One million people applied for unemployment insurance last week: Unless Congress acts, millions of people will soon be left without a safety net

Another 1.0 million people applied for UI benefits last week, including 712,000 people who applied for regular state UI and 289,000 who applied for Pandemic Unemployment Assistance (PUA). After two weeks of increases, the 1.0 million who applied for UI last week was a welcome decline of 105,000 from the prior week. However, last week was the 37th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still nearly three times where they were a year ago.)

Most states provide 26 weeks (six months) of regular benefits, but this crisis has gone on for nearly nine months. That means many workers have exhausted their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 569,000.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA—more on these expirations below).

Reinstating and extending the pandemic unemployment insurance programs through 2021 could create or save 5.1 million jobs

Key takeaways:

- While the economy remains 10 million jobs below pre-pandemic levels and job growth is slowing significantly as the pandemic surges, the remaining suite of pandemic unemployment insurance (UI) programs are set to expire on December 26, even as one of the most important—the extra $600 per week—has already expired and millions of workers have already exhausted benefits or had them significantly slashed.

- The economic shock from COVID-19 has been ongoing long enough that roughly one-third of unemployed workers have been unemployed for 27 weeks or longer. Unemployment insurance benefits should not just be made much more generous, they should also have their durations extended substantially. Once again, this highlights that UI benefit generosity and duration should never be tied to arbitrary dates but should rather be dictated by economic conditions (preferably tied to employment rates).

- If these programs—including the extra $600—are reinstated and extended through 2021, and if the virus is brought under control so that economic growth for 2021 returns to being simply a function of aggregate demand growth, the economy would be boosted by 3.5% and 5.1 million more jobs would be added in 2021.

Wages for the top 1% skyrocketed 160% since 1979 while the share of wages for the bottom 90% shrunk: Time to remake wage pattern with economic policies that generate robust wage-growth for vast majority

Newly available wage data tell a familiar story: In every period since 1979, wages for the bottom 90% were continuously redistributed upward to the top 10% and frequently to the very highest 1.0% and 0.1%. This unceasing growth of wage inequality that undercuts wage growth for the bottom 90% reaffirms the need to place generating robust wage growth for the vast majority and worker power at the center of economic policymaking.

For last year, 2019, the data show a continuation of the trend of annual wages rising fastest for those in the top 10% while those in the bottom 90% saw below-average wage growth. However, within the top 10%, wages rose faster for those in the 90th–99th percentiles than for those in the top 1%.

A similar pattern as in 2019 prevailed over the entire 2007–2019 business cycle as wages were redistributed in two ways, up from the bottom 90% to the top 10% and within the top 10% downward from the top 1% to those in the 90th–99th percentiles. Still, the top 1% has done far better in the 2009–2019 recovery (wages rose 20.4%) than did those in the bottom 90% (wages rose only 8.7%).

Unemployment claims rise for second week in a row: Millions will lose federal unemployment benefits in December unless Senate Republicans act

Because of the Thanksgiving holiday this week, data on unemployment insurance (UI) claims—usually released on Thursdays—were released today. The data show that another 1.1 million people applied for UI benefits last week, including 778,000 people who applied for regular state UI and 312,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.1 million who applied for UI last week was an increase of 22,000 from the prior week’s figures—the second week in a row that initial claims have risen. Further, last week was the 36th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still greater than the second-worst week of the Great Recession.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 299,000, from 6.4 million to 6.1 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA—more on these expirations below).

Racism and the Economy: Focus on Employment

Valerie Wilson, director of the Economic Policy Institute Program on Race, Ethnicity, and the Economy, gave the keynote address at the Federal Reserve Symposium on Racism and the Economy. These are her remarks.

According to the Center for Assessment and Policy Development, racial equity is the condition that would be achieved if one’s racial identity no longer predicted, in a statistical sense, how one fares.

In reality, statistical analysis often reveals that racial identity is a measurable, significant, and persistent predictor of labor market outcomes. Let’s pause and think about that for a moment. Why should racial identity—something as arbitrary and superficial as physical appearance (skin color)—be statistically correlated with one’s likelihood of being employed or how much they are paid for their labor?

