affected firms, and the lack of a clear incentive to offset the potential costs of the wage proposal.

The United States economy is in many ways the envy of the world. Productivity growth, a key measure of economic efficiency, has been stellar over this business cycle, rising 3.1% per year.1 Our unemployment rate has been below 5% for the past year, and though real wage gains arrived on the scene only recently in this recovery, the last few months have been impressive in this regard as well. Profits to the nation’s businesses have soared throughout the recovery, and as a share of national income, profits stand at a 56 year high.2

Yet, amidst all this prosperity, too many working families have been left behind. The income of the typical, working-age family is down five percent, or $3,000 dollars since 2000, and at the low end of the income scale, where the minimum wage makes a real difference, poverty is up significantly, from 11.3% of the population in 2000 to 12.6% in 2005.3

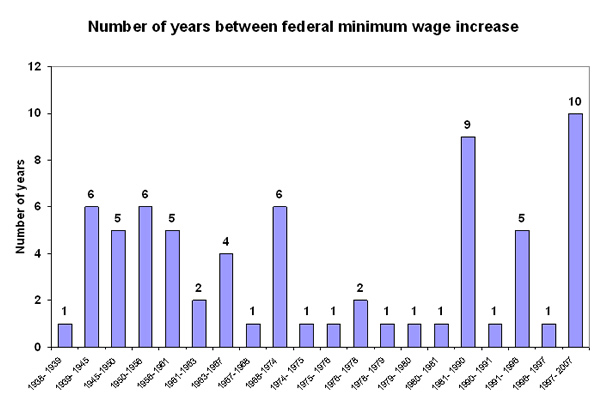

There are many reasons for the disconnection between growth and broadly shared prosperity, but one factor that has undoubtedly played a role is long-term decline in the real value of the minimum wage. Congress legislated a two-step increase in the minimum wage in 1996, and the wage floor has not been raised since September of 1997. As shown in Figure 1, we recently entered the longest period on record in which Congress has failed to raise the federal minimum wage.

As Congress considers legislation to raise the minimum wage to $7.25 by 2009, my testimony stresses these points:

• In terms of its buying power, the federal minimum wage stands at a 52 year low. Compared to the average wage, the current minimum wage stands at 30.8%, the lowest level on record.4

• Since the last increase in the minimum wage, inflation has eroded one-fifth of its value. For someone working full-time, full-year at the federal minimum, this represents a loss of over $2,500 per year.

• While opponents of the increase stress job loss effects, recent research on the employment impacts of minimum wage increases show such effects to be negligible, with estimates that hover about zero; high-quality research tapping pseudo-experimental methods has been particularly enlightening in this regard.

• The last increase in the federal minimum wage did not result in any of the negative predictions made by opponents. Instead, it was followed the strongest job and wage growth in the low-wage labor market in decades.

• Economists and policy makers are recognizing the importance of the new research and these actual outcomes. In 2006, over 650 economists, including five Nobel Prize winners and six past presidents of the American Economics Association signed a statement that stated: “[w]e believe that a modest increase in the minimum wage would improve the well-being of low-wage workers and would not have the adverse effects that critics have claimed.”

• The proposal under consideration is very modest. We forecast that it will directly lift the earnings of four percent of the workforce, about half the share reached by the 1996/97 raise.

• Given this moderate result, the Congress should pass a “clean” minimum wage bill, without tax cuts. Only one federal increase—the last one—was accompanied by such cuts, and since then businesses small and large have benefited from $300 billion in tax cuts. Any further cuts should be debated on their own merits, outside of this minimum wage debate.

The Decline in the Buying Power of the Minimum wage

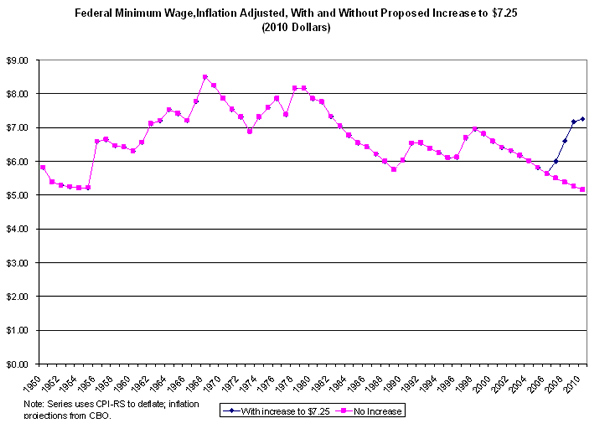

Figure 2 shows the long-term trend in the minimum wage, adjusted for inflation, including a projection of H.R. 2429, a proposal to raise the minimum wage in three steps from $5.15 to $7.25 by 2009.

