Working Paper #296

This working paper was prepared for a forum on the top one percent to be published in the Summer 2013 issue of the Journal of Economic Perspectives. We are grateful to the editor, David Autor; the managing editor, Timothy Taylor; co-editors Chang-Tai Hseih and Ulrike Malmendier; and to Ann Norman for most helpful comments.

Josh Bivens is Research and Policy Director and Lawrence Mishel is President, Economic Policy Institute, Washington, D.C.

The debate over the extent and causes of rising inequality of American incomes and wages has now raged for at least two decades. In this paper, we will make four arguments. First, the increase in the incomes and wages of the top 1 percent over in the last three decades should largely be interpreted as driven by the creation and/or redistribution of economic rents, and not simply as the outcome of well-functioning competitive markets rewarding skills or productivity based on marginal differences. This rise in rents accruing to the top 1 percent could be the result of increased opportunities for rent-shifting, increased incentives for rent-shifting, or a combination of both. Second, this rise in incomes at the very top has been the primary impediment to living standards growth for low and moderate-income households approaching the growth rate of economy-wide productivity. Third, because this rise in top incomes is largely driven by rents, there is the potential for checking (or even reversing) this rise through policy measures with little to no adverse impact on overall economic growth. Lastly, this analysis suggests two complementary approaches for policymakers wishing to reverse the rise in the top 1 percent’s share of income: dismantling the institutional sources of their increased ability to channel rents their way and/or reducing the return to this rent-seeking by significantly increasing marginal rates of taxation on high incomes.

Evidence on the Rise in Income Shares at the Top

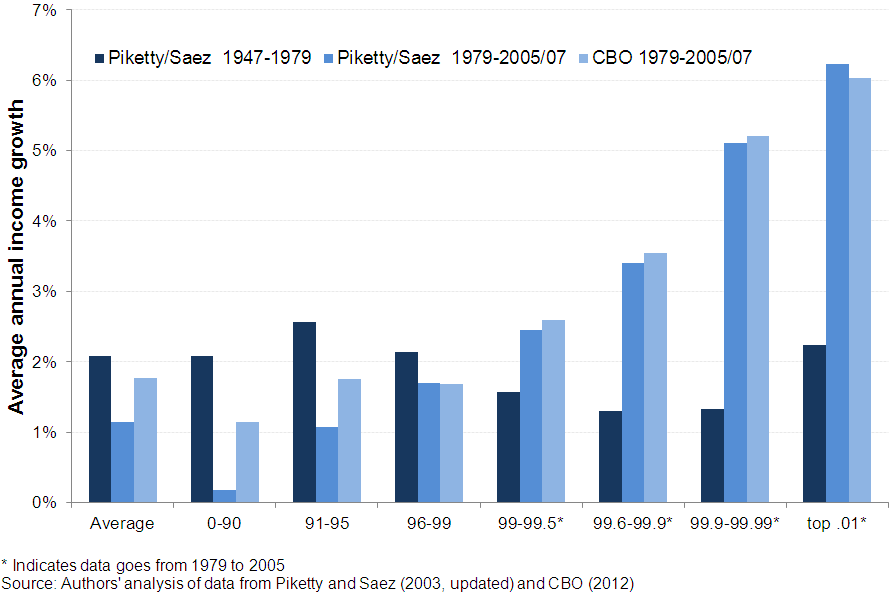

The facts of this rise in income shares at the very top are well-known, so our summary will be brief. Exhibit 1 summarizes the main points. It shows average annual income growth using the Piketty and Saez (2003, updated) data, which is based on cash, market-based incomes in two time-periods, 1947-1979 and 1979-2007. For comparison, the figure also looks at Congressional Budget Office (2012) data for the latter period on comprehensive incomes, which includes noncash benefits from employers and government transfers. The Piketty and Saez data indicate, for instance, that between 1979 and 2007, the top 1 percent of American tax units accounted for 59.8 percent of average growth in cash, market-based incomes, compared to just 9 percent of average growth in this period accounted for by the bottom 90 percent. While including transfers and non-cash incomes reduces the share of growth received by the top 1 percent significantly, as shown in the Congressional Budget Office data, the top 1 percent still account for 38.3 percent of growth, more than the 31.0 percent share received by the bottom 80 percent.

The figure also illustrates several other points. First, the Piketty and Saez data indicate strongly that the rise in inequality is only a feature of the latter period: that is, on the figure, the darker bars on the left showing income growth for the 1947-79 period are fairly similar between the 0-90th percentile and the other measures shown. However, the measures the more recent period from 1979 to 2007 show much faster income growth at the upper levels of income.

Second, while measuring income using the cash, market-based data from Piketty and Saez does have some shortcomings, movements in these incomes do actually overwhelmingly drive trends in inequality even in the more comprehensive income data set tracked by the Congressional Budget Office. This finding should hardly be a shock, because cash, market-based incomes account for roughly 80 percent of all incomes even in the CBO data. Both of these points hold even more strongly when looking just at incomes in the top 1 percent and above: growth rates for these incomes are nearly identical in the latter period in both datasets, as the dominance of cash, market-based incomes is even much greater for the highest income households.

Third, the divergence in income growth rates for the bottom 90 percent in these two datasets is striking. In the Piketty and Saez data, the bottom 90 percent saw average annual growth of just 0.2 percent, as compared to 1.1 percent in the CBO data. We have noted elsewhere (Mishel et al. 2012, Table 2.13) that more than half of the income growth for households in the middle of the income distribution between 1979 and 2007 was driven by government transfers (dominated by Social Security and Medicare) and pensions currently received for past labor market service. These influences accounted for more than 80 percent of the rise in average incomes for the middle-fifth. Cash wages and salaries, conversely, accounted for just 6.1 percent of overall income growth for these families (while employer-sponsored health insurance contributions contributed 12 percent of overall growth in comprehensive incomes). We view the Piketty and Saez data as most reflective of how well the market economy has been providing income gains for households in the bottom 90 percent (not very well), while the CBO data provides a better measure of the actual living standards attained by this group.

Lastly, in both the Piketty and Saez data as well as the CBO data, income growth by fractile does not equal or exceed overall average growth below the 96th to 99th percentile average.

Table 1 provides an overview of the sources of income growth for the top 1 percent in the three decades before the Great Recession, using the broader definition of income from the Congressional Budget Office (2012) data. The first two rows show that that rising top shares have been driven by concentration within all forms of market income. In particular, the top 1 percent’s share of labor income doubled and the share of total capital income grew from 31.8 to 56.2 percent. The CBO data also indicates that the direct, arithmetic influence of taxes and transfers has been minimal, with rising inequality of market incomes explaining more than 100 percent of the rise in the after-tax income share of the top 1 percent (Mishel et al. 2012, Figure 2N) .

The next block of columns shows a shift from less-concentrated sources of income (particularly labor compensation) and towards more-concentrated sources of income (particularly capital gains and business income). The most striking finding here is the large decline in labor compensation’s share of total income, falling from 69.8 percent in 1979 to 60.3 percent in 2007. Correspondingly, the combined share of capital income (including capital gains) and business income rose substantially, from 18.3 to 22.8 percent.1 We have noted elsewhere (Mishel et al. 2012) that the rise in capital income’s share is driven overwhelmingly by a higher profit rate, not a rise in capital-output ratios. Finally, both other income (mostly pension payments for past labor services) as well as transfer incomes rise as a share of total incomes, from 3.2 percent to 6.3 percent over the period and 8.7 percent to 10.7 percent, respectively. The total effect of shifts between income categories – driven overwhelmingly by shifts from labor compensation to capital and business incomes – accounts for 2.6 of the total 9.8 percentage point increase in the top 1 percent share. Overall, however, the increasing concentration within categories of income made a bigger contribution to the rising income share of the top 1 percent than the shift between income category shares.

