Income Inequality and Economic Mobility

Elise Gould, Senior Economist

Economic Policy Institute

Washington Internship Institute

Tuesday, September 12, 2017

Economic inequality

Average annual family income growth, by income group, 1947–2015

| 1947-1979 | 1979-2007 | 2007-2015 | |

|---|---|---|---|

| Lowest fifth | 2.52% | 0.02% | -0.48% |

| Second fifth | 2.21% | 0.37% | -0.50% |

| Third fifth | 2.39% | 0.59% | -0.30% |

| Fourth fifth | 2.43% | 0.89% | -0.09% |

| 80th-95th percentile | 2.36% | 1.17% | -0.11% |

| Top 5 percent | 1.86% | 1.99% | 0.41% |

Note: Data are for money income. Because of a redesign in the CPS ASEC income questions in 2013, we imputed the historical series using the ratio of the old and new method in 2013.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement Historical Income Tables (Table F-3)

Updated from: Figure 2C in The State of Working America, 12th Edition (Mishel et al. 2012), an Economic Policy Institute book published by Cornell University Press in 2012

Change in real annual household income, by income group, 1979–2013

| Bottom 90 percent | 91st-99th percentile | Top 1 percent | |

|---|---|---|---|

| 1979 | 0.0% | 0.0% | 0.0% |

| 1980 | -3.0% | -3.0% | -4.8% |

| 1981 | -3.4% | -3.9% | -5.5% |

| 1982 | -4.4% | -4.6% | -1.0% |

| 1983 | -5.0% | -1.9% | 8.6% |

| 1984 | -0.6% | 5.6% | 19.9% |

| 1985 | 0.0% | 6.2% | 28.2% |

| 1986 | 3.4% | 14.3% | 68.2% |

| 1987 | 3.6% | 14.5% | 35.9% |

| 1988 | 5.4% | 17.9% | 70.5% |

| 1989 | 7.1% | 20.1% | 59.0% |

| 1990 | 7.1% | 16.7% | 52.7% |

| 1991 | 5.8% | 14.7% | 36.6% |

| 1992 | 6.9% | 18.2% | 55.0% |

| 1993 | 8.1% | 18.7% | 48.9% |

| 1994 | 9.4% | 20.8% | 53.3% |

| 1995 | 12.3% | 26.0% | 70.7% |

| 1996 | 13.7% | 30.3% | 87.5% |

| 1997 | 15.8% | 36.5% | 115.4% |

| 1998 | 19.5% | 42.2% | 142.9% |

| 1999 | 22.4% | 48.1% | 162.9% |

| 2000 | 22.2% | 51.7% | 186.7% |

| 2001 | 21.9% | 43.3% | 126.4% |

| 2002 | 19.1% | 39.4% | 100.5% |

| 2003 | 19.6% | 42.5% | 112.5% |

| 2004 | 23.4% | 49.3% | 153.3% |

| 2005 | 25.4% | 57.4% | 205.2% |

| 2006 | 27.6% | 61.2% | 229.1% |

| 2007 | 30.0758101551046% | 66.2001647952772% | 244.12435417348% |

| 2008 | 25.5% | 55.2% | 178.3% |

| 2009 | 24.7% | 48.6% | 118.4% |

| 2010 | 24.8% | 52.6% | 153.0% |

| 2011 | 23.3% | 53.2% | 149.1% |

| 2012 | 23.6% | 58.4% | 207.0% |

| 2013 | 25.6% | 61.1% | 159.6% |

Note: Data are for comprehensive income. Shaded areas denote recessions.

Source: Authors' analysis of data from the Congressional Budget Office (2014)

Workers produced much more, but typical workers' pay lagged far behind: Disconnect between productivity and typical worker's compensation, 1948–2016