The series in Figure 2 shows how inflation erodes the buying power of the minimum wage, and reveals the two longest periods in which Congress failed to increase the wage: the current period, and the 1980s. Using CBO inflation projections to put these wage values in 2010 dollars, the figure shows the alternative paths of allowing inflation to further erode the current minimum wage versus raising the wage floor to $7.25. The increase would return the buying power of the federal minimum back to its level in the early 1980s.

Bernstein and Shapiro (2006) show a similar long-term trend in the minimum wage relative to the average wage of non-managerial workers. As we noted in that report, “The federal minimum wage has often been set with the level of other workers in mind. This approach reflects the principle that minimum-wage workers should share in economic gains and should not fall too far behind other workers.” 5

During the 1950s and the 1960s, the minimum wage averaged 50%—or half—the average wage of workers in nonsupervisory positions. The minimum wage has now fallen to 30.8%—or less than one-third—of the average hourly wage for nonsupervisory workers of $16.73 in 2006. This is the lowest share in the history of this data series, which begins in 1947. Research has shown that the fall in the relative value of the minimum wage has contributed to the persistent increase in wage inequality since the latter 1970s.6

Who Would Benefit From an Increase in the Minimum wage to $7.25?

Research by Liana Fox at the Economic Policy Institute (Appendix Table 1) reveals that about 4% of the workforce, about 5.6 million, would be directly affected (another 7.4 million might indirectly benefit through so-called spillover effects). Most directly affected workers are adults (71%) and women (61%); 43% work full-time, and another 36% work 20-34 hours per week. Comparing the two columns reveals that those disproportionately affected by the increase include African-Americans and Hispanics, and workers in retail, hospitality, sales and low-end services.

Analysis shown in Table 1 suggests that while affected workers are disproportio

nately in smaller firms, size is by no means a primary determinant indicator of minimum wage receipt. About 11% more affected workers are in small (less than 100 employees) relative to all firms, and only 7.5% fewer are in large firms (more than 1000).

While data suggest that most of the prospective beneficiaries of the proposal are adults working in low-wage sectors, some critics have claimed that the minimum wage is poorly targeted. That is, since receipt of the minimum is not income-tested, some who benefit from the increase live in families with incomes above the poverty line.

Research on workers’ wage levels by income class reveals, however, that the policy is actually highly progressive in the sense that most of its benefits flow to working families in the lower reaches of the income scale, families that arguably need the raise. Over half of the benefits flow to families in the bottom 30%, families that receive only 14% of total income, and whose average income is around $25,000.7 On the other end of the income scale, less than 5% of the benefits from an increase in the minimum wage are likely to flow to families in the top ten percent of the income scale.

Furthermore, new research by Furman and Parrot (2007) on the current minimum wage proposal finds the just under half (48%) of those likely to benefit from the higher wage are their family’s primary breadwinner while a similar share (47%) live in families below twice the poverty line.8

Of course, since minimum wage receipt is not conditioned on family income, it lacks the target efficiency of the Earned Income Tax Credit, a wage subsidy for low-wage workers in low income families. However, it is worth recalling Congress’ initial motivation for enacting the policy back in 1938. In addition to raising the living standards of low-income families, the policy is also a statement that we will not let the market drive wages down to unacceptably low levels. This is equally as true for a middle-class youth working to raise money for college as it is for a single mother supporting a family. Raising the income of the working poor is not the sole purpose of the minimum wage. It is also about the value and dignity of work, and the opportunities that work provides, regardless of family income.