Besides their sources of income, the occupations of the top 1 percent have also been investigated. In a study of tax returns from 1979 to 2005, Bakija et al. (2010) show the trend in the shares of total income of U.S. households accruing to the top 1.0 and top 0.1 percent of households. They establish that the increases in income at the top were disproportionately driven by households headed by someone who was either an “executive” (including managers and supervisors and hereafter referred to as executives) in nonfinancial sectors or in the financial sector as an executive or other worker. Households headed by a non-finance executive were associated with 44 percent of the growth of the top 0.1 percent’s income share and 36 percent in the growth among the top 1.0 percent. Those in the financial sector were associated with nearly a fourth (23 percent) of the expansion of the income shares of both the top 1.0 and top 0.1 percent. Together, finance and executives accounted for 58 percent of the expansion of income for the top 1.0 percent of households and an even greater two-thirds share (67 percent) of the income growth of the top 0.1 percent of households. Relative to others in the top 1 percent, households headed by executives had roughly average income growth, those headed by someone in the financial sector had above average income growth and the remaining households (non-executive, non-finance) had slower than average income growth. In our view this analysis of household income data understates the role of executives and the financial sector since they do not account for the increased spousal income from these sources.

Mishel and Sabadish (2013) examine chief executive officers of 350 firms with largest revenue in any given year and show that their compensation grew 79 percent between 1965 and 1978during a period when the stock market (as measured by the Dow Jones and Standard & Poor’s indices) fell by about half (see Table 2). Average CEO compensation grew strongly over the 1980s but then exploded in the 1990s and peaked in 2000 at nearly $20 million, growing by a multiple of 13 or 14 from 1978 to 2000 (depending on whether one accounts for stock options as they are granted or as they are realized). This growth in compensation for chief executive officers far exceeded even the substantial rise in the stock market, which grew roughly five-fold in value over the 1980s and 1990s.

Since 2000, compensation for chief executive officers first dropped after the fall in the stock market in the early 2000s, rebounded by about 2007, fell again in the financial crisis of 2008-2009, and then has rebounded again. By 2012, average compensation had returned to $14.1 million (measured with stock options realized) or $10.7 million (measured with options granted). The compensation of chief executive officers in 2012 is high by any metric, except when compared with its own peak in 2000 after the 1990s stock bubble. From 1978 to 2012, even with the setbacks provided by the 2001 and 2008 stock market crashes, CEO realized compensation grew 876 percent, more than double the real growth in the stock market. CEO compensation based on options granted grew a lesser” 685 percent that was still far in excess of stock market gains. In contrast, the hourly compensation of a private sector production/nonsupervisory worker grew a meager 5 percent.

This analysis of a narrow group of occupations’ role in driving top 1 percent incomes allows us to usefully narrow the argument about the role of rents in high incomes. That is, if one could establish that high compensation in just these two occupations (or sectors) is indeed heavily influenced by rents, and are not just the efficient marginal return to differences in skill and ability, then one has effectively made this case for the majority of the top 1 percent.

Rent-Shifting and the Rise in Top 1 Percent Incomes

In many discussions, “rent-seeking” refers loosely to ill-gotten gains. For example, it often refers to gains obtained by lobbying the government for some form of subsidy or preferential treatment, or for profits that stem from anti-competitive behavior. Such rents do exist, and powerful economic actors do indeed manage to influence policy to protect them from competition, and these probably do have non-trivial influences on some incomes in the top 1 percent. Legal and policy measures that enforce intellectual property claims, for example, surely play a key role in high incomes in Silicon Valley. However, in this paper we are referring to rents in a broader sense: in this discussion, a “rent” means only that the income received was in excess of what was needed to induce the person to supply labor and capital to these respective markets. As an illustrative example, it seems likely that many top-level professional athletes would continue to supply essentially the same amount of labor to their sport, even if their salary was reduced by some substantial fraction, because even the reduced salary would be much higher than their next-best options. Thus, we are making a positive argument, not a normative one, that the rise in income for the top 1 percent income was not necessary to entice the people in that group to seek those jobs nor to provide effort in those jobs. One implication of this is that even rents that do no not necessarily interfere with efficient allocation of talent (for example, those described in Gabaix and Landier (2008) and Tervio (2008) can be redistributed (say by progressive marginal taxation) –without introducing economic distortions. And where rents do stem from institutional arrangements that block the efficient allocation of resources (as in many of the models of financial sector rents or CEO “pay-skimming” noted below or models with labor market rents like Tervio (2009)), then dismantling the sources of these rents will self-evidently lead to increased efficiency.

Since rents are rarely observable, direct evidence on their role in driving income dynamics is scarce. However, we will focus in this paper on a wealth of suggestive evidence consistent with rents being important in income determination, and then will point to direct evidence suggesting that the large increases in top 1 percent income shares has clearly not been associated with improved economic performance overall. We take this as further confirmation that well-designed policies can brake or reverse rising top 1 percent shares without harming overall economic growth – and this suggests strongly that these rising top shares are indeed rents.

Executive Pay

The contribution made by concentration of labor compensation to the growth in the income share of the top 1 percent can largely be explained by a pay-setting institution that had existed for a long time, but took off with particular force in the last couple of decades: exercised stock options and bonuses. Kruse, Blasi and Freeman (2011), for example, note that in 2006 roughly $65.1 billion in labor compensation was actually the result of exercised stock options, while Jaquette, Knittel and Russo (2003) have estimated that total “spread income” (the exercise of non-qualified stock options) was $126 billion in 2000, and was even $78 billion in 2001, following the stock market decline. Stock options and bonuses are particularly relevant to the pay of high-level corporate executives.

Bebchuk and Fried (2004) compile ample evidence in favor of the claim that top executive pay is largely the result of rent-extraction. Perhaps their most persuasive argument is to point out that a well-designed contract for executive pay should offer rewards based on relative performance. For example, an executive for a company in an industry where stock prices are down across the board should be rewarded for performing less poorly than others, while an executive who runs a company in which the stock price is up, but up by less than every other firm in the industry, should not be rewarded. However, real-world compensation arrangements for chief executive officers are typically “camouflaged” to look like they are the result of contractual arrangements that reward relative performance, but generally do not.

One example of this camouflage is the hiring of compensation consultants and the construction of “peer groups” to benchmark top executive salaries. While at first glance benchmarking to insure that shareholders are not overpaying for managers may seem like sound corporate practice, these consultants and peer-group constructions can often be used to justify inflated corporate pay. Bizjack, Lemmon and Nguyen (2011), for example, find evidence that “peer groups are constructed in a manner that biases compensation upward.”

