Issue Brief #145

The Perils of Privatization

Bush’s lethal plan for Social Security

by Edith Rasell and Christian E. Weller

In his proposal for Social Security, presidential candidate George Bush would allow a portion of each worker’s payroll taxes to be placed in a personal account and invested in stocks and bonds. Creating voluntary personal accounts within Social Security would change the fundamental character of the program and potentially carve a path toward its eventual demise. Social Security would no longer be a social insurance program providing a guarantee of inflation-proof, lifelong retirement income. Instead, workers’ core retirement income would be put at risk in an investment program where benefits are determined by the luck and wisdom of their investment choices and the ups and downs of financial markets.

Increased risk — In a privatized system, workers’ retirement income would depend upon many factors: the performance of the stock market, luck, investment savvy, the timing of retirement (i.e., whether the stock market was up or down), and other factors outside a worker’s control. Social Security’s income guarantee would be lost, and it would no longer serve as a source of ensured income for the elderly, especially lower-income workers, women, and minorities.

Winners and losers — Currently, no one gets rich on their Social Security benefits, but most everyone gets by. In 1998, the average benefit a retired worker received was about $725 per month. Under the Bush proposal, some people would do very well but others would fare poorly. People with more experience with investments, those who are willing to devote significant time and effort to monitor the performance of their portfolio, and those able to hire financial advisors will probably make better investment decisions than others. People with less time, talent, money or inclination to manage their personal accounts will likely fare worse. And even in this stock market that is, on average, rising, some investors are still losing money.

Administrative costs — Creating a large number of small accounts is the costliest way of handling the nation’s retirement savings. Fund managers charge administrative fees for handling an account and managing the investments. Annual administrative fees on mutual fund accounts average 1.5% of the value of the account. Over the 40 years of someone’s working life, a 1.5% annual fee reduces the total value of his or her account by 30%. By contrast, Social Security’s administrative overhead is less than 1%.

But because financial firms incur fixed costs for managing each account, regardless of the amount invested, average administrative fees for small personal accounts would likely be significantly higher than 1.5%. Average earnings under Social Security in 1998 were $23,651. If a worker contributed 2% of earnings to a personal account (Bush does not specify a percentage contribution amount but this is considered a likely figure), even after five years, a 1.5% charge will still total less than $50 annually-too small an amount to cover necessary administrative costs. Moreover, at least half of all workers would have even lower annual earnings and make even smaller contributions. To manage these accounts, brokers will have to charge far more than 1.5%.

Outliving benefits — Social Security’s inflation-adjusted benefits continue for as long as a retiree lives (and continue throughout the lifetime of a surviving spouse as well). But income from these personal accounts or any investment is not guaranteed to last that long. Since no one knows how long they are going to live, upon retirement workers will need to convert their personal accounts into an annuity that will guarantee them a monthly benefit throughout their remaining years.

Annuities are costly-to convert an investment account into an annuity, insurance companies typically charge 4-6% of the total value of the account. Added to the annual administrative fees, a minimum of 35% of a worker’s total account will be lost before the first retirement check is issued. Moreover, unlike Social Security, annuity disbursements generally are not adjusted for inflation and decline in value as prices rise. In sum, a system of personal accounts will provide worse benefits at a higher cost to workers.

Transition costs — Switching to a system of personal accounts will also impose transition costs. Current and future workers for the next 30 to 40 years will pay twice for their retirement income. Current workers and retirees have already contributed to Social Security and have accrued benefits under the old system. Bush has promised to honor the existing commitments to retirees and near-retirees. But all other workers will have the option to pay part of their payroll tax into a private account. Additional money will be needed to continue to pay traditional Social Security benefits for the next 30 to 40 years.

If, as expected, 2 percentage points of the 12.4% payroll tax are diverted to personal accounts, then Social Security will lose 16% of contributions (2 is 16% of 12.4). In 1999, this transfer would have meant a loss in income to Social Security of $74 billion. In each year for the next four decades, the loss will equal roughly 0.8% of GDP or more than 4% of the federal budget. Bush proposes to cover this loss with money from the Social Security surplus-the same type of circular funding proposal made by President Clinton that brought charges of “double counting.”