It’s also the case that while most minimum wage workers will soon earn above the minimum as they gain skills and experience, a minority remain at or near the minimum wage for years. Carrington and Fallick (2001) use longitudinal data to show that a non-trivial share of workers continue to earn wages near the minimum wage for extended periods of time.9 For example, they find that ten years into their career, about ten percent of the population held a job paying near the minimum wage, with higher shares for women and minorities.

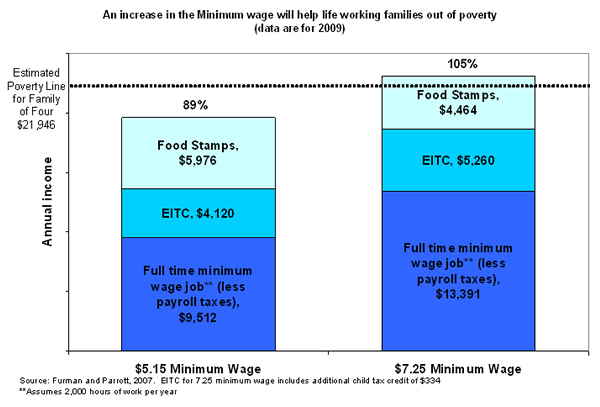

Returning for a moment to the question of the Earned Income Tax Credit, because it is more precisely targeted, opponents often argue that it is preferable to the minimum wage for helping low-income workers. Yet Furman and Parrott (2007) show the complementary nature of the EITC and the minimum wage. Figure 3 shows that a family of four with one full-time, minimum-wage worker remains below the poverty line, even when we account for EITC and the market value of food stamps. With the increase to $7.25, however, the family’s income goes above the poverty threshold. For a family with two minimum-wage workers—one full and the other half time—income relative to poverty comes to 108% under the current minimum and 126% under a $7.25 wage. In other words, the increase in tandem with available tax credits helps move families from poor to near-poor.

This complementarity is too often ignored by minimum wage opponents who advocate for sole reliance on the EITC to help low-wage workers. Since the policy under discussion is a minimum wage increase, it is not suitable to simply cite the existence of the EITC as a counterargument. Minimum wage opponents taking this tack must advocate for an expansion of the tax credit. This clearly has a fiscal cost which must be considered, one which many, myself included, might well deem worthy. Yet taxpayers may reasonably view a higher minimum wage as another valid source of support for low-wage workers. Congress can of course offset the costs of expanding the EITC by phasing the credit out more quickly, but this higher marginal tax rate creates a work disincentive that lawmakers may want to avoid.

Will the Increase Price Low-Wage Workers out of the Labor Market?

Like any legislated policy change, Congress needs to consider any unintended consequences generated by the policy. The most scrutinized question in this regard is whether increases in the minimum wage lead employers to lay off workers affected by the increase. The question flows from the simplest version of economic theory which predicts that workers whose wages rise by mandate instead of by market forces will be priced out of the labor market.

Like all theoretical contentions in economics, this question can only be answered by looking at the evidence. In this regard, there are some important insights for Congress to recognize:

• The fact that so many states and cities have introduced their own minimum wage, above the federal level, has allowed research to tap this rich variation in the context of pseudo-experimental designs. Much of this research has found no measurable disemployment (Card and Krueger, 1995), challenging the simplistic theory of the labor market.10

• In cases where the new research does find job loss effects, these effects tend to be small, in that the number of beneficiaries from an increase far surpass the number of job losers.

• This work has moved many economists’ views. As Nobel laureate Robert Solow stated: “The main thing about this research is that the evidence of job loss is weak. And the fact that the evidence is weak suggests that the impact on jobs is small.”11

Echoing these sentiments, Alan Blinder, a leading economic thinker and a former vice chairman of the Federal Reserve, recently summarized the research this way: “What’s changed in the last 10 to 15 years is an accumulation of pretty convincing evidence that the employment problem is not very significant.” 12

In fact, note the difference in the way Blinder discusses the policy in two editions of his influential economics textbook.

From the first edition (1979, p. 519): “… the minimum wage effectively bans the employment of workers whose marginal product is less than [the minimum wage]. The primary consequence of the minimum wage law is not an increase in the incomes of the least skilled workers but a restriction of their employment opportunities.”