No improvement in initial unemployment claims as labor market gains falter

Another 1.1 million people applied for unemployment insurance (UI) benefits last week, including 742,000 people who applied for regular state UI and 320,000 who applied for Pandemic Unemployment Assistance (PUA). The 1.1 million who applied for UI last week was an increase of 55,000 from the prior week’s figures. Last week was the 35th straight week total initial claims were greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still 3.3 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 429,000, from 6.8 million to 6.4 million.

For now, after an individual exhausts regular state benefits, they can move on to Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire on December 26 (as is PUA).

In the latest data available for PEUC (the week ending October 31), PEUC rose by 233,000, from 4.1 million to 4.4 million, offsetting only about 60% of the 383,000 decline in continuing claims for regular state benefits for the same week. This is likely due in large part to the fact that many of the roughly 2 million workers who were on UI before the recession began, or who are in states with less than the standard 26 weeks of regular state benefits, are exhausting PEUC benefits at the same time others are taking it up. More than 1.5 million workers have exhausted PEUC so far (see column C43 in form ETA 5159 for PEUC here). Last week, 634,000 workers were on Extended Benefits (EB), which is a program that eligible unemployed workers in some states can get on if they’ve exhausted PEUC.

Learning during the pandemic: What decreased learning time in school means for student learning

One reflection of how much students have learned and developed since schools closed in March can be found in late Argentinian cartoonist Quino’s 2007 comic strip, in Manolito and his peers’ self-assessments of what they learned in school. When Manolito’s teacher asks, he replies: “From March to today, nothing.” (The implied message is: Others are learning, while he is stuck.)

Lavado, Joaquín Salvador, Quino. 2007. Toda Mafalda. Buenos Aires, Ediciones de la Flor.

As many parents and teachers have seen, these are the likely realities for students in 2020. Because learning time in school matters, and students’ learning and development tend to vary greatly even when schools operate in normal circumstances, challenges to learning were magnified when schools closed—due to prolonged cuts to learning time in school, the access to some “substitute” educational opportunities during the pandemic, and the many factors that influence out-of-school learning.

In this blog post, we review the consequences of reduced learning time in school settings during the pandemic, and what the evidence tells us to do about it when we begin to control the spread of the virus. (For a detailed review of the challenges COVID-19 brought to education and our policy recommendations, see “COVID-19 and student performance, equity, and U.S. education policy: Lessons from pre-pandemic research to inform relief, recovery, and rebuilding.”)

With unemployment benefits for millions of workers set to expire in December, Senate Republicans must stop blocking aid

More than 1.0 million people applied for unemployment insurance (UI) benefits again last week, including 709,000 people who applied for regular state UI and 298,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program that provides up to 39 weeks of benefits for workers who are not eligible for regular unemployment insurance, like the self-employed. Without congressional action, PUA will expire on December 26 (more on that below).

The 1.0 million who applied for UI last week was a decline of 112,000 from the prior week’s figures. Last week was the 34th straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still more than 3.0 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 436,000, from 7.2 million to 6.8 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, like PUA, PEUC is set to expire on December 26 (more on that below).

Voters chose more than just the president: A review of important state ballot initiative outcomes

With enormous attention focused—understandably—on the outcome of the presidential and congressional races on November 3, it’s easy to forget that voters also decided on nearly 6,000 state legislative races and a host of ballot measures in states and localities, including many with important implications for workers, economic justice, racial equity, and the fight against climate change.

There were 120 statewide measures considered by voters across the country. In this post, we briefly highlight some of the notable measures that would have a meaningful impact on the welfare of workers, families, and communities; the power of workers and communities to have a voice in economic policy decisions; and the ability of all people to achieve economic security, regardless of race, ethnicity, or gender. We also call attention to the advocacy and research of Economic Analysis and Research Network (EARN) members in these states, whose work in many cases was critical in explaining the implications of the measures for workers, families, and communities.