Another example of such camouflage is construction of stock options – an instrument that could be consistent with aligning manager and shareholder interests – that largely reward the luck of whether the stock market rises or falls, rather than specific performance. Bertrand and Mullainathan (2001), for example, have found that the pay for luck is actually as large as pay for performance, and they interpret this finding as evidence in support of the rent-extraction hypothesis for pay of chief executive officers.

As yet another example, Bebchuk and Fried (2010) note that, “standard pay arrangements have commonly failed to restrict the use of financial instruments that can weaken or eliminate entirely the incentive effects of equity-based instruments awarded as part of compensation arrangements.” They note that in a study by Schwab and Thomas (2006) of 375 employment contracts governing pay of chief executive officers, not a single one restricted hedging away the risk of the option grants.

A last bit of evidence that flawed corporate governance has allowed U.S. corporate executives to receive inefficiently high pay is the high ratio of the pay of U.S. chief executive officers relative to their international peers. Fernandes et al. (2012) show U.S. compensation for chief executive officers in 2006 to be twice that of other advanced nations at both the median and mean. A survey by Towers Perrin, a consulting firm, shows U.S. CEO compensation was triple that of other advanced nations in 2003, up from 2.1 times foreign CEO compensation in 1988 (Mishel et al. 2004, Table 2.47). Tower Perrin also reports that U.S. CEO compensation was 44 times that of the average worker whereas the non-U.S. ratio was 19.9.

Fernandes et al. (2012) seek to challenge the claim that U.S. CEOs are paid significantly more than their foreign counterparts. As noted above, they find U.S. CEOs to be paid double that of their counterparts. However, even after controlling for firm-level characteristics—size, leverage, stock return, stock volatility and Tobin’s Q—they find a U.S. pay premium of 88 percent. It is only when they control for “inside and institutional ownership” that they knock the pay premium down to a still substantial 31 percent. It is not clear to us that U.S. institutional board arrangements are reflective of the skill of chief executive officers and should be included as a control when estimating the pay premium. Once could, in fact argue simply that U.S.-style governance features are associated with excessive pay for chief executive officers both here and abroad.

A Closer Look at Rent-Shifting in the Financial Services Sector

The case for whether rents are driving much of the increase in top salaries in the financial sector is a debate that is largely inseparable from the broader question of the social value of marginal increases in the activities of the finance sector, and whether or not the large expansion of the sector between the 1970s and 2007 was of benefit or detriment to the larger economy. This question has been interestingly addressed in a symposium in the Spring 2013 issue of this journal. Although we will not reiterate the arguments in detail here, we are convinced by arguments that the wider economy has not benefited from this expansion of finance and that it largely represents overpayment for financial intermediation services that more competitive markets could have delivered more efficiently. Moreover, this expansion of finance actually imposed large negative externalities on the wider economy through the increase in systemic risk that has accompanied the rise in large, complex financial institutions.

Again, the evidence on rent-shifting behavior should be viewed not as conclusive, but as highly suggestive. First, the rise in finance’s share of overall economic activity and the steep rise in top incomes in this sector coincide with a range of legislative and regulatory changes that vastly expanded the range of activities in which financial firms could engage. Regulatory prohibitions from earlier eras were explicitly dismantled or made moot (for a good summary of many of these changes, see Sherman 2012). The result of these regulatory changes was a large rise in bank concentration, following a generation of economic history that saw concentration ratios roughly hold steady. There is very little evidence that the large rise in bank concentration reflected economies of scale or scope that were passed onto consumers in lower prices of intermediation (Haldane 2010a).

Second, it has become clear that in the aftermath of the Great Recession that some potentially substantial share of the income for large financial institutions is based on implicit insurance against bankruptcy (if it can still be called “implicit” after all the financial sector loans and bailouts) that large financial firms receive from the government. These subsidies can be economically significant, both in fiscal costs from clean-ups after crises happen (Laeven and Valencia 2008), as well as reduced financing costs for firms perceived to be too big or too interconnected or too politically influential to fail (Baker and McCarthur 2009). Further, the value of this implicit insurance rises with the risk of the underlying activities, and given that deregulation in this sector allowed a wider range of (often quite risky) activities, the value of this implicit insurance surely got larger as well

Third, some financial firms seem to extract large rents largely by hiding financial risk, rather than managing it. Haldane (2009b) has highlighted many of the means through which financial firms have in recent decades assumed risk in a search for high returns, while also managing to hide this risk from their sources of finance. Bebchuck, Cohen and Spamann (2009) provide a stark example of the large gap between value produced by financial sector institutions and value claimed by their managers in examining the compensation provided to executives at Bear Stearns and Lehman Brothers – two of the most spectacular failures in American finance during the crisis. They show that even after including the losses suffered by top management from the loss of value of their holdings at the time of each banks’ respective crash, that managers at these firms were able to obtain staggering payoffs over the entire 2000-2008 period: $650 million for Bear Stearns’ top executive team and $400 million for Lehmann’s team. Biais, Rochet, and Wooley (2010) note that financial managers often have an opportunity, with a combination of asymmetric information and the inability of outside investor to punish moral hazard fully (because of limited liability), to shift rents to themselves by failing to assess the true underlying risks of new financial innovations when they manage principals’ money.

The overall pay of financial sector workers relative to others in the economy has risen substantially. Our own calculations, using National Income and Product Accounts Data, show the unadjusted ratio of financial sector pay (annual compensation per full-time employee) since 1948. Between 1952 and 1982 this ratio never exceeded 1.1. By 2007, after decades of steady growth, it had reached 1.83. The rise in financial sector pay persists in the data even when standard wage-equation controls for experience and education are introduced. Philippon and Reshef (2009) also chart a rapid rise in the pay of financial sector workers, and they construct a time-series to chart the tight correlation between above-average pay in finance and the historical ebb and flow of financial regulation and de-regulation (see also their paper in the Spring 2013 issue of this journal). They note that a significant pay-premium to working in finance persists even in regressions with multiple controls, and conclude that roughly 30-50 percent of pay premium in finance seems due to rents.

In short, the financial sector illustrates that in one of the most important sectors to drive top 1 percent incomes in recent years, there was an extraordinary divergence between what top managers took home and even what shareholders (surely a privileged group compared to the wider U.S. economy) gained. This type of divergence seems like powerful evidence to us that a substantial part of the extraordinary rise of top 1 percent incomes is not a result of well-functioning markets allocating pay according to value generated, but instead resulted from shifting institutional arrangements leading to shifting of rents to those at the very top.

Objection: But It’s Other Professions, Too

One response sometimes heard to our analysis of rent-shifting behavior by executives and financial professionals is that their pay has largely risen in proportion to the pay of others in the top 1 percent. Thus, the argument goes, it is implausible to argue that rent-shifting was happening to the same extent across different professions, and a supply-and-demand explanation about higher rewards to those with very rare skills is a more plausible answer. While we cannot discuss every occupation that has contributed to top 1 percent pay, we will note that rents seem extraordinarily important to many of the other occupations, and especially those represented outside of executives and finance professionals in the very top – say the top 0.1 or 0.01 percent).