| Year | Hourly compensation | Productivity |

|---|---|---|

| 1948 | 0.00% | 0.00% |

| 1949 | 6.25% | 1.55% |

| 1950 | 10.48% | 9.33% |

| 1951 | 11.76% | 12.35% |

| 1952 | 15.04% | 15.63% |

| 1953 | 20.85% | 19.55% |

| 1954 | 23.52% | 21.56% |

| 1955 | 28.74% | 26.46% |

| 1956 | 33.95% | 26.66% |

| 1957 | 37.14% | 30.09% |

| 1958 | 38.16% | 32.78% |

| 1959 | 42.55% | 37.64% |

| 1960 | 45.50% | 40.05% |

| 1961 | 47.99% | 44.36% |

| 1962 | 52.48% | 49.79% |

| 1963 | 55.03% | 55.01% |

| 1964 | 58.51% | 59.99% |

| 1965 | 62.47% | 64.94% |

| 1966 | 64.90% | 70.00% |

| 1967 | 66.90% | 72.05% |

| 1968 | 70.74% | 77.16% |

| 1969 | 74.67% | 77.88% |

| 1970 | 76.61% | 80.37% |

| 1971 | 82.02% | 87.10% |

| 1972 | 91.25% | 92.05% |

| 1973 | 91.31% | 96.75% |

| 1974 | 86.98% | 93.66% |

| 1975 | 86.86% | 97.92% |

| 1976 | 89.68% | 103.44% |

| 1977 | 93.15% | 105.79% |

| 1978 | 95.98% | 107.79% |

| 1979 | 93.45% | 108.14% |

| 1980 | 88.59% | 106.57% |

| 1981 | 87.61% | 111.02% |

| 1982 | 87.79% | 107.88% |

| 1983 | 88.37% | 114.13% |

| 1984 | 86.96% | 119.73% |

| 1985 | 86.33% | 123.43% |

| 1986 | 87.34% | 127.99% |

| 1987 | 84.62% | 129.12% |

| 1988 | 83.87% | 131.78% |

| 1989 | 83.72% | 133.65% |

| 1990 | 82.24% | 136.98% |

| 1991 | 81.90% | 138.89% |

| 1992 | 83.07% | 147.56% |

| 1993 | 83.41% | 148.37% |

| 1994 | 83.84% | 150.75% |

| 1995 | 82.73% | 150.86% |

| 1996 | 82.81% | 156.92% |

| 1997 | 84.82% | 160.50% |

| 1998 | 89.19% | 165.71% |

| 1999 | 91.94% | 172.08% |

| 2000 | 92.92% | 178.50% |

| 2001 | 95.59% | 182.84% |

| 2002 | 99.40% | 190.72% |

| 2003 | 101.66% | 200.17% |

| 2004 | 100.87% | 208.21% |

| 2005 | 100.07% | 213.58% |

| 2006 | 100.24% | 215.48% |

| 2007 | 101.73% | 217.70% |

| 2008 | 101.74% | 218.24% |

| 2009 | 109.72% | 224.75% |

| 2010 | 111.56% | 234.28% |

| 2011 | 109.09% | 234.67% |

| 2012 | 107.30% | 236.51% |

| 2013 | 108.34% | 237.57% |

| 2014 | 109.22% | 239.30% |

| 2015 | 112.81% | 241.08% |

| 2016 | 115.14% | 241.76% |

Note: Data are for compensation (wages and benefits) of production/nonsupervisory workers in the private sector and net productivity of the total economy. "Net productivity" is the growth of output of goods and services less depreciation per hour worked.

Source: EPI analysis of Bureau of Labor Statistics and Bureau of Economic Analysis data

Updated from Figure A in Raising America’s Pay: Why It’s Our Central Economic Policy Challenge

Source: EPI analysis of unpublished Total Economy Productivity data from Bureau of Labor Statistics (BLS) Labor Productivity and Costs program, wage data from the BLS Current Employment Statistics, BLS Employment Cost Trends, BLS Consumer Price Index, and Bureau of Economic Analysis National Income and Product Accounts

Updated from: Figure A in Raising America’s Pay: Why It’s Our Central Economic Policy Challenge, by Josh Bivens, Elise Gould, Lawrence Mishel, and Heidi Shierholz, Economic Policy Institute, 2014.

Cumulative percent change in real annual wages, by wage group, 1979–2015

| Year | Bottom 90% | 90th–95th | 95th–99th | Top 1% | Average |

|---|---|---|---|---|---|

| 1979 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| 1980 | -2.2% | -1.3% | -0.2% | 3.4% | -1.4% |

| 1981 | -2.6% | -1.1% | -0.1% | 3.1% | -1.7% |

| 1982 | -3.9% | -0.9% | 2.2% | 9.5% | -1.9% |

| 1983 | -3.7% | 0.7% | 3.6% | 13.6% | -1.1% |

| 1984 | -1.8% | 2.5% | 6.0% | 20.7% | 1.2% |

| 1985 | -1.0% | 4.0% | 8.1% | 23.0% | 2.4% |

| 1986 | 1.1% | 6.4% | 12.5% | 32.6% | 5.3% |

| 1987 | 2.1% | 7.4% | 15.0% | 53.5% | 7.9% |

| 1988 | 2.2% | 8.2% | 18.4% | 68.7% | 9.7% |

| 1989 | 1.8% | 8.1% | 18.2% | 63.3% | 9.0% |

| 1990 | 1.1% | 7.1% | 16.5% | 64.8% | 8.3% |

| 1991 | 0.0% | 6.9% | 15.5% | 53.6% | 6.5% |

| 1992 | 1.5% | 9.0% | 19.2% | 74.3% | 9.8% |

| 1993 | 0.9% | 9.2% | 20.6% | 67.9% | 9.1% |

| 1994 | 2.0% | 11.2% | 21.0% | 63.4% | 9.8% |

| 1995 | 2.8% | 12.2% | 24.1% | 70.2% | 11.3% |

| 1996 | 4.1% | 13.6% | 27.0% | 79.0% | 13.3% |

| 1997 | 7.0% | 16.9% | 32.3% | 100.6% | 17.9% |

| 1998 | 11.0% | 21.3% | 38.2% | 113.1% | 22.8% |

| 1999 | 13.2% | 25.0% | 42.9% | 129.7% | 26.5% |

| 2000 | 15.3% | 26.8% | 48.0% | 144.8% | 29.9% |

| 2001 | 15.7% | 29.0% | 46.4% | 130.4% | 29.3% |

| 2002 | 15.6% | 29.0% | 43.2% | 109.3% | 27.2% |

| 2003 | 15.7% | 30.3% | 44.9% | 113.9% | 27.9% |

| 2004 | 15.6% | 30.8% | 47.1% | 127.2% | 29.2% |

| 2005 | 15.0% | 30.8% | 48.7% | 135.3% | 29.6% |

| 2006 | 15.7% | 32.5% | 52.1% | 143.4% | 31.3% |

| 2007 | 16.7% | 34.1% | 55.4% | 156.174999145907% | 33.4% |

| 2008 | 16.0% | 34.2% | 53.8% | 137.5% | 31.4% |

| 2009 | 16.0% | 35.3% | 53.5% | 116.2% | 29.9% |

| 2010 | 15.2% | 35.7% | 55.7% | 130.9% | 30.8% |

| 2011 | 14.6% | 36.2% | 56.9% | 134.1% | 30.7% |

| 2012 | 14.7% | 36.4% | 58.4% | 148.5% | 32.1% |

| 2013 | 15.2% | 37.2% | 59.5% | 137.6% | 31.9% |

| 2014 | 16.7% | 38.9% | 62.6% | 149.4% | 34.4% |

| 2015 | 20.7% | 43.4% | 68.3% | 156.700964435763% | 38.9% |

Source: EPI analysis of Kopczuk, Saez, and Song (2010, Table A3) and Social Security Administration wage statistics