The Job Openings and Labor Turnover Survey shows declines in hires: As winter hits, the Biden administration will be facing a mounting, not waning, crisis

Last week, the Bureau of Labor Statistics (BLS) reported that, as of the middle of September, the economy was still 10 million jobs below where it was in February. Job growth slowed considerably over the last few months and the jobs deficit in October was easily over 11.6 million from where we would have been if the economy had continued adding jobs at the pre-pandemic pace.

Today’s BLS Job Openings and Labor Turnover Survey (JOLTS) reports job openings changed little at 6.4 million in September while hires and layoffs fell. While the slowdown in layoffs is promising from 1.5 million to 1.3 million, the softening in hires is a concern (6.0 million to 5.9 million). The U.S. economy is seeing a significantly slower pace of hiring than we experienced in May or June—hiring is roughly where it was before the recession, which is a big problem given that we have more than 11.6 million jobs to make up. And job openings are now substantially below where they were before the recession began (6.4 million at the end of September, compared to 7.1 million on average in the year prior to the recession). No matter how it is measured, the U.S. economy is facing a huge job shortfall.

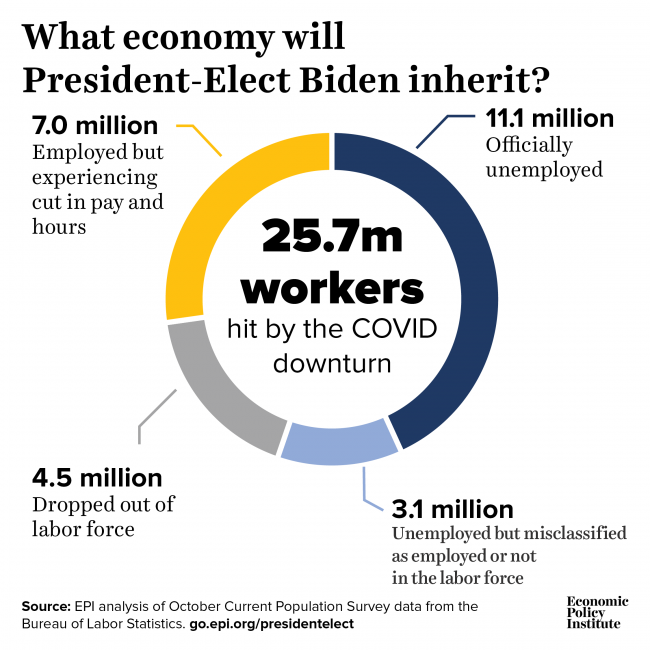

One of the most striking indicators from today’s report is the job seekers ratio, that is, the ratio of unemployed workers (averaged for mid-September and mid-October) to job openings (at the end of September). On average, there were 11.8 million unemployed workers while there were only 6.4 million job openings. This translates into a job seeker ratio of about 1.8 unemployed workers to every job opening. Another way to think about this: for every 18 workers who were officially counted as unemployed, there were only available jobs for 10 of them. That means, no matter what they did, there were no jobs for 5.4 million unemployed workers. And this misses the fact that many more weren’t counted among the unemployed. The economic pain remains widespread with more than 25 million workers hurt by the coronavirus downturn. Without congressional action to stimulate the economy, we are facing a slow, painful recovery.Read more

What the next president inherits: More than 25 million workers are being hurt by the coronavirus downturn

Some of the most frequent questions I’ve gotten in the last few months are, “How many workers are being hurt by the coronavirus recession?” and “What kind of economy will the next president inherit?”

There is a huge amount of confusion about the number of workers impacted by this downturn because two major, completely separate, government data sets that address these questions are reporting very different numbers. Specifically, the Bureau of Labor Statistics (BLS) reported that the official number of unemployed workers in October, from the Current Population Survey, was 11.1 million. But during the reference week for the October monthly unemployment figure—the week ending October 17—the Department of Labor (DOL) reported that there were a total of 21.5 million people claiming unemployment insurance (UI) benefits in all programs. The UI number is compiled by DOL from reports it receives from state unemployment insurance agencies.