Lawyers, for example, are often hired explicitly to redistribute returns to productive activity. In one research paper, Murphy, Shleifer and Vishny (1991) explicitly use pre-law college majors as a proxy for the presence of rent-seeking behavior. As another example, the health care sector is one of the few that has actually outpaced finance in terms of claiming an ever-larger share of overall economic activity, yet much analysis finds not only that a large fraction of provided (and billed-for) care does not measurably improve health outcomes, but that prices in the American system are vastly higher than in the health systems of our advanced country peers (Anderson et al. (2003); Cutler and Sheiner (1999)). Further, the growth of spending on pharmaceuticals and medical devices constitute a significant share of overall health spending over the last generation, and these are sectors within health care given explicit government protection in the form of patents (Davis et al. (2007)).

More broadly, the existence and growth of rent-seeking sectors can pull up wages and incomes in other sectors. For example, Laugesen and Glied (2011) have demonstrated that physician salaries (orthopedists, in their study) are significantly higher in the United States than compared to even those in our high-income industrial peers. The authors then make an astute point: “One explanation for the higher incomes of U.S. physicians may lie in the broader U.S. income structure. The share of income received by people in the top 1 percent of the U.S. income distribution far exceeds the corresponding share in the comparison countries.” Empirical support for their point can be found in the work of Kedrosky and Stangler (2011) and Goldin and Katz (2008), both of which chart a large increase in the share of graduates from elite universities choosing to enter finance rather than other fields like medicine or hard sciences.

In short, just to keep a constant quality workforce in the face of rent-driven increases in pay for chief executive officers and financial professionals, even competitive labor markets in other occupations near the top of the income distribution would have to see pay rise. In addition, it appears to us that the enormous pay increases received by chief executive officers of large firms has spillover effects, in the sense that the pay of other executives and managers rises in tandem with the pay of chief executive officers, but we do not know of any systematic studies that have established the scale of this impact.

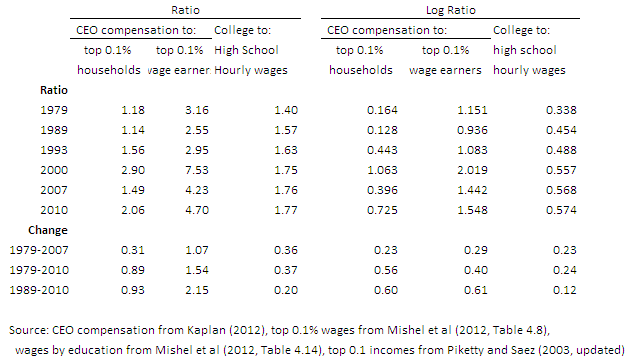

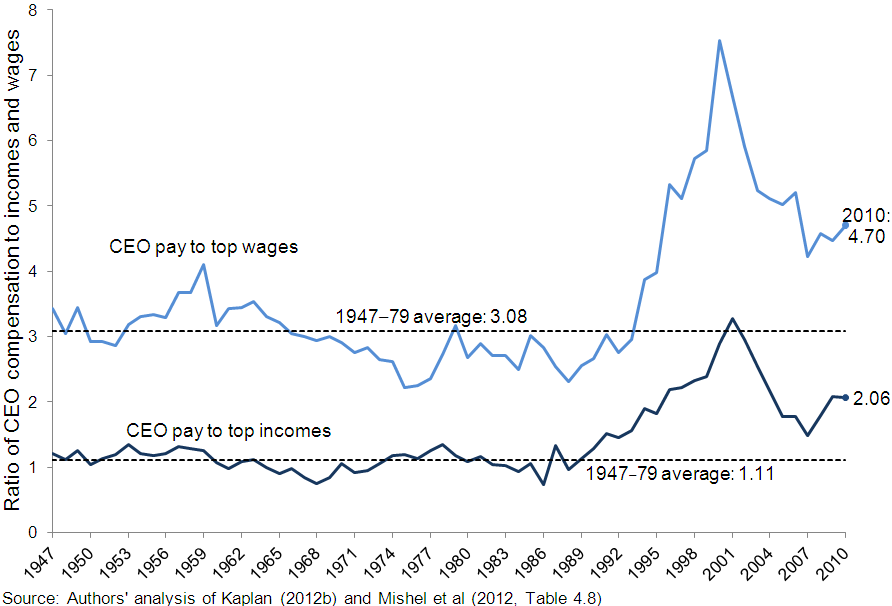

One prominent example of the “it’s other professions, too” argument comes from Kaplan (2012b), who argues that the pay of chief executive officers has risen in line with that of other highly-paid workers and that this is evidence against managerial power and rent-seeking driving the pay trends for chief executive officers. As noted a moment ago, even if the pay of chief executive officers was rising in line with other in the top 1 percent, we are not sure that this actually would be evidence against the managerial power theory of high pay for chief executive officers. But in addition, our reading of Kaplan’s own data and more precise data yields an opposite conclusion. Table 3 presents the ratio of the average compensation of chief executive officers of large firms, the series developed by Kaplan, to two benchmarks. The first is the one Kaplan uses, the average household income of those in the top 0.1 percent developed by Piketty and Saez (2003, updated). The second is the average annual earnings of the top 0.1 of wage earners based on a series developed by Kopczuk et al. (2010) and updated in Mishel et al. (2012). Each ratio is presented as a simple ratio and logged (to convert to a ‘premium’). The wage benchmark seems the most appropriate one since it avoids issues of household demographics—changes in two-earner couples, for instance—and limits the income to labor income and excludes capital income. Both of these ratios clearly understate the relative wage of CEOs since executive pay is a nontrivial share of the denominator, a bias that has probably grown over time simply because CEO relative pay has grown.2 For comparison purposes Table 3 also shows the changes in the gross (not regression-adjusted) college-high school wage premium.

Between 1989 and 2010 CEO compensation grew from 1.14 to 2.06 times that of the incomes of the top 0.1 percent households, the metric Kaplan employs to measure CEO pay relative to that of other highly paid people. CEO pay relative to top 0.1 percent wage earners grew even more, from 2.55 to 4.70 in that same time frame, a rise (2.15) equal to the pay of more than two very high earners. The log ratio of CEO relative pay grew roughly 60 log points from 1989 to 2010 using either top household income or wage earners as the comparison.

Is this a large increase? Kaplan (2012b, page 14) does not find this increase in relative pay (CEO pay relative to top household incomes) to be large, simply noting that the ratio ‘remains above its historical average and the level in the mid-1980s’. To put this in context Exhibit 2 presents the ratios displayed in Table 3 back to 1947. In fact, Kaplan’s ratio of CEO pay to top household incomes in 2010 (2.06) was nearly double the historical average 1.11, a gain roughly equivalent to the total income of a top 0.1 percent household. CEO pay relative to top wage earners in 2010 was 4.70, 1.62 higher than the historical average (a gain of 1.6 high wage earners). As the data in Table 3 show the increase in the logged CEO pay premium since 1979, and particularly since 1989, was far in excess of the rise in the college-high school wage premium which is widely and appropriately considered to have substantially grown. Presumably, CEO relative pay has grown further since 2010: as Table 2 showed CEO compensation (options) realized pay rose 15 percent while estimated pay (options granted) fell 4 percent between 2010 and 2012. It is noteworthy that Kaplan (2012b) argues that realized pay is the preferred measure of performance.3 IF CEO pay growing faster than that of other high earners is a test of the presence of rents then we would conclude that executives receive substantial rents.