Inequality comes at a cost

The U.S. middle class has faced a huge "inequality tax" in recent decades: Household income of the broad middle class, actual and projected, assuming it grew at overall average rate, 1979–2013

| Year | Actual | Projected |

|---|---|---|

| 1979 | $ 61,550 | $ 61,550 |

| 1980 | $ 59,506 | $ 59,527 |

| 1981 | $ 59,157 | $ 59,317 |

| 1982 | $ 58,082 | $ 59,213 |

| 1983 | $ 57,173 | $ 59,520 |

| 1984 | $ 60,506 | $ 62,684 |

| 1985 | $ 60,492 | $ 63,780 |

| 1986 | $ 62,343 | $ 68,523 |

| 1987 | $ 61,433 | $ 66,324 |

| 1988 | $ 62,300 | $ 69,100 |

| 1989 | $ 63,164 | $ 69,648 |

| 1990 | $ 63,402 | $ 69,136 |

| 1991 | $ 62,430 | $ 67,433 |

| 1992 | $ 62,824 | $ 69,370 |

| 1993 | $ 63,483 | $ 69,654 |

| 1994 | $ 64,001 | $ 70,576 |

| 1995 | $ 66,000 | $ 73,309 |

| 1996 | $ 66,706 | $ 75,677 |

| 1997 | $ 67,795 | $ 78,567 |

| 1998 | $ 70,031 | $ 82,290 |

| 1999 | $ 71,814 | $ 85,759 |

| 2000 | $ 71,697 | $ 86,986 |

| 2001 | $ 71,770 | $ 82,500 |

| 2002 | $ 70,123 | $ 79,095 |

| 2003 | $ 70,210 | $ 80,289 |

| 2004 | $ 72,569 | $ 85,040 |

| 2005 | $ 73,757 | $ 89,278 |

| 2006 | $ 74,463 | $ 91,847 |

| 2007 | $ 76,402 | $ 94,239 |

| 2008 | $ 73,541 | $ 86,863 |

| 2009 | $ 72,693 | $ 82,429 |

| 2010 | $ 72,829 | $ 84,614 |

| 2011 | $ 72,079 | $ 83,608 |

| 2012 | $ 72,011 | $ 87,419 |

| 2013 | $ 73,535 | $ 86,215 |

Note: Data show average income of households in the 20th–80th percentile.

Source: EPI analysis of data from the Congressional Budget Office (2016). Reproduced from Figure I in Raising America’s Pay: Why It’s Our Central Economic Policy Challenge.

Source: EPI analysis of data from The Distribution of Household Income and Federal Taxes, 2011, the Congressional Budget Office, 2014.

Reproduced from Figure I in Raising America’s Pay: Why It’s Our Central Economic Policy Challenge, by Josh Bivens, Elise Gould, Lawrence Mishel, and Heidi Shierholz, Economic Policy Institute, 2014.

Poverty rate, actual and simulated supplemental poverty measure, 1967–2015

| Year | Actual poverty rate (Supplemental Poverty Measure, anchored 2015) | Simulated poverty rate* (predicted SPM) |

|---|---|---|

| 1967 | 24.4% | 24.1% |

| 1968 | 22.4% | 23.2% |

| 1969 | 21.0% | 22.6% |

| 1970 | 21.0% | 22.9% |

| 1971 | 21.0% | 22.4% |

| 1972 | 19.4% | 21.3% |

| 1973 | 18.2% | 20.0% |

| 1974 | 19.2% | 20.4% |

| 1975 | 18.4% | 20.7% |

| 1976 | 17.7% | 19.6% |

| 1977 | 17.6% | 18.5% |

| 1978 | 17.0% | 17.2% |

| 1979 | 16.8% | 16.6% |

| 1980 | 18.2% | 17.0% |

| 1981 | 19.4% | 16.6% |

| 1982 | 20.4% | 17.5% |

| 1983 | 20.9% | 16.4% |

| 1984 | 19.8% | 14.4% |

| 1985 | 19.6% | 13.3% |

| 1986 | 19.0% | 12.4% |

| 1987 | 17.8% | 11.5% |

| 1988 | 17.7% | 10.4% |

| 1989 | 17.4% | 9.4% |

| 1990 | 17.9% | 9.1% |

| 1991 | 18.5% | 9.7% |

| 1992 | 18.6% | 9.0% |

| 1993 | 19.7% | 8.4% |

| 1994 | 18.2% | 7.3% |

| 1995 | 16.6% | 6.8% |

| 1996 | 16.5% | 5.8% |

| 1997 | 15.7% | 4.4% |

| 1998 | 14.8% | 3.1% |

| 1999 | 14.1% | 1.6% |

| 2000 | 13.6% | 0.5% |

| 2001 | 14.0% | 0.6% |

| 2002 | 14.3% | 0.3% |

| 2003 | 14.4% | -0.4% |

| 2004 | 14.2% | -1.7% |

| 2005 | 14.0% | -2.8% |

| 2006 | 14.1% | -3.8% |

| 2007 | 14.3% | -4.4% |

| 2008 | 14.1% | |

| 2009 | 14.2% | |

| 2010 | 14.8% | |

| 2011 | 15.1% | |

| 2012 | 15.6% | |

| 2013 | 15.6% | |

| 2014 | 15.9% | |

| 2015 | 14.2% |

* Predicted SPM, or the simulated poverty rate based on the Supplemental Poverty Measure, is based on a model of the statistical relationship between growth in per capita GDP and poverty that prevailed between 1967 and 1979.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement data, Wimer, Fox, Garfinkel, Kaushal, and Waldfogel (2013), and Bureau of Economic Analysis National Income Product Accounts public data. Analysis using Danziger and Gottschalk (1995). Anchored 2015 SPM provided by Wimer, Fox, Garfinkel, Kaushal, and Waldfogel.