What is going on? In a nutshell: The BLS official number of unemployed workers vastly understates the number of workers who have faced the negative consequences of the coronavirus recession, and DOL’s UI number overstates the number of workers receiving unemployment benefits.

Let’s first look at UI. One straightforward way that the weekly UI numbers are higher than the monthly unemployment numbers is that the UI numbers include both Puerto Rico and the Virgin Islands, and the monthly unemployment numbers include only the 50 states and the District of Columbia. The number of people on UI (regular state benefits, Pandemic Unemployment Assistance, Pandemic Emergency Unemployment Compensation, or Extended Benefits) for the week ending October 17 was 294,000 in Puerto Rico and 4,000 in the Virgin Islands, for a total of nearly 300,000 UI claims outside of the 50 states and the District of Columbia.

Over a million people still filed initial unemployment claims last week with no COVID-19 relief in sight

Another 1.1 million people applied for unemployment insurance (UI) benefits last week, including 751,000 people who applied for regular state UI and 363,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program that provides up to 39 weeks of benefits for workers who are not eligible for regular unemployment insurance, like the self-employed. Without congressional action, PUA will expire in less than two months (more on that below).

The 1.1 million who applied for UI last week was little changed (a decline of 3,000) from the prior week’s revised figures. Last week was the 33rd straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still 3.6 times where they were a year ago.)

Most states provide 26 weeks of regular benefits, but this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 538,000, from 7.8 million to 7.3 million.

For now, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, PEUC is set to expire in less than two months (more on that below).

Older workers are voting with an eye on the economy

Recent polls have shown that older Americans and women appear to have turned against President Trump, and the reasons aren’t hard to grasp. The administration’s mishandling of the COVID-19 pandemic has been especially deadly for older Americans, while women have borne the brunt of the economic downturn, with greater job losses and caregiving responsibilities.

One factor has received less attention: Older Americans, too, have been hard hit in the economic downturn. Senior women (women ages 65 and older) have seen a steep decline in employment—almost as steep as that of young women just entering the labor force (see Table 1). Senior men also saw a steep decline in employment early in the pandemic but rebounded faster than senior women.

Heading into election day, at least 30 million workers are being hurt by the coronavirus recession

One of the most frequent questions I’ve gotten in the last few months is, “How many workers are being hurt by the coronavirus recession?” There is a huge amount of confusion about this because two major, completely separate, government data sets that address this question are reporting very different numbers. Specifically, the Bureau of Labor Statistics (BLS) reported that the official number of unemployed workers in September, from the Current Population Survey, was 12.6 million (September is the latest data available; October numbers will be released this Friday). But during the reference week for the September monthly unemployment figure—the week ending September 12—the Department of Labor (DOL) reported that there were a total of 26.5 million people claiming unemployment insurance (UI) benefits. The UI number is compiled by DOL from reports it receives from state unemployment insurance agencies.

What is going on? In a nutshell: The BLS official number of unemployed workers vastly understates the number of workers who have faced the negative consequences of the coronavirus recession, and DOL’s UI number overstates the number of workers receiving unemployment benefits.

Let’s first look at UI. An important way the numbers coming out of DOL are overstating the number of people receiving UI benefits right now has to do with delays in the processing of applications (delays caused by the overwhelming number of applications UI agencies have received during the COVID-19 crisis). When a worker’s benefits are delayed, they are paid retroactively. This is as it should be, but it causes reporting problems. Say a worker claims UI benefits not just for their most recent week of unemployment, but also for the six prior weeks. That worker will show up in the data not as one person who claimed seven weeks of benefits, but as seven claims. Nobody knows how extensive that problem is, but this New York Times article has good information on it. Another issue is that state UI agencies have been the target of fraud—not individuals filing one or two fraudulent claims, but sophisticated cyberattacks involving extensive identity theft and the overriding of security systems. Note: None of this negates the fact that the expansions of unemployment insurance in the CARES Act were an enormous success! These expansions have been a lifeline to millions and a crucial boost to the economy.