Kaplan (2012a, 2012b) also suggests that pay of chief executive officers grew on par with firm size in the last few decades and this is evidence of market-determined pay. However, Frydman and Saks (2010, footnote 25) comment that “the strong correlation in more recent decades may be due to an upward trend in both variables instead of a causal effect of firm size on pay.” They also note “the strong correlation between compensation and aggregate firm size was limited to the 1980s and 1990s. For all other decades in our sample, average market value accounts for less than 1 percent of the variation in executive pay.” As Gordon and Dew-Becker (2007) point out, the available evidence does not support a unitary elasticity between firm size and pay of chief executive officers, either historically back to 1936 (Frydman and Saks 2010) or in annual cross-sections from 1990-2004. Fernandes et al. (2012) report an elasticity of 0.4 from pay of chief executive officers to firm size, which they report is in line with prior studies.

The Rising Incentive for Rent-Shifting

So far, we have argued that the evidence supports the case that rents are an important component of top 1 percent incomes. We have also argued that in some cases (particularly in the financial sector), evidence suggests that there have been increased opportunities for shifting rents to boost incomes and wages in recent decades. We admit that the case for a rise in rent-shifting as the primary driver of rising inequality is not yet ironclad, although it is certainly consistent with lots of evidence.

However, the case that incentives for rent-shifting have changed is completely unambiguous. From the late 1960s into the mid-1980s, in particular, top federal marginal income tax rates fell substantially. For example, the top marginal income tax rate was above 70 percent in 1970, but had fallen to 28 percent in 1986. Those extremely high marginal income tax rates in previous decades mainly applied to the upper slice of the top 1 percent of the income distribution—but as we have argued, the rise in incomes for that group is a major factor in increasing the share of income going to the top 1 percent.

The incentive effect of lower marginal tax rates could well impact top incomes if they are significantly composed of rents. For example, in the model of Bebchuk and Fried (2004), well-placed individuals who have some ability to shift rents will balance the costs and benefits of exerting more influence to boost their own incomes, where one of the costs is whether they encounter an “outrage constraint.” Lower marginal tax rates at top income levels will provide a greater incentive for well-placed individuals at that income level to spend more energy on rent-shifting.

Piketty, Saez and Stantcheva (2012) have shown that the link between falling marginal rates and higher pre-tax top 1 percent shares is significant both in time-series data for the U.S. as well as across countries. In their paper in this symposium, Alvarado, Atkinson, Piketty, and Saez discuss these issues.

Policy and Institutional Changes Beyond the Top 1 Percent

We have been arguing so far mostly within a framework amendable to microeconomists—at least microeconomists of the broad-minded and institutionalist variety—positing that developments within specific sectors and occupational labor markets have boosted the ability of well-placed groups to redistribute rents their way. However, the levers of rent-shifting can include both changes that shift bargaining power to those at the top of income distribution generally, or to subvert the bargaining power of those at the bottom and middle.

Mishel et al. (2012) documents the ways in which a range of policy developments over the last generation have disproportionately damaged the wage prospects of low and moderate-wage workers, including the declining real value of the minimum wage and the failure to update labor law to provide a level playing field in the face of growing employer hostility to union organizing efforts. Indeed, many of these policy changes were intentional and pursued with much greater vigor in the last generation than the previous one (Hacker and Pierson 2010). There is considerable evidence that these kinds of institutional changes can shift rents. 4 Too often the assumption is that policy variables like the real value of the minimum wage cannot be relevant to top 1 percent incomes as it is, by definition, non-binding on high wages. Yet one person’s income is another person’s cost. If a declining value of the minimum wage, or increased effectiveness in blocking union organizing, keeps wages in check at, say, Wal-Mart, then it is hardly a shock that this could well lead to higher pay for corporate managers and higher returns to Wal-Mart shareholders. (see Draca, Machin and Van Reenen (2012) for evidence in the UK that higher minimum wages reduce firm profitability – but with no significant impact on employment).

Further, the role of globalization—a mixture of exogenous and policy-induced changes—also likely looms large. Textbook Stolper-Samuelson models explicitly show (at least in the older textbooks!) that trade openness can increase capital incomes and reduce labor compensation in rich countries like the United States Rodrik (1999) and Jayadev (2007) have similarly noted that capital account openness, which is largely a policy choice, could well tilt bargaining power away from workers and towards capital-owners, resulting in higher capital shares not just in developed countries (the standard Stolper-Samuelson result) but in developing countries as well -a non-standard result that has shown up strongly in the data.

Will Putting A Brake On Top 1 Percent Growth Harm Overall Growth Rates?

If the rise in top 1 percent incomes has accrued largely from shifting rents, then multiple possibilities exist for redistributing these rents without slowing overall economic growth or distorting economic efficiency. Successful redistributions would then translate directly into increased living standards for low- and moderate-income households. Besides the evidence assembled above indicating that the growth of these incomes are largely rents, a number of recent studies have looked directly at the issue of shifting top shares on overall economic growth. For the US economy, the broad historical pattern is a strong association between stable top income shares and faster overall growth in early post-World War II economic history followed by rising top income shares and notably slower growth in the three decades before the Great Recession. This broad association between greater inequality and less growth is clearly not reversed in systematic attempts to establish a link between rising top shares and aggregate economic performance, nor by looking at international or state-level data.

For example, Piketty, Saez and Stantcheva (2012) examine the relationship between top marginal tax rates, top income shares, and aggregate economic performance, both in U.S time-series as well as using an international panel of 18 OECD countries. They find strong evidence that falling top marginal tax rates are associated with higher pre-tax top income shares. However, they do not find a strong association either between falling top marginal rates and rising economic growth or (for the U.S. data) rising top income shares and faster economic growth. They also find significant evidence that falling top marginal tax rates are associated with slower income growth for the bottom 99 percent of households. They take this constellation of evidence as supporting a “bargaining model where gains at the top have come at the expense of the bottom.”

Andrews, Jencks and Leigh (2011) find slightly mixed evidence on the larger issue of top shares and subsequent growth, with increases in the share of income accruing to the top 10 percent positively (and generally statistically significant across regression specifications) related to subsequent overall growth in their preferred regression models. They note the modest economic impact implied by their results: “But at the very least, the 95 percent confidence intervals for our preferred estimates appear to rule out the claim that a rise in top income shares causes a large short-term increase or decrease in economic growth. The claim that inequality at the top of the distribution either benefits or harms everyone therefore depends on long-term effects that we cannot estimate very precisely even with these data.” Most importantly for the question at hand, these results are driven by what is happening between the 90th and 99th percentiles. They note: “The top 1 percent’s share is never both positively and significantly related to the growth rate.”

Thompson and Leight (2012) have recently used a different sort of panel to examine the relationship between top income shares and growth – looking at the top 1 percent within individual U.S. states. Their analysis finds that rising top 1 percent income shares are associated with falling subsequent growth in incomes and earnings for households in the middle of the distribution, while having no significant effect on growth at the bottom of the distribution. Further, their finding on the statistical significance of the depressing effects of rising top shares on middle-incomes is fairly robust and survives the inclusion of a range of covariates (though its economic impact is relatively modest).

Some advocates for reversing the rise of the income share of the top 1 percent occasionally make strong claims that the rise at the top has harmed overall economic growth. Our claim here is more modest: the empirical evidence that has directly examined the effect of rising top 1 percent shares on overall economic growth certainly does not suggest that they are strongly and robustly associated. But as long as the shift to the top 1 percent is not associated with improved growth, then the rest of the income distribution is harmed.