Economic mobility

Probability that sons of fathers in the bottom 20 percent of the earnings distribution end up in the bottom or top 40 percent as adults, by country

| Low-earning father, son in bottom 40 percent | Low-earning father, son in top 40 percent | |

|---|---|---|

| United States | 66.7% | 18.1% |

| United Kingdom | 53.8% | 29.6% |

| Norway | 51.6% | 27.8% |

| Finland | 51.2% | 28.5% |

| Sweden | 50.1% | 28.5% |

| Denmark | 47.3% | 33.3% |

Source: Authors' analysis of Jantti et al. (2006)

American sons of top-earning fathers are more likely to remain in the top decile than Canadian sons: Earnings decile of sons born to top-decile fathers

| United States | Canada | |

|---|---|---|

| Bottom | 3.0% | 8.4% |

| 2nd | 8.0% | 7.8% |

| 3rd | 6.0% | 7.6% |

| 4th | 7.0% | 7.5% |

| 5th | 7.0% | 8.2% |

| 6th | 5.0% | 8.7% |

| 7th | 10.0% | 9.6% |

| 8th | 16.0% | 11.2% |

| 9th | 11.0% | 13.2% |

| Top | 26.0% | 18.0% |

Source: Corak (2009), figure 2, page 8; Corak and Heisz (1999), Table 6, page 520; Mazumder (2005b), Table 2.2, page 93.

American sons of bottom-earning fathers are also more likely to have low earnings than their Canadian counterparts: Earnings decile of sons born to bottom-decile fathers

| United States | Canada | |

|---|---|---|

| Bottom | 22.0% | 15.8% |

| 2nd | 18.0% | 13.7% |

| 3rd | 10.0% | 11.7% |

| 4th | 10.0% | 11.0% |

| 5th | 11.0% | 9.7% |

| 6th | 11.0% | 8.7% |

| 7th | 5.0% | 8.3% |

| 8th | 5.0% | 7.4% |

| 9th | 2.0% | 7.0% |

| Top | 7.0% | 6.9% |

Source: Corak (2009), figure 2, page 8; Corak and Heisz (1999), Table 6, page 520; Mazumder (2005b), Table 2.2, page 93.

Economic mobility and education

Higher-income families spend more on children's enrichment activities: Per-child expenditures on enrichment activities, 1973–2006

| Top income quintile | Bottom income quintile | |

|---|---|---|

| 1973 | $3,536 | $835 |

| 1984 | $5,650 | $1,264 |

| 1995 | $6,975 | $1,173 |

| 2006 | $8,872 | $1,315 |

Note: "Enrichment expenditures" refers to the amount of money families spend per child on books, computers, high-quality child care, summer camps, private schooling, and other things that promote their children's capabilities.

Source: Adapted from Duncan and Murnane (2011)

Share of students completing college, by socioeconomic status and eighth-grade test scores

| Low socioeconomic status (bottom fourth) | Middle socioeconomic status (middle half) | High socioeconomic status (top fourth) | |

|---|---|---|---|

| Low score | 2.9% | 6.7% | 30.3% |

| Middle score | 8.0% | 21.3% | 51.2% |

| High score | 28.8% | 46.6% | 74.1% |

Note: Socioeconomic status is measured by a composite score that includes family income, parental education, and parental occupation.

Source: Authors' analysis of Fox, Connolly, and Snyder (2005, Table 21)

Elasticities between parental income and sons' earnings, 1950–2000

| Year | Intergenerational elasticities |

|---|---|

| 1950 | 0.40 |

| 1960 | 0.35 |

| 1970 | 0.34 |

| 1980 | 0.32 |

| 1990 | 0.46 |

| 2000 | 0.58 |

Note: The higher the intergenerational elasticity (IGE), the lower the extent of mobility. The IGEs shown are for 40- to 44-year-old sons.

Source: Authors' analysis of Aaronson and Mazumder (2007, Table 1)

Share of 25-year-olds from each family income fourth without a college degree, by birth cohort

| 1961-1964 birth cohort | 1979-1982 birth cohort | |

|---|---|---|

| Bottom | 95% | 91% |

| Second | 86% | 79% |

| Third | 83% | 68% |

| Top | 64% | 46% |

Note: Family income fourths are those of 25-year-olds when they were children.