Moral policy = good economics: What’s needed to lift up 140 million poor and low-income people further devastated by the pandemic

Seven months into a global pandemic, U.S. families are suffering: 225,000 lives have been lost, 30 million workers have lost either jobs or significant hours of work, nearly every state is facing sharp drops in revenue that will threaten even more cuts to essential social programs and jobs, and the U.S. economy remains deeply depressed, and a reentry into outright recession in coming months is highly possible.

There is no mystery about what has brought us to this point. The immediate cause of the economic crisis we face is the fallout of the pandemic and the Trump administration’s failed response. As social distancing measures were enacted to slow the spread of the coronavirus, economic activity collapsed. A burst of new activity has accompanied some reopenings, but now, because the government has failed to curb the pandemic and failed to enact a just response, the economy is plunging deeper into crisis.

This all is taking place in a society that was already deeply unequal. Before the pandemic, 140 million people were poor or one emergency away from being poor, including approximately 60% of Black, non-Hispanic people (26 million); 64% of Hispanic people (38 million); 60% of indigenous people (2.15 million); 40% of Asian people (8 million); and 33% of white people (66 million).

The pandemic spread and deepened along the fissures of that inequality and the inadequate public policies that existed prior to the pandemic. It is no surprise that 8 million people were pushed below the poverty line in the past five months as COVID-19 economic disruptions continued.

Senate Republicans have failed struggling families: It is cruel, and bad economics, to withhold stimulus aid

Another 1.1 million people applied for unemployment insurance (UI) benefits last week, including 751,000 people who applied for regular state UI and 360,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year.

The 1.1 million who applied for UI last week was a decline of just 25,000 from the prior week’s revised figures. Last week was the 32nd straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still 3.7 times where they were a year ago.)

Most states provide 26 weeks (six months) of regular benefits, and this crisis has gone on much longer than that. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 709,000, from 8.5 million to 7.8 million.

Fortunately, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. However, in the latest data available for PEUC (the week ending October 10) PEUC rose by “just” 387,000 to 3.7 million, offsetting only 42% of the 921,000 decline in continuing claims for regular state benefits for the same week. The small increase in PEUC relative to the decline in continuing claims for regular state UI is likely due in large part to delays workers are facing getting onto PEUC, including workers either not being told about PEUC or not being told that they have to apply for it (states are required to notify eligible workers, but it may not be happening). Further, many of the roughly 2 million workers who were on unemployment insurance before this recession began, or who are in states with less than the standard 26 weeks of regular state benefits, are exhausting PEUC benefits.

Counties that pivoted to Trump had lower wage growth than other counties

In the home stretch to next week’s election, a number of articles have attempted to rebut claims that the Trump administration has practiced “phony” populism. But the only piece of real-world evidence these articles cite to defend the Trump administration’s record in helping working-class voters turns out to be either false or highly misleading.

Specifically, one of the articles defending the Trump record, by Alan Tonelson, highlights wage growth in “pivot counties”—counties that voted for Obama twice but then voted for Trump—and claims that “Average annual private-sector pay in most of these [pivot] counties rose faster during the first three years of the Trump administration than during the last three years of the [sic] Mr. Obama’s presidency.”

In Tonelson’s telling, this wage growth justifies the vote-flipping in those counties between Obama and Trump because the Trump administration has done something that has boosted wage growth in these presumably blue-collar counties. But Tonelson’s analysis is wrong, for a number of reasons.

First, our calculations show that pivot counties didn’t see faster wage growth on average. As Figure A shows, between 2013 and 2016 average real annual pay in pivot counties grew by 4.3%, and between 2016 and 2019 these pivot county average earnings grew by just 2.2%. In all other (nonpivot) counties, the slowdown in earnings growth was smaller: Average earnings grew by 4.0% in the first period and then 3.1% in the second period.

Latina Equal Pay Day: Essential Latina workers face substantial pay gap during COVID-19 pandemic

October 29 is Latina Equal Pay Day, marking how far into 2020—nearly 11 months—the typical Latina must work to make the same amount as the typical non-Hispanic white man was paid in 2019. Latina workers are paid just 67 cents on the dollar on an average hourly basis, relative to non-Hispanic white men with the same level of education, age, and geographic location.

