March 15, 2000

U.S. balance of payments shows record red ink

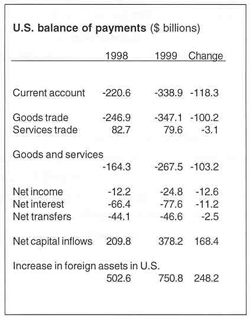

The U.S. current account deficit set an all-time record of $338.9 billion in 1999, more than a 50% increase from its 1998 level of $220.6 billion, according to balance-of-payments data released today by the U.S. Department of Commerce. The current account is the broadest measure of the U.S. trade balance, covering trade in goods and services plus net income from abroad and net unilateral transfers.

The rise in the current account deficit was led by a surge in the merchandise (goods) trade deficit, which rose to a historic high of $347.1 billion in 1999 – more than $100 billion higher than its previous record of $246.9 billion in 1998. Measured as percentages of gross domestic product, the current account deficit was 3.7% and the goods trade deficit was 3.8%, exceeding the previous peaks set in 1987 of 3.4% for both indicators.

The services surplus fell from $82.7 billion in 1998 to $79.6 billion in 1999. As a result, the balance of trade in goods and services together reached a record deficit of $267.5 billion in 1999, up from $164.3 billion in 1998. The rising trade deficit for goods and services is driven by strong consumer demand at home, weak economic conditions abroad (especially in Asia and Europe), and an overvalued exchange rate of the U.S. dollar.

Other components of the current account also worsened in 1999. The deficit on net income from abroad (foreign investment income and labor income) more than doubled from $12.2 billion in 1998 to $24.8 billion in 1999. The worsening performance on income from abroad is mainly a result of rising interest payments on the growing U.S. foreign debt. These interest payments increased from a net outflow of $66.4 billion in 1998 to $77.6 billion in 1999.

Other components of the current account also worsened in 1999. The deficit on net income from abroad (foreign investment income and labor income) more than doubled from $12.2 billion in 1998 to $24.8 billion in 1999. The worsening performance on income from abroad is mainly a result of rising interest payments on the growing U.S. foreign debt. These interest payments increased from a net outflow of $66.4 billion in 1998 to $77.6 billion in 1999.

Since the United States has to borrow from other countries to finance its current account deficit, the U.S. net foreign debt position worsened dramatically in 1999. While official data on the U.S. net international investment position for 1999 will not be released by the Commerce Department until June 29, 2000, EPI estimates that the U.S. net international debt increased from $1.2 trillion at the end of 1998 to about $1.6 trillion at the end of 1999.

The worsening of the U.S. foreign debt situation also appears in the capital account data released today. The capital account statistics show that U.S. assets abroad increased by $372.6 billion in 1999, while foreign assets in the U.S. (i.e., U.S. liabilities to foreigners) soared by $750.8 billion, resulting in a net capital inflow of $378.2 billion for 1999. While this massive international borrowing helps to finance U.S. economic growth in the short term, it also undermines the sustainability of that growth in the long run.

As the U.S. international debt soars, net interest outflows are bound to increase, thus putting further downward pressure on the overall net income balance and the current account balance. According to EPI estimates, the U.S. net international debt will reach $1.9 trillion by the end of 2000 and $3.8 trillion by the end of 2005, resulting in annual net interest outflows of about $86 billion this year and $166 billion by 2005, if present trends continue. These rising debts and interest outflows portend possible problems for the U.S. economy in the form of a future dollar crisis or economic recession if foreign investors decide that it is too risky to keep lending the United States the amounts needed to finance its present level of current account deficits.

by Robert A. Blecker

The Economic Policy Institute TRADE PICTURE is published upon the release of year-end trade figures from the Commerce Department.