Source: Authors' analysis of Bailey and Dynarski (2011, Figure 3)

Intergenerational mobility and income inequality in 22 countries

| Country | Intergenerational earnings elasticity | Gini coefficient |

|---|---|---|

| Argentina | 0.49 | 0.458 |

| Australia | 0.26 | 0.352 |

| Brazil | 0.58 | 0.539 |

| Canada | 0.19 | 0.326 |

| Chile | 0.52 | 0.523 |

| China | 0.6 | 0.415 |

| Denmark | 0.15 | 0.247 |

| Finland | 0.18 | 0.269 |

| France | 0.41 | 0.327 |

| Germany | 0.32 | 0.283 |

| Italy | 0.5 | 0.36 |

| Japan | 0.34 | 0.249 |

| New Zealand | 0.29 | 0.362 |

| Norway | 0.17 | 0.258 |

| Pakistan | 0.46 | 0.327 |

| Peru | 0.67 | 0.48 |

| Singapore | 0.44 | 0.425 |

| Spain | 0.4 | 0.347 |

| Sweden | 0.27 | 0.25 |

| Switzerland | 0.46 | 0.337 |

| United Kingdom | 0.5 | 0.36 |

| United States | 0.47 | 0.408 |

Note: The higher the Gini coefficient, the higher the inequality. The higher the intergenerational earnings elasticity, the lower the extent of mobility.

Source: Authors' adaptation of Corak (2012, Figure 2)

What can be done?

Pursue full employment

Strengthen labor standards

Restrain top 1% growth

Pursue full employment

Effect on hourly wage growth of 1 percentage-point decline in unemployment, by wage percentile and gender

| Men | Women | |

|---|---|---|

| 10th percentile* | 1.86% | 1.44% |

| 50th percentile* | 1.14% | 0.92% |

| 95th percentile** | 0.39% | 0.67% |

* Estimates for men and women are not statistically significantly different.

** Estimates for men are not statistically significant.

Note: Regression of hourly wages changes on contemporaneous unemployment rate, lagged value of productivity growth, time-period dummy variables, and lagged value of inflation.

Source: EPI analysis based on method described in Lawrence Mishel, Josh Bivens, Elise Gould, and Heidi Shierholz, The State of Working America, an Economic Policy Institute book published in 2012 by Cornell University Press

Strengthen labor standards

The federal minimum wage would be much higher if it had kept up with a growing economy

| Actual minimum wage (2017$) | Minimum wage if it had grown with average wages | Minimum wage if it had grown with productivity | |