From the tenth edition (2006, p. 493): “Elementary economic reasoning… suggests that setting a minimum wage…above the free-market wage…must cause unemployment… Indeed, earlier editions of this book, for example, confidently told students that a higher minimum wage must lead to higher unemployment. But some surprising economic research published in the 1990s cast serious doubt on this conventional wisdom.”

As much of this new research was being conducted, another very important phenomenon occurred: the federal minimum wage increase of 1996/97 was followed by the best low-wage labor market outcomes in decades. When that proposed increase was under discussion, opponents predicted massive job losses among those affected by the increase from $4.25 to the current level of $5.15. Instead, the employment rates of the least advantaged workers soared to unprecedented levels, poverty rates fell to historic lows, particularly for minority populations, the least skilled workers, and single mothers. Low wages rose in step with productivity growth for the first time in almost thirty years.

Note that I do not claim that the federal minimum wage increase was solely responsible for these outcomes. It helped boost wages at the very bottom of the wage scale, but the full employment macroeconomic conditions that prevailed over these years were of much greater importance. But Congress should take note: the 1996/97 increase complemented these conditions; it did not preclude them.

I stress the gains of the least advantaged workers in this context for an important reason: these are the same populations that opponents of the current increase argue will be hurt the most by the increase under consideration. They were wrong the last time we had this debate, and they are wrong today.

An objective reading of the minimum wage research on this question of job loss leads to this conclusion: moderate increases have their intended effect. They raise the incomes of the vast majority of their intended beneficiaries without hurting their employment prospects.

Before closing this section, lawmakers will reasonably wonder: if minimum wage increases do not lead to significant job loss effects, how are the increases absorbed. The mechanisms appear to be profits, prices, and productivity. Researchers have not suitably quantified the relative roles of these absorption mechanisms, it part because they interact and are very difficult to parse out.

There is some evidence of price effects, but they are relatively small, suggesting pass-though of a small fraction of the wage increase (Lee et al, 1999; Aaronson, 2006).13 There is less evidence of redistribution from profits to wages, though this is due to data limitations and the difficulty teasing out this impact from the myriad forces effecting profit margins. However, it is likely that this is an important mechanism. Certainly, the investment in lobbying activities by affected firms to stop such increases is indirect evidence of this effect.

Finally, numerous researchers have suggested that higher minimum wages partially pay for themselves by reducing firm-level inefficiencies such as protracted vacancies and excessive turnover, both of which are notable problems in low-wage industries. Higher wages, it is argued, reduce these costs, and thus while wage costs may rise following a minimum wage increase, neither unit labor nor unit profit costs (wages or profits relative to productivity) are likely to follow suit.

Note that both the productivity and price mechanisms imply that the net cost to businesses of a minimum wage increase are lower than the gross costs. This insight has implications for the final section of this testimony.

Should the Increase by Accompanied by Tax Cuts?

Some members of Congress, as well as President Bush, have argued that the increase in the minimum wage should be accompanied by tax cuts to affected businesses to offset the increase in labor costs. While such tax cuts may or may not have merit, there are many good reasons to separate these two ideas in the policy process, and pass a clean minimum wage bill (i.e., a bill that solely raises the minimum wage).

• Unless they are strictly temporary, any tax cuts are likely to cost more and last longer than the minimum wage increase, i.e., the offset will deprive the federal budget of more revenues than the policy it is supposed to be offsetting.

• Since the proposed increase is a federal mandate, except for those states with minimum wages above $7.25, every firm faces the same minimum. The fact that no firm is at a competitive disadvantage also militates against the need for offsets.

• Since many businesses with low-wage workers are already paying wages above $7.25 (or will be by 2009), or are in states with higher minimum wages, it will be very difficult to target any offsets to firms actually facing higher labor costs due to the proposed increase.

• Even if Congress could target the cuts, it is not clear what costs these tax cuts are supposed to offset. Since employment effects are negligible at best, these cuts will not lead businesses to retain workers they would have otherwise laid off. This, along with the targeting challenge, raises the possibility that the cuts could end up being a windfall for businesses that have already received billions in tax cuts.

• The Democratic majority has committed to a pay-as-you-go budget rule, meaning the cost of these tax cuts will have to be made up with either more revenue or less spending in some other part of the budget. Any offsets that are used for this bill will thus not be available for other, more pressing priorities, such as providing health coverage for all eligible children through SCHIP and reversing the loss of subsidized child care placements.