Excessive rates of return — The Bush proposal assumes an excessively high rate of return on personal accounts- an average real rate of 6%, but future returns are likely to be much lower. Present rates cannot persist nor will returns over the next 75 years equal those of the past 75-primarily because the stock market is currently overvalued. Expert opinion is predicting future returns over the next 75 years to average 4.0% to 4.5%, adjusted for inflation. Returns on bonds in the Social Security Trust Fund are expected to average 3%, after inflation. Even the 1% to 1.5% advantage of stocks over bonds will largely be erased by the higher overhead associated with equity investments.

Moreover, the stock market has shown that it can produce long droughts for financial investors. In the twentieth century, three different 20-year periods-1901 to 1921, 1928 to 1948, and 1962 to 1982-have generated average real rates of return of 0%. Under such circumstances, private investments in equities will not provide sufficient returns for a decent standard of living in retirement.

Reduced progressivity — Bush makes the false promise that personal accounts will build wealth, particularly for lower-income workers. But because of the risks and costs associated with these accounts, they are a particularly poor investment vehicle for low-income workers. Social Security’s progressive benefit structure, which replaces a larger share of income for lower-earning workers than higher earners, provides the best possible option for lower-wage workers. Everyone should be encouraged to save and invest their savings as they wish, but the core retirement income of workers-especially lower-income workers-should be guaranteed, should increase with inflation, and should last throughout the retirement years.

Voluntary accounts — The Bush proposal states that personal accounts will be voluntary. The specifics of this feature of the program have not been detailed, but this is potentially the most dangerous aspect of the proposal. In the Social Security program, higher earners pay some of the cost of benefits for lower earners. (This is how the progressive benefit structure is financed

.) Given the opportunity, high earners will likely opt for private accounts, while lower earners would do best by remaining in the traditional program. A system of voluntary personal accounts is bad economics and bad politics. If the tax revenues from higher earners flow into private accounts instead of the Social Security trust fund, the funding shortfall will be larger and occur earlier than currently projected, further weakening the system on which low- and middle-wage workers depend. Political support for the program will also erode as higher earners leave. Social Security will begin to resemble a welfare program for the low- and middle-income workers, not a social insurance program serving the whole population.

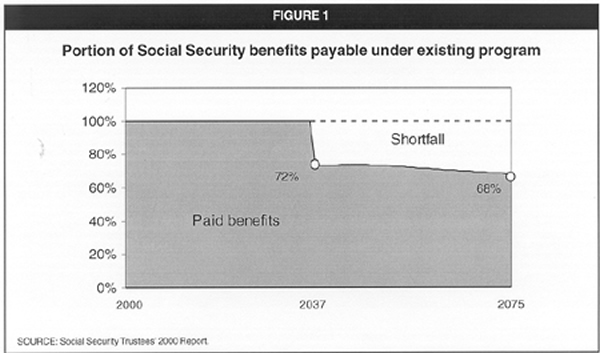

A better option — Social Security can pay all benefits until 2037 and, without any changes, have sufficient funds to pay more than two-thirds of benefits between 2037 and 2075 (Figure 1). The funding shortfall, however, requires a program tune-up, not a fundamental transformation. To bring more money into the system and to make the payroll tax more equitable, the cap on earnings subject to the payroll tax-currently set at $76,200-should be eliminated. Just 6% of workers would be affected, but the additional revenue coming into the program (net of the higher benefits paid these high earners) would eliminate more than three-quarters of the 75-year funding shortfall.

The promises of personal accounts do not add up. Social Security is too important a source of income for America’s families to be left to the uncertainties of the stock market. A better solution exists that preserves the social insurance system and offers the promise of a much safer and sound future for America’s retirement program.