|---|---|---|---|

| 1938 | $ 3.80 | ||

| 1939 | $ 4.63 | ||

| 1940 | $ 4.60 | ||

| 1941 | $ 4.38 | ||

| 1942 | $ 3.95 | ||

| 1943 | $ 3.72 | ||

| 1944 | $ 3.66 | ||

| 1945 | $ 4.77 | ||

| 1946 | $ 4.40 | ||

| 1947 | $ 3.85 | ||

| 1948 | $ 3.56 | $5.67 | |

| 1949 | $ 3.61 | $5.75 | |

| 1950 | $ 6.68 | $5.84 | |

| 1951 | $ 6.19 | $6.29 | |

| 1952 | $ 6.07 | $6.46 | |

| 1953 | $ 6.03 | $6.65 | |

| 1954 | $ 5.98 | $6.88 | |

| 1955 | $ 6.00 | $6.99 | |

| 1956 | $ 7.89 | $7.28 | |

| 1957 | $ 7.63 | $7.29 | |

| 1958 | $ 7.42 | $7.49 | |

| 1959 | $ 7.37 | $7.64 | |

| 1960 | $ 7.25 | $7.92 | |

| 1961 | $ 8.25 | $8.06 | |

| 1962 | $ 8.17 | $8.31 | |

| 1963 | $ 8.76 | $8.62 | |

| 1964 | $ 8.65 | $8.92 | |

| 1965 | $ 8.51 | $9.21 | |

| 1966 | $ 8.28 | $9.49 | |

| 1967 | $ 8.99 | $9.78 | |

| 1968 | $ 9.90 | $ 9.90 | $9.90 |

| 1969 | $ 9.47 | $ 10.08 | $9.94 |

| 1970 | $ 9.03 | $ 10.18 | $10.08 |

| 1971 | $ 8.66 | $ 10.39 | $10.46 |

| 1972 | $ 8.40 | $ 10.85 | $10.73 |

| 1973 | $ 7.90 | $ 10.83 | $10.99 |

| 1974 | $ 8.99 | $ 10.56 | $10.82 |

| 1975 | $ 8.71 | $ 10.41 | $11.06 |

| 1976 | $ 9.03 | $ 10.54 | $11.37 |

| 1977 | $ 8.49 | $ 10.64 | $11.50 |

| 1978 | $ 9.15 | $ 10.76 | $11.59 |

| 1979 | $ 9.15 | $ 10.60 | $11.61 |

| 1980 | $ 8.80 | $ 10.30 | $11.52 |

| 1981 | $ 8.68 | $ 10.22 | $11.77 |

| 1982 | $ 8.19 | $ 10.19 | $11.59 |

| 1983 | $ 7.85 | $ 10.19 | $11.94 |

| 1984 | $ 7.54 | $ 10.13 | $12.25 |

| 1985 | $ 7.29 | $ 10.08 | $12.46 |

| 1986 | $ 7.16 | $ 10.11 | $12.72 |

| 1987 | $ 6.93 | $ 10.02 | $12.78 |

| 1988 | $ 6.68 | $ 9.98 | $12.93 |

| 1989 | $ 6.41 | $ 9.93 | $13.03 |

| 1990 | $ 6.92 | $ 9.85 | $13.22 |

| 1991 | $ 7.47 | $ 9.80 | $13.30 |

| 1992 | $ 7.29 | $ 9.79 | $13.80 |

| 1993 | $ 7.11 | $ 9.80 | $13.85 |

| 1994 | $ 6.97 | $ 9.85 | $13.96 |

| 1995 | $ 6.80 | $ 9.88 | $14.02 |

| 1996 | $ 7.40 | $ 9.95 | $14.29 |

| 1997 | $ 7.86 | $ 10.11 | $14.53 |

| 1998 | $ 7.75 | $ 10.38 | $14.83 |

| 1999 | $ 7.59 | $ 10.53 | $15.22 |

| 2000 | $ 7.34 | $ 10.59 | $15.55 |

| 2001 | $ 7.14 | $ 10.68 | $15.79 |

| 2002 | $ 7.03 | $ 10.82 | $16.24 |

| 2003 | $ 6.87 | $ 10.87 | $16.77 |

| 2004 | $ 6.69 | $ 10.80 | $17.22 |

| 2005 | $ 6.47 | $ 10.74 | $17.52 |

| 2006 | $ 6.27 | $ 10.80 | $17.62 |

| 2007 | $ 6.92 | $ 10.92 | $17.74 |

| 2008 | $ 7.47 | $ 10.92 | $17.78 |

| 2009 | $ 8.29 | $ 11.29 | $18.15 |

| 2010 | $ 8.16 | $ 11.37 | $18.68 |

| 2011 | $ 7.91 | $ 11.24 | $18.71 |

| 2012 | $ 7.75 | $ 11.18 | $18.81 |

| 2013 | $ 7.64 | $ 11.24 | $18.87 |

| 2014 | $ 7.52 | $ 11.32 | $18.97 |

| 2015 | $ 7.51 | $ 11.54 | $19.07 |

| 2016 | $ 7.41 | $ 11.68 | $19.10 |

| 2017 | $ 7.25 | $ 11.62 | $19.33 |

Note: Growth in average wages measures anverage wages of production workers. Inflation measured using the CPI-U-RS and the CPI projection for 2017 from CBO (2017). Productivity is measured as total economy productivity net depreciation.

Source: EPI analysis of the Fair Labor Standards Act and amendments. Total economy productivity data from the Bureau of Labor Statistics Labor Productivity and Costs program. Average hourly wages of production nonsupervisory workers from the Bureau of Labor Statistics Current Employment Statistics.

Decline in union membership mirrors income gains of top 10%: Union membership and share of income going to the top 10 percent, 1917–2015