The budgetary cost of the tax cuts can easily swamp the costs engendered by the minimum wage, i.e., the supposed offsets are ultimately likely to cost much more than the policy they are offsetting. Since the minimum wage is not indexed for inflation, it fades over time as a cost to business. For example, the value of the last federal minimum wage increase has been fully eroded by inflation and no longer constitutes an increased business cost.14 Yet the tax cuts that were passed in 1996 allegedly to offset the cost of this eroded increase remain in place. In fact, several have been expanded (e.g., expensing caps under section 179 have been raised significantly since 1996).

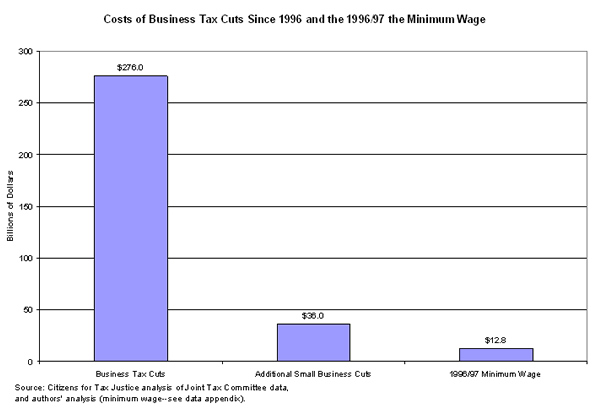

My estimate of the increase in labor costs through 2005 attributable to the 1996/97 federal minimum wage hike is about $13 billion (see Figure 4 and data appendix). Joint Taxation Committee data, analyzed by the Citizens for Tax Justice, reveal $276 billion worth of tax cuts targeted at businesses over the past decade, with an additional $36 billion in cuts targeted directly to small businesses. Of course, only a small share of the budgetary costs of these cuts date back to the 1996 minimum wage legislation, but the point stands: businesses, both small and large, have been much more than compensated for any labor cost increases associated with a minimum wage increase, past and future.

In this context, it is also worth considering the relatively small share of workers affected by the proposed increase. Along with state minimum wage increases, nominal wages have grown considerably since the last increase, and the 10th percentile wage was about $7.50 in 2006. Aging this value by CBO inflation projections yields a 10th percentile wage of $7.90 in 2009, already well above the proposed minimum scheduled to phase in that year. CBO projects that in the FY2010, the first year when the proposed bill is fully phased in, the cost will by $5.7 billion, less the 0.1% of total wage and salary costs.15 The current proposal is thus unlikely to represent a significant cost increase to businesses, and will ve

ry likely cost less than any tax cuts under consideration.

These values imply that any tax cuts associated with this bill has a potentially serious targeting problem, in that it will be impossible for Congress to reliably reach firms whose labor costs are raised by the wage increase. Many businesses in states with higher minimum wages are already paying higher wages to their low-wage employees (California, Connecticut, Massachusetts, Oregon, and Washington State either already have or are scheduled to have their own minimum wage higher than the Federal). As the above wage numbers reveal, market forces have also led many low-wage employers to already pay more than the new minimum. Thus, some employers will essentially receive a windfall: a tax cut to compensate them for a federal minimum wage increase that did not affect them at all.

Even if Congress could effectively target the tax cuts to businesses that whose labor costs were truly affected by the increase, it is worth asking whether this is a wise reason to sacrifice revenue. These employers have kept wages very low relative to employers in states with higher minimum wages, or those providing better jobs in states still tied to the federal minimum. Why should these employers be compensated for raising wages, after years of benefiting from Congressional inaction on the minimum wage?

Possibly for these reasons, minimum wage bills have historically not included tax cuts. Only one federal minimum wage bill, the 1996 legislation, included such cuts. Relative to much of Congress’ work, raising the minimum wage is a simple, highly transparent piece of legislation, requiring little more than statements of the wage level and phase-in dates. Tax cuts, however, complicate the legislation considerably, both because of their complexity and their budgetary implications.