What to Do? Attack Rents Directly and Raise Taxes

We think the suggestive evidence that the rise in top 1 percent shares stems from the creation and/or redistribution of rents, as well as the direct evidence that changing shares in the U.S. economy do not seem to significantly affect aggregate outcomes, means that there is ample room for policymakers to act to stabilize or reverse top 1 percent shares. Taking much more ambitious steps (so long as they are intelligently directed) to halt or reverse the concentration of income at the very top will not kill any golden goose of economic growth. Instead, it will just lead to more income for those at the bottom and middle of the income distribution.

As we see it, there are two broad categories to describe what can be done about the rise of the top 1 percent: try to attack the source of their ability to shift rents directly and try to reduce the incentives for rent-shifting.

Attacking the source of the top 1 percent’s ability to claim rents means acting on a long laundry list of policy changes. Baker (2011) provides a compelling argument behind many of these needed changes: Corporate governance reform that gives not just shareholders but other stakeholders as well real influence over executive pay decisions (for example, DiNardo et al. (1997) find that unionized firms more successfully restrict managerial pay); reform to ensure that financial firms are less likely to seek profits by hiding risks or exploiting information asymmetries; reconstituting labor standards that boost bargaining power at the low and middle-end of the wage-scale (higher minimum wages and labor law reform that allows willing workers to bargain collectively if they choose); the dedicated pursuit of genuinely full employment; and reform of intellectual property law that greatly reduces the legal monopoly granted to sectors like pharmaceuticals, software, medical devices, and entertainment.

Attacking the sources of rent-shifting at the top may also provide addition benefits. If corporate governance reforms better align the incentives of managers and important stakeholders, this could be efficiency enhancing. If reform of intellectual property laws reduces the price of pharmaceuticals and medical devices, money will be saved by ultimate consumers of health care.

Reducing the incentives for the top 1 percent to shift rents can be achieved with a much shorter list: significantly raising the marginal tax rates on high incomes, including a reduction in the current gap in taxation of labor earnings (which we should note includes the return to human capital) versus income derived from ownership of financial capital. Raising these marginal rates would also address other problems in American political economy – closing long-run fiscal gaps and providing revenue needed (during times of full-employment) to undertake productive public investment and maintain social insurance programs. Importantly, a rise in top tax rates – so long as they keep after-tax income rising with pre-tax income – would redistribute rents without harming economic efficiency even in cases where rents co-exist with an efficient allocative equilibrium.

More specifically, the tax benefit received by corporations that allow them to deduct even executive compensation in excess of $1 million annually so long as it is “performance-based” has given a quasi-official blessing of executive pay practices like stock options and bonuses. But as noted before, such practices are not guarantees that executive pay and performance are tightly linked, and non-cash compensation often serves to disguise the true extent of corporate executive pay. In short, this tax preference clearly does not appear to spur better corporate governance, so should be repealed.5

Finally, we should boost those economic institutions and policy levers that can shift bargaining power to low- and middle-income workers. These include a higher minimum wage that is indexed to keep from losing ground as an effective labor standard, labor law reform that allows willing workers to bargain collectively, the prioritizing of genuinely full employment over very low rates of inflation, and a deepening of social insurance programs that have been some of the only genuinely good news for the bottom 99 percent in recent decades.

In short, there is much to recommend these broad courses of action, and there’s no reason for those concerned about the rise of income concentration at the very top to choose only one route. The economic stakes are large: in the last generation, low- and moderate-income households have not from seeing growth in their living standards that comes close matching overall income growth rates. In previous work (Mishel at al. (2012)), we have shown that growth in middle-fifth comprehensive incomes in 2007 would have been more than twice as rapid if they had matched overall average rates (19.2 percent actual versus 51.5 percent overall growth). Further, nearly 60 percent of the cumulative gap between growth of the middle-quintile and overall average growth (which we have labeled an implicit “inequality tax” on these middle-quintile incomes) between 1979 and 2007 can be accounted for solely by growth of the top 1 percent. In short, the stakes are large in debates about why top 1 percent incomes have grown so fast and what can be done about it.

—Thanks to David Autor, Dean Baker, Jacob Hacker, Chang-Tai Hsieh, and Ulrike Malmendier for comments on a previous draft, and to Timothy Taylor for very useful suggestions on both substance and organization. The research on CEO compensation was made possible by financial support from the Stephen Silberstein Foundation.

Endnotes

1. The 1.6 percentage point increase in business income between 1979 and 2007 is likely dominated by the growth of dividend payments to owners of S corporations, making this category of income a bit more “capital-like” than is often appreciated. Just between 1991 and 2007, dividends to S corporation owners rose by more than 2 percent of total U.S. gross domestic product.

2. In 2007, according to the Capital IQ database (tabulations kindly provided by Temple University professor Steve Balsam), there were 38,824 executives in publicly-held firms. There were 9,692 in the top 0.1 of wage earners, a group whose average W-2 earnings were $4,400,028. Using Mishel et al (2012) estimates of top 0.1 wages the executive wages comprised 13.3 of total top 0.1 percent wages. One can gauge the bias of including executives in the denominator by noting: the ratio of executive wages to all top 0.1 percent wages in 2007 was 2.14 but the ratio of executive wages to non-executive wages was 2.32. Unfortunately, we do not have data that permit an assessment of the bias in 1979 or 1989. We also do not have information on the number and wages of executives in privately-held firms: their inclusion would clearly indicate an even larger bias. The IRS reports there were nearly 15,000 corporate tax returns in 2007 of firms with assets exceeding $250 million indicating there are many more executives of large firms than just those in publicly-held firms.

3. “Critics confuse estimated pay- what the boards give to the CEOs as estimated pay-and realized pay. The key question is whether CEOs who perform better earn more in realized pay”. Kaplan (2012b, page 22).

4. Many studies, while not focusing on the top 1 percent, are strongly consistent with the interpretation that institutional changes can shift economic rents, which in turn can affect the level of inequality. For example, studies of the minimum wage lie DiNardo, Fortin, and Lemeiux (1992), Lee (1999) and Autor, Manning and Smith (2010) have identified strong effects of the minimum wage in driving “lower-tail” inequality, while numerous other studies like Card and Krueger (1995), Allegretto, Dube and Reich (2011), Manning (2003) have not found employment losses following these increases in the minimum wage. The combination of these results strongly suggests that the primary effect of minimum wage increases is to redistribute economic rents, rather than to affect employment levels. Levy and Temin (2006) have identified the breakdown of a range of rent-shifting institutions that they shorthand as the “Treaty of Detroit” as driving inequality between the top (roughly 90th percentile) and middle of the wage and income distribution.