| Year | Union membership | Share of income going to the top 10 percent |

|---|---|---|

| 1917 | 11.0% | 40.3% |

| 1918 | 12.1% | 39.9% |

| 1919 | 14.3% | 39.5% |

| 1920 | 17.5% | 38.1% |

| 1921 | 17.6% | 42.9% |

| 1922 | 14.0% | 42.9% |

| 1923 | 11.7% | 40.6% |

| 1924 | 11.3% | 43.3% |

| 1925 | 11.0% | 44.2% |

| 1926 | 10.7% | 44.1% |

| 1927 | 10.6% | 44.7% |

| 1928 | 10.4% | 46.1% |

| 1929 | 10.1% | 43.8% |

| 1930 | 10.7% | 43.1% |

| 1931 | 11.2% | 44.4% |

| 1932 | 11.3% | 46.3% |

| 1933 | 9.5% | 45.0% |

| 1934 | 9.8% | 45.2% |

| 1935 | 10.8% | 43.4% |

| 1936 | 11.1% | 44.8% |

| 1937 | 18.6% | 43.3% |

| 1938 | 23.9% | 43.0% |

| 1939 | 24.8% | 44.6% |

| 1940 | 23.5% | 44.4% |

| 1941 | 25.4% | 41.0% |

| 1942 | 24.2% | 35.5% |

| 1943 | 30.1% | 32.7% |

| 1944 | 32.5% | 31.5% |

| 1945 | 33.4% | 32.6% |

| 1946 | 31.9% | 34.6% |

| 1947 | 31.1% | 33.0% |

| 1948 | 30.5% | 33.7% |

| 1949 | 29.6% | 33.8% |

| 1950 | 30.0% | 33.9% |

| 1951 | 32.4% | 32.8% |

| 1952 | 31.5% | 32.1% |

| 1953 | 33.2% | 31.4% |

| 1954 | 32.7% | 32.1% |

| 1955 | 32.9% | 31.8% |

| 1956 | 33.2% | 31.8% |

| 1957 | 32.0% | 31.7% |

| 1958 | 31.1% | 32.1% |

| 1959 | 31.6% | 32.0% |

| 1960 | 30.7% | 31.7% |

| 1961 | 28.7% | 31.9% |

| 1962 | 29.1% | 32.0% |

| 1963 | 28.5% | 32.0% |

| 1964 | 28.5% | 31.6% |

| 1965 | 28.6% | 31.5% |

| 1966 | 28.7% | 32.0% |

| 1967 | 28.6% | 32.0% |

| 1968 | 28.7% | 32.0% |

| 1969 | 28.3% | 31.8% |

| 1970 | 27.9% | 31.5% |

| 1971 | 27.4% | 31.8% |

| 1972 | 27.5% | 31.6% |

| 1973 | 27.1% | 31.9% |

| 1974 | 26.5% | 32.4% |

| 1975 | 25.7% | 32.6% |

| 1976 | 25.7% | 32.4% |

| 1977 | 25.2% | 32.4% |

| 1978 | 24.7% | 32.4% |

| 1979 | 25.4% | 32.3% |

| 1980 | 23.6% | 32.9% |

| 1981 | 22.3% | 32.7% |

| 1982 | 21.6% | 33.2% |

| 1983 | 21.4% | 33.7% |

| 1984 | 20.5% | 33.9% |

| 1985 | 19.0% | 34.3% |

| 1986 | 18.5% | 34.6% |

| 1987 | 17.9% | 36.5% |

| 1988 | 17.6% | 38.6% |

| 1989 | 17.2% | 38.5% |

| 1990 | 16.7% | 38.8% |

| 1991 | 16.2% | 38.4% |

| 1992 | 16.2% | 39.8% |

| 1993 | 16.2% | 39.5% |

| 1994 | 16.1% | 39.6% |

| 1995 | 15.3% | 40.5% |

| 1996 | 14.9% | 41.2% |

| 1997 | 14.7% | 41.7% |

| 1998 | 14.2% | 42.1% |

| 1999 | 13.9% | 42.7% |

| 2000 | 13.5% | 43.1% |

| 2001 | 13.5% | 42.2% |

| 2002 | 13.3% | 42.4% |

| 2003 | 12.9% | 42.8% |

| 2004 | 12.5% | 43.6% |

| 2005 | 12.5% | 44.9% |

| 2006 | 12.0% | 45.5% |

| 2007 | 12.1% | 45.7% |

| 2008 | 12.4% | 46.0% |

| 2009 | 12.3% | 45.5% |

| 2010 | 11.9% | 46.4% |

| 2011 | 11.8% | 46.6% |

| 2012 | 11.2% | 47.8% |

| 2013 | 11.2% | 46.7% |

| 2014 | 11.1% | 47.3% |

| 2015 | 11.1% | 47.8% |

Sources: Piketty and Saez 2014, Gordon 2013, and Bureau of Labor Statistics Current Population Survey public data series

Data on union density follows the composite series found in Historical Statistics of the United States; updated to 2014 from unionstats.com. Income inequality (share of income to top 10 percent) from Piketty and Saez, “Income Inequality in the United States, 1913–1998,” Quarterly Journal of Economics vol. 118, no. 1 (2003), 1–39. Updated data for this series and other countries, is available at the Top Income Database. Updated 2016.

Restrain top 1% growth

CEO-to-worker compensation ratio, 1965–2016

| Year | CEO-to-worker compensation ratio based on options realized |

|---|---|

| 1965 | 20.2 |

| 1966 | 21.3 |

| 1967 | 22.6 |

| 1968 | 23.9 |

| 1969 | 23.6 |

| 1970 | 23.3 |

| 1971 | 23.0 |

| 1972 | 22.8 |

| 1973 | 22.5 |

| 1974 | 23.8 |

| 1975 | 25.3 |

| 1976 | 26.8 |

| 1977 | 28.4 |

| 1978 | 30.1 |

| 1979 | 32.0 |

| 1980 | 34.0 |

| 1981 | 36.1 |

| 1982 | 38.4 |

| 1983 | 40.8 |

| 1984 | 43.4 |

| 1985 | 46.1 |

| 1986 | 49.0 |

| 1987 | 52.1 |

| 1988 | 55.4 |

| 1989 | 58.9 |

| 1990 | 71.3 |

| 1991 | 86.3 |

| 1992 | 104.4 |

| 1993 | 111.8 |

| 1994 | 87.3 |

| 1995 | 122.6 |

| 1996 | 153.8 |

| 1997 | 233.0 |

| 1998 | 321.8 |

| 1999 | 286.7 |

| 2000 | 376.1 |

| 2001 | 214.2 |

| 2002 | 192.1 |

| 2003 | 234.9 |

| 2004 | 263.1 |

| 2005 | 314.6 |

| 2006 | 344.1 |

| 2007 | 347.5 |

| 2008 | 238.3 |

| 2009 | 196.6 |

| 2010 | 230.3 |

| 2011 | 232.7 |

| 2012 | 281.5 |

| 2013 | 291.8 |

| 2014 | 298.7 |

| 2015 | 286.1 |

| 2016 | 270.5 |

Notes: CEO annual compensation is computed using the “options realized” and “options granted” compensation series for CEOs at the top 350 U.S. firms ranked by sales. The “options realized” series includes salary, bonus, restricted stock grants, options realized, and long-term incentive payouts. The “options granted” series includes salary, bonus, restricted stock grants, options granted, and long-term incentive payouts. Projected value for 2016 is based on the change in CEO pay as measured from June 2015 to June 2016 applied to the full-year 2015 value. Projections for compensation based on options granted and options realized are calculated separately. “Typical worker” compensation is the average annual compensation of the workers in the key industries of the firms in the sample.

Source: Authors’ analysis of data from Compustat’s ExecuComp database, the Bureau of Labor Statistics’ Current Employment Statistics data series, and the Bureau of Economic Analysis NIPA tables