Congress should be particularly wary of any ideas to weaken existing labor standards. For example, one source suggested that as part of this bill, businesses with gross annual sales of less than $1 million should be exempted from minimum wage laws (the current cap is $500,000), or that workers should not get overtime in one week, if they work reduced hours the next week (so called “flex time”).16 Analysis by Ross Eisenbrey of the Economic Policy Institute finds that the proposal to raise the FLSA coverage threshold to $1 million will remove more employees from minimum wage and overtime coverage than the number directly affected by the proposed wage increase. These ideas go way beyond monetary offsets, striking at the heart of long-standing protections that insulate workers with little bargaining power from unfair treatment and privation-level wages.

None of these points are intended to cast aspersions on any particular tax cut to businesses. Members of this committee are surely aware, for example, that the limit for small business expensing will revert back to $25,000, not indexed for inflation, by 2010 (2003 tax legislation set the level to $100,000, indexed). There is ample time before that sunset, however, to address this reversion.

This strategy of discussing each tax cut on its merits is particularly important as not every proposed cut can reasonably be viewed as a legitimate offset to a minimum wage increase. Legislation by the House of Representatives in the previous Congress attached a partial estate tax repeal to a minimum wage increase. Offsets to a minimum wage bill in 2000, never enacted, included increased write-offs for business meals and for business investments, tax breaks for timber companies and for tax-exempt bonds, a higher self-employment health deduction, and expanded enterprise zones. While some of these may have merit, they should not be considered offsets to higher labor costs.

Even assuming Congress could target the tax cuts to businesses affected by this proposed minimum wage increase, it seems reasonable to ask the committee precisely what cost these tax cuts are supposed to offset. Recalling the discussion in the last section, since employment effects are negligible at best, these cuts will not lead businesses to retain workers they would have otherwise laid off. To the extent that efficiency gains, such as less vacancies and lower turnover rates absorb the wage increase, the tax cuts are also an unnecessary offset. More likely, the tax cuts will simply feed into higher after-tax profits, a windfall unrelated to the minimum wage hike.

Finally, the Democratic majority has committed to a pay-as-you-go budget rule, meaning the cost of these tax cuts will have to be made up with either more revenue or less spending in some other part of the budget. In an era of worrisome budget deficits, this is a highly worthy endeavor, but the discussion of these fiscal options and their relative tradeoffs should occur independently of a minimum wage increase, a policy that has virtually no fiscal implications. And any offsets that are used for this bill, unnecessarily so in my view, will not be available for other, more pressing priorities.

Conclusion

The American economy is the envy of the world. Our living standards, on average, are well above those in many other advanced economies. Yet, as is well known, there is tremendous variation around that average. Even as the economy prospers, and well-placed workers receive outlandish bonuses on top of impressive salaries, too many in our workforce fail to benefit much at all from their efforts.

This reality violates a basic social value: whether it’s a home health aid dressing the wounds of homebound senior, a cashier on her feet all day in retail, or a CEO atop a global corporation, all the bakers should get their fair slice of the pie. They shouldn’t all get the same slice: some are demonstrably more productive than others. But it is a basic premise of economics, as well as a basic democratic value, that those who contribute to the economy’s productive capacity should receive compensation commensurate with their contribution.

This premise has been violated in recent years, and one reason is that Congress has failed to raise the value of the minimum wage for 10 years, the longest period since the wage floor was introduced in 1938. In that regard, the fact that Congress is considering correcting this oversight is indeed welcome news.

As I have argued, minimum wage policy is a simple, direct way to help lift the earnings of those whose limited ability to bargain for a fair wage has precluded them from sharing in the prosperity they themselves help to generate. High-quality research and the uniquely positive experiences of low-wage workers following the last federal increase has revealed that the policy leads to few of the distortions cited by opponents. And while targeting concerns have also been raised, the evidence shows that most of the benefits from the increase flow to workers who need the raise.

Finally, there is little rationale for adding any tax cuts to this bill. Businesses both large and small have enjoyed hundreds of billions of such cuts over the past decade, as the value of the last federal minimum wage increase has evaporated. The wage increase under consideration is a small one in historical terms, and it is very likely that any tax cuts intended to offset its costs to businesses will swamp it in magnitude. And while the wage increase has no fiscal costs, the same cannot be said for tax cuts. They must either add to the federal budget deficit or, under the new PAYGO rules, be paid for by revenue additions and spending cuts elsewhere.