5. See Balsam (2012) for a full discussion of this provision and its effectiveness.

References

Allegretto, Sylvia, Arindrajit Dube, and Michael Reich. 2011. “Do Minimum Wages Really Reduce Teen Employment? Accounting for Heterogeneity and Selectivity in State Panel Data.” Industrial Relations, 50(2): 205-240. http://www.irle.berkeley.edu/workingpapers/166-08.pdf

Anderson, Gerald F, Uwe E. Reinhardt, Peter S. Hussey and Varduhi Petrosyan. “It’s the Prices, Stupid: Why the United States is So Different From Other Countries.” Health Affairs, 22(3): 89-105. http://content.healthaffairs.org/content/22/3/89.full.pdf

Andrews, Dan, Christopher Jencks and Andrew Leigh. 2011. “Do Rising Top Incomes Lift All Boats?” The B.E. Journal of Economic Analysis & Policy, Berkeley Electronic Press, vol. 11, no. 1. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1603369

Autor, David, Alan Manning, and Christopher Smith. 2010. “The Contribution of the Minimum Wage to U.S. Wage Inequality Over Three Decades: A Reassessment.” Massachusetts Institute of Technology Working Paper. http://economics.mit.edu/files/3279

Baker, Dean. 2011. The End of Loser Liberalism: Making Markets Progressive. Washington, D.C.: Center for Economic Policy Research. http://deanbaker.net/images/stories/documents/End-of-Loser-Liberalism.pdf

Baker, Dean and McArthur, Travis. 2009. “The Value of the ‘Too Big to Fail’ Big Bank Subsidy.” Center for Economic and Policy Research Issue Brief. http://www.cepr.net/documents/publications/too-big-to-fail-2009-09.pdf

Bakija, Jon, Adam Cole and Bradley Heim. 2010. “Job and Income Growth of Top Earners and The Causes of Changing Income Inequality: Evidence from U.S. Tax Return Data.” Working paper. http://piketty.pse.ens.fr/files/Bakijaetal2010.pdf

Balsam, Steven. 2012. “Taxes and Executive Compensation”. Economic Policy Institute Briefing Paper #344.

Bebchuk, Lucian, Alma Cohen and Holger Spamann. 2009. “The Wages of Failure: Executive Compensation at Bear Stearns and Lehman 2000-2008.” Harvard Law and Economics Discussion Paper no. 657. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1513522##

Bebchuk, Lucian and Jesse Fried. 2004. Pay Without Performance: The Unfulfilled Promise of Executive Renumeration. Cambridge, MA, Harvard University Press.

Bebchuk, Lucian and Jesse Fried. 2010. “How to tie equity compensation to long-term results.” Journal of Applied Corporate Finance, 22(1): 906-106.

Bertrand, Marianne and Sendhil Mullainathan. 2001. “Are CEOs rewarded for luck? The ones without principals are.” The Quarterly Journal of Economics, 116(3): 901-932. http://www.jstor.org/stable/2696421

Biais, Bruno, Jean-Charles Rochet, and Paul Woolley. 2010. “Innovations, rents and risk.” The Paul Woolley Centre Working Paper Series No. 13, Discussion Ppaer Series No. 659. http://www2.lse.ac.uk/fmg/researchProgrammes/paulWoolleyCentre/workingPapers/dp659PWC13.pdf

Bizjak, John, Michael Lemmon, and Thanh Nguyen. 2011. “Are all CEOs above average? An empirical analysis of compensation peer groups and pay design.” Journal of Financial Economics, 100(3): 538-555.

Bronfenbrenner, Kate. 2000. “Uneasy Terrain: The Impact of Capital Mobility on Workers, Wages, and Union Organizing.” Submitted to the U.S. Trade Deficit Review Commission. http://govinfo.library.unt.edu/tdrc/research/bronfenbrenner.pdf

Card, David and Alan Krueger. 1995. Myth and Measurement: The New Economics of the Minimum Wage. Princeton, N.J.: Princeton University Press.

Congressional Budget Office. 2011. Trends in the Distribution of Household Income between 1979 and 2007. Congressional Budget Office Report No. 4031, Washington, D.C. http://cbo.gov/sites/default/files/cbofiles/attachments/10-25-HouseholdIncome.pdf

Congressional Budget Office. 2012. The Distribution of Household Income and Federal Taxes, 2008 and 2009. Congressional Budget Office Report No. 4441, Washington, D.C. http://www.cbo.gov/sites/default/files/cbofiles/attachments/43373-06-11-HouseholdIncomeandFedTaxes.pdf

Cutler, David M. and Louise Sheiner. 1999. “The Geography of Medicare.” American Economic Review, 89(2): 228-233. http://www.federalreserve.gov/pubs/feds/1999/199918/199918pap.pdf

Davis, Karen, Kathy Schoen, and Stuart Guterman. 2007. “Slowing the Growth of U.S. Health Care Expenditures: What are the Options?” Prepared for the Commonwealth Fund/Alliance for Health Reform 2007 Bipartisan Congressional Health Policy Conference. http://www.commonwealthfund.org/usr_doc/Davis_slowinggrowthUShltcareexpenditureswhatareoptions_989.pdf

DeParle, Jason. 2011. “Top Earners Not So Lofty in the Days of Recession.” The New York Times. http://www.nytimes.com/2011/12/13/business/economy/recession-crimped-incomes-of-the-richest-americans.html?_r=0

DiNardo, John, Kevin Hallock and Jorn-Steffan Pischke. 1997. Unions and Managerial Pay. National Bureau of Economic Research. NBER Working Paper #6318. Cambridge: NBER.

DiNardo, John, Nicole Fortin, and Thomas Lemieux. 1996. “Labor Market Institutions and the Distribution of Wages, 1973-1992: A Semiparametric Approach.” Econometrica, 64(5): 1001-1044. http://www.uh.edu/~adkugler/DiNardoetal.pdf

Draca, Mirko, Stephen Machin, and John Van Reenen. 2011. “Minimum Wages and Firm Profitability.” American Economic Journal: Applied Economics, 3(1): pp. 129-151.

Fernandes, Nuno G., Miguel A. Ferreira, Pedro P. Matos and Kevin J. Murphy. 2012. Are US CEOs Paid More? New International Evidence.” EFA 2009 Bergen Meetings Paper; AFA 2011 Denver Meetings Paper; ECGI – Finance Working Paper No. 255/2009. http://ssrn.com/abstract=1341639 or http://dx.doi.org/10.2139/ssrn.1341639

Kruse, Douglas, Joseph Blasi, and Richard Freeman. 2011. “Does Shared Capitalism Help the Best Firms Do Even Better?” Paper prepared for British Academy Seminar “The Economics of Share Ownership and Gainsharing: Findings and Policy Implications,” Centre for Economic Performance, London School of Economics.

Frydman, Carola and Raven E. Saks. 2010. “Executive Compensation: A New View from a Long-Term Perspective, 1936-2005.” Review of Financial Studies 23, 2099-2138.

Gabaix, Xavier and Augustin Landier. 2008. “Why has CEO pay increased so much?” Quarterly Journal of Economics, 123(1): 49-100.

Goldin, Claudia, and Lawrence F. Katz. 2008. “The Race between Education and Technology: The Evolution of U.S. Educational Wage Differentials, 1890 to 2005.” NBER Working Paper Series, w12984. http://www.nber.org/papers/w12984

Gordon, Robert J and Ian Dew-Becker. 2007. “Selected Issues in the Rise of Income Inequality.” Brookings Papers on Economic Activity, 2007(2): 169-190. http://faculty-web.at.northwestern.edu/economics/gordon/Selected%20Issues%20in%20the%20Rise%20of%20Income%20Inequality.pdf

Grundfest, Joseph. 2009. “What’s Needed is Uncommon Wisdom.” New York Times Dealbook Dialogue. New York, New York, New York Times Company. http://dealbook.nytimes.com/2009/10/06/dealbook-dialogue-joseph-gundfestuncommon-wisdom/

Hacker, Jacob, and Paul Pierson. 2010. Winner-Take-All Politics: How Washington Made the Rich Richer – and Turned Its Back on the Middle Class. New York, New York, Simon and Schuster, Inc.