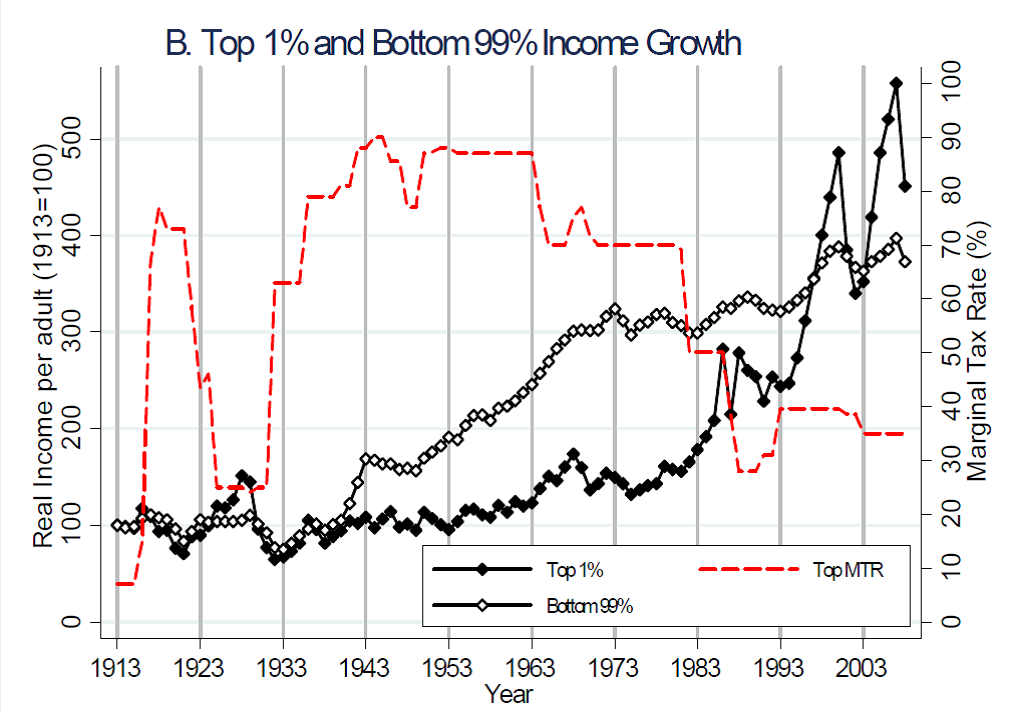

Source: Piketty, Saez, and Stantcheva (2012)

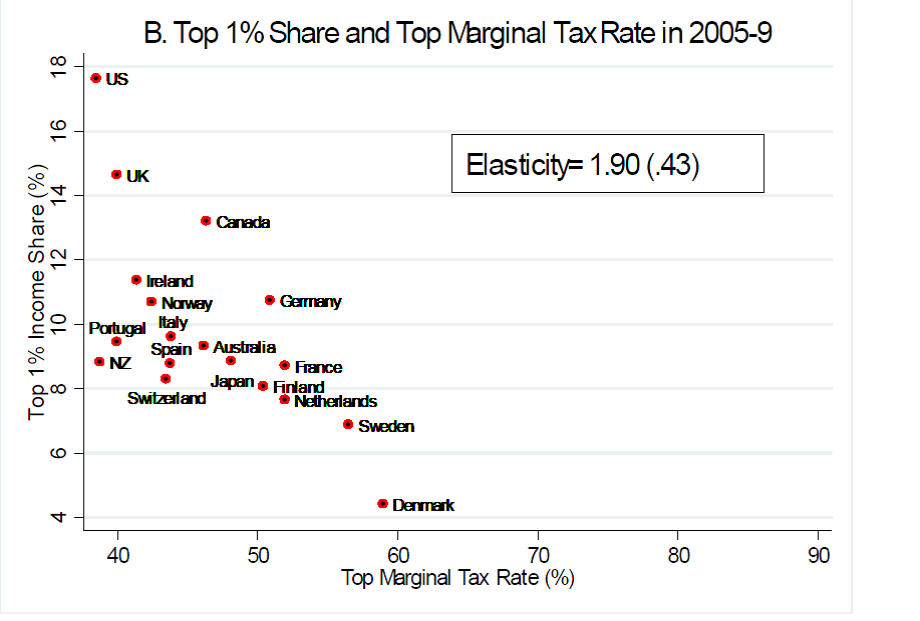

Source: Piketty, Saez, and Stantcheva (2012)

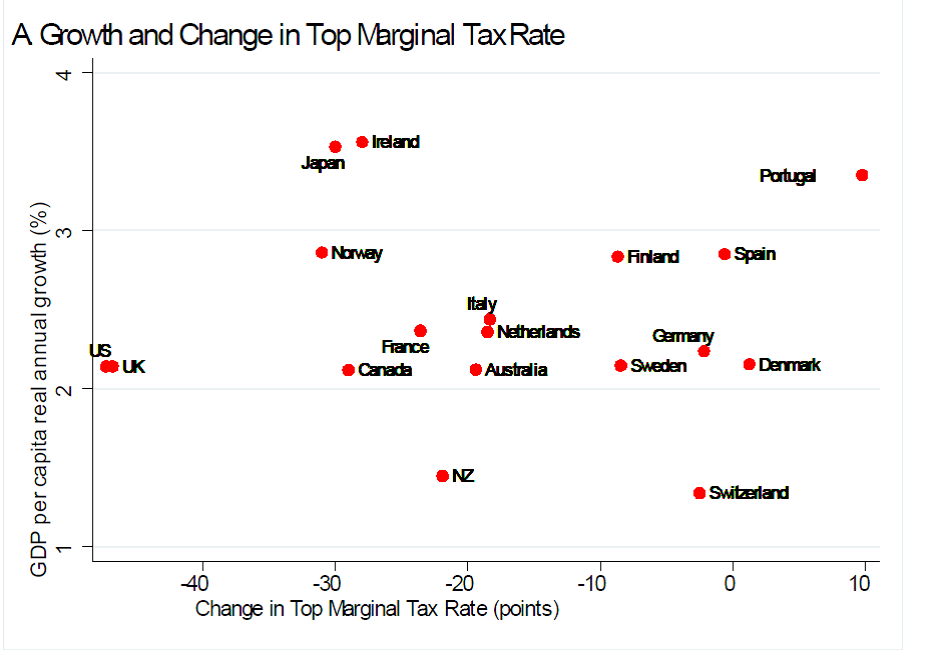

Source: Piketty, Saez, and Stantcheva (2012)

Thank you!

Economic Policy Institute: epi.org