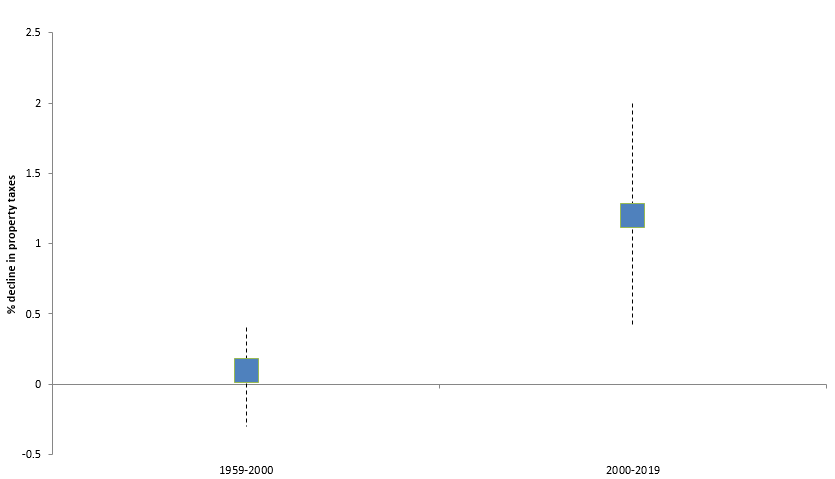

Figure B

Growing cyclical sensitivity of property tax revenues: Annual decline in property tax revenues associated with lagged 1 percentage point increase in unemployment, pre and post-2000

Note: The annual change in state and local taxes property taxes is regressed on the annual change in the unemployment rate lagged two years and a time trend. The earlier time-period includes the years from 1959 to 2000, while the later time period includes all years 2000 and after. The lines above and below the estimate represent 95% confidence intervals.

Source: EPI analysis of Bureau of Economic Analysis National Income and Product Accounts (NIPA) Table 3.3, and BLS Labor Force Statistics from the Current Population Survey.

This chart appears in:

Next chart: Union coverage rates of essential and nonessential workers, 2019 »