Haldane, Andrew. 2010. “The $100 Billion Question.” Speech, Bank of England. http://www.bankofengland.co.uk/publications/Documents/speeches/2010/speech433.pdf

Haldane, Andrew. 2010. “The Contribution of the Financial Sector: Miracle or Mirage?” Speech prepare for the Future of Finance Conference, London. http://www.bankofengland.co.uk/publications/Documents/speeches/2010/speech442.pdf

Jacquette, Scott, Matthew Knittel and Karl Russo. 2003. “Recent Trends in Stock Options.” Office of Technical Assistance Working Paper no. 89. U.S. Department of the Treasury, Washington,D.C.

Jayadev, Arjun. 2007. “Capital account openness and the labour share of income.” Cambridge Journal of Economics, 31(3): 424-443.

Kaplan, Steven N. 2012. “Executive Compensation and Corporate Governance in the U.S.: Perceptions, Facts, and Challenges.” Martin Feldstein Lecture.

Kaplan, Steven N. 2012. “Executive Compensation and Corporate Governance in the U.S.: Perceptions, Facts and Challenges.” NBER Working Paper Series, number w18395. http://www.nber.org/papers/w18395

Kedrosky, Paul and Dane Stangler. 2011. “Financialization and Its Entrepreneurial Consequences.” Kauffman Foundation Research Series: Firm Formation and Economic Growth. Ewing Marion Kauffman Foundation. http://www.kauffman.org/uploadedfiles/financialization_report_3-23-11.pdf

Kopczuk, Wojciech, Emmanuel Saez, and Jae Song. 2010. “Earnings Inequality and Mobility in the United States: Evidence from Social Security Data Since 1937.” The Quarterly Journal of Economics 125(1): 91-128. http://qje.oxfordjournals.org/content/125/1/91.short

Laeven, Luc and Fabian Valencia. 2008. “Systemic Banking Crises: A New Database.” International Monetary Fund working paper, Washington, D.C. http://www.imf.org/external/pubs/ft/wp/2008/wp08224.pdf

Laugesen, Miriam and Sherry Glied. 2011. “Higher Fees Paid To US Physicians Drive Higher Spending For Physician Services Compared to Other Countries.” Health Affairs, 30(9): 1647-1656. http://content.healthaffairs.org/content/30/9/1647.abstract

Lee, David. 1999. “Wage Inequality in the United States During the 1980s: Rising Dispersion or Falling Minimum Wage?” Quarterly Journal of Economics 114(3): 977-1023. http://www.princeton.edu/~davidlee/wp/inequality.pdf

Levy, Frank and Peter Temin. 2007. “Inequality and Institutions in 20th Century America.” Cambridge, MA: Massachusetts Institute of Technology Working Paper Series. http://web.mit.edu/ipc/publications/pdf/07-002.pdf

Lindert, Peter. 2004. Growing Public: Volume 1, the Story: Social Spending and Economic Growth Since the Eighteenth Century. Cambridge, UK, Cambridge University Press.

Manning, Alan. 2005. Monopsony in Motion: Imperfect Competition in Labor Markets. Princeton, NJ, Princeton University Press.

McCardle, Megan. 2011. “The 1% Ain’t What It Used To Be.” The Atlantic Monthly, blog post. http://www.theatlantic.com/business/archive/2011/10/the-1-aint-what-it-used-to-be/247011/

Mishel, Lawrence, Jared Bernstein, and Sylvia Allegretto. 2004. The State of Working America: 2004-05. An Economic Policy Institute book. Ithaca, N.Y.: Cornell University Press.

Mishel, Lawrence, Josh Bivens, Elise Gould, and Heidi Shierholz. 2012. The State of Working America, 12th Edition. An Economic Policy Institute book. Ithaca, N.Y.: Cornell University Press.

Mishel, Lawrence, and Natalie Sabadish. 2012. “CEO Pay and the top 1%.” Economic Policy Institute Issue Brief #331. Economic Policy Institute, Washington, D.C.

Mishel, Lawrence, and Natalie Sabadish. 2013. “CEO Pay in 2012” Economic Policy Institute Issue Brief. Economic Policy Institute, Washington, D.C.

Murphy, Kevin M., Andrei Shleifer and Robert W. Vishny. 1991. “The Allocations of Talent: Implications for Growth.” Quarterly Journal of Economics, 106(2): 503-30. http://www.economics.harvard.edu/faculty/shleifer/files/allocation_talent.pdf

Philippon, Thomas, and Ariell Reshef. 2009. “Wages and Human Capital in the U.S. Financial Industry: 1909-2006.” NBER Working Paper Series, w14644. http://www.nber.org/papers/w14644

Piketty, Thomas, and Emmanuel Saez. 2003. “Income Inequality in the United States, 1913-1998.” Quarterly Journal of Economics, 118(1): 1-39. Tables and figures updated to 2010 in Excel format, March 2012). http://elsa.berkeley.edu/~saez/pikettyqje.pdf

Piketty, Thomas, Emmanuel Saez, and Stefanie Stantcheva. 2011, revised 2012. “Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities.” NBER Working Paper Series w17616. http://elsa.berkeley.edu/~saez/piketty-saez-stantcheva12thirdelasticity_nber_v2.pdf

Rodrik, Dani. 1999. “Globalization and Labor, Or: If Globalization is a Bowl of Cherries, Why Are There so Many Glum Faces Around the Table?” in Richard E. Baldwin, et al., eds., Market Integration, Regionalism and the Global Economy, Cambridge University Press for CEPR, New York.

Schmitt, John and Ben Zipperer. 2009. “Dropping the Ax: Illegal Firings During Union Election Campaigns.” Report. Center for Economic and Policy Research, Washington, D.C. http://www.cepr.net/documents/publications/unions_2007_01.pdf

Stewart J. Schwab and Randall S. Thomas. 2006. An Empirical Analysis of CEO Employment Contracts: What Do Top Executives Bargain For? 63 Wash & Lee L. Rev. 231 (2006),

http://scholarlycommons.law.wlu.edu/wlulr/vol63/iss1/6

Sherman, Matthew. 2009. “A Short History of Financial Deregulation in the United States.” Report. Center for Economic and Policy Research, Washington, D.C. http://www.cepr.net/documents/publications/dereg-timeline-2009-07.pdf

Stiglitz, Joseph. 2012. The Price of Inequality. New York, New York: W. W. Norton & Company.

Tervio, Marko. 2008. “The Difference That CEOs Make: An Assignment Model Approach.” American Economic Review, 98(3): 642-68.

Tervio, Marko. 2008. “Superstars and Mediocrities: Market Failure in the Discovery of Talent”. Review of Economic Studies, 76(2): 21-49.

Thompson, Jeffrey and Elias Leight. 2012. “Do Rising Top Income Shares Affect the Incomes or Earnings of Low and Middle-Income Families?” Finance and Economics Discussion Series, Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Washington, D.C. http://www.federalreserve.gov/pubs/feds/2012/201276/201276pap.pdf