More tax cuts for businesses may or may not be warranted, but I urge Congress to have save that debate for a different day. Today, there should be little debate: low-wage workers have waited long enough fo

r this much-needed increase in the federal minimum wage.

I thank Jin Dai, Aviva Aron-Dine, Ross Eisenbrey, Michael Ettlinger, Liana Fox, Jason Furman, Rob Gray, Mark Greenberg, Sharon Parrot, and Jesse Rothstein for helpful comments and assistance. Any mistakes are my own.

* Assuming a phase-in with the final step in 2009

** These are the workers earning between the state minimium wage and $7.25

*** Includes workers not covered by minimum wage.

Source: EPI analysis of 2005 Current Population Survey data by Liana Fox.

Data appendix: estimating the costs of the 1996/97 minimum wage increase (Figure 4).

The 1995 outgoing rotation group files of the Current Population Survey were used for this simulation (since later year data sets reflected the actual higher minimum, I would not be able to simulate costs from them). In order to derive a counterfactual against which to measure employers’ costs, I took the difference between the higher minimum wage phased in over 1996-97 and actual wages in the affected range. To simulate wage growth on the 1995 file, I aged wages by actual nominal wage growth at the 20th percentile in each successive year until 2002, when the $5.15 minimum wage no longer was binding (i.e., low-wage growth in the economy applied to $4.25 in 1996 surpassed $5.15 in 2002).

The extra hourly wage costs was then multiplied by weekly hours worked and by 52 (for weeks worked) and finally by the ORG person weight. This variable was aged by the rate of total employment growth, and the values were summed over the data set. The employers share of social security tax (7.65%) was added to this sum.

Endnotes

[1] Source: Bureau of Labor Statistics, Nonfarm Business Productivity, 2001q1-2006q3.

[2] Source: Bureau of Economic Analysis. As a share of gross domestic income, profits were 14.1% in 2006q3, the highest share since 1950q4.

[3] Source: Census Bureau’s data on real median household income of families headed by a person under 65 and poverty for all persons.

[4] See http://www.epi.org/page/-/old/issuebriefs/227/ib227.pdf

[5] See: http://www.epi.org/content.cfm/ib227.

[6] See, for example, David Lee, “Inequality in the United States during the 1980s: Rising dispersion or falling minimum wage?” Quarterly Journal of Economics, 1999, 114(3), 977-1023.

[7] See Figure 6, http://www.epi.org/content.cfm/webfeatures_viewpoints_raising_minimum_wage_2004.

[8] http://www.cbpp.org/1-5-07mw.htm.

[9] http://www.bls.gov/opub/mlr/2001/05/art2full.pdf.

[10] Card, David and Alan B. Krueger. 1995. Myth and Measurement: The New Economics of the Minimum Wage. Princeton, New Jersey: Princeton University Press.

[11] Quoted in Uchitelle, Louis. 1995. “A Pay Raise’s Impact.” New York Times (January 12), p. D1.

[12} http://www.nytimes.com/2006/10/25/business/25leonhardt.html?ex=1168232400&en=d749a9ae053c9174&ei=5070

[13] Chinkook Lee and O’Roark, Brian. The Impact of Minimum Wage Increases of Food and Kindred Product Prices: An Analysis of Price Pass-Through, Technical Bulletin No. (TB1877), August 1999, USDA Economic Research Service. Daniel Aaronson and Eric French. Product Market Evidence on the Employment Effects of the Minimum Wage, Journal of Labor Economics, volume 25, 2007.

[14] Before the first step of the last increase in October 1996, the federal minimum wage was $4.25. In Nov 2006 dollars, that amounts to $5.41 (using CPI-RS), above today’s federal minimum wage of $5.15.

[15] CBO, Letter to Honorable William Thomas, December 29, 2006. CBO also projects that wage and salary income will be 7.43 trillion in 2010.

[16] Congressional Quarterly Today, Jan 2, 07.

Jared Bernstein is a senior economist at the Economic Policy Institute in Washington, D.C.

[ POSTED TO VIEWPOINTS ON JANUARY 10, 2007. ]