Although this alarming and unacceptable pay gap persists even in better economic times, it is particularly outrageous during the current public health and economic crisis, when many Latinas are essential workers. The infographics below take a closer look at average hourly wages of Latinas and non-Hispanic white men employed in major occupations at the center of national efforts to address COVID-19. These occupations include front-line workers in health care and essential businesses like grocery stores, those who have borne the brunt of job losses in the restaurant industry, and teachers and child care workers who have been all but abandoned in the U.S. coronavirus response. We find that Latinas make 6% to 32% less than non-Hispanic white men in these occupations.

Debunking the specious claims underlying Missouri’s anti–collective bargaining law

Next month, the Missouri Supreme Court will hear arguments in a case about collective bargaining for public-sector workers in Missouri. With collective bargaining rights enshrined in the state’s constitution, the case revolves around whether onerous restrictions placed on public-sector unions and collective bargaining in a 2018 law unconstitutionally infringe on those rights. EPI has filed a friend of the court (“amicus curiae”) brief in the case to debunk some of the specious claims used by proponents of the law and to show how the law will hurt workers, employers, communities, and the economy.

EPI’s brief shows how weakening collective bargaining rights for public-sector workers will worsen the pay gap that women workers and workers of color face when their wages are compared with those of white men. We cite a new study documenting that Wisconsin went from having no wage gap to having a significant wage gap after state legislators and then-governor Scott Walker weakened the state’s public-sector collective bargaining law. EPI’s brief also explains how weakening collective bargaining rights deprives workers of due process and a proven means for challenging arbitrary or discriminatory treatment.

One of the most problematic provisions in the Missouri law requires public-sector unions to be recertified every three years. A majority of the bargaining unit (not just a majority of voting bargaining unit members) would need to vote to affirm their support for the union. This requirement would force public-sector unions, already burdened by the U.S. Supreme Court’s Janus decision, to expend scarce resources turning out members for a vote every three years.

The recertification requirement is unnecessary because under Missouri law, like other collective bargaining laws, workers have the right to file for a decertification vote if they want to initiate a vote on whether to keep their union. One pretext used by proponents of the recertification requirement is that the workforce in three years may not resemble the workforce today due to employee turnover. This argument ignores the fact that turnover in the public sector is roughly half that of the private sector. EPI’s brief includes these statistics and explains why the recertification requirement is unnecessary.

Black, Hispanic, and young workers have been left behind by policymakers, but will they vote?

EPI research finds that Black, Hispanic, and young workers are among those hit hardest by the COVID-19 recession—facing unemployment rates higher than what white workers and older workers are facing, with fewer resources to fall back on. The resulting economic challenges—including food insecurity and the threat of eviction, among others—will compound if additional relief doesn’t come soon. In addition to economic threats, the health threats of the coronavirus pandemic have affected communities of color far worse than white communities.

Young adults and Black and Hispanic citizens have also been historically underrepresented at the polls, for a variety of reasons that we explore below. But could that change in 2020?

Historical voting trends among the Black, Hispanic, and young adult populations

Black voters have faced a 150-year struggle against voter intimidation and suppression tactics and the multilayered legacies of slavery. Black Americans are also disproportionately disenfranchised by state laws that ban convicted felons from voting—even, in some states, after they have served their full sentence. Given the U.S.’s high incarceration rate and systemic racism in the criminal justice system, this is just one more way the Black vote is suppressed.

Black voter registration and participation rose after the passage of the Voting Rights Act of 1965; while Black voting rates would continue to lag behind white voting rates, the gap had narrowed significantly—particularly in the South. In 2008, the gap essentially closed, and in 2012, Black voting rates exceeded white voting rates (Figure A). However, Black voting rates dipped below white voting rates in the 2016 presidential election, as reports of voter suppression and intimidation increased relative to previous elections.

Curb your enthusiasm: Rapid third-quarter GDP growth won’t mean the economy has healed

On Thursday, the Bureau of Economic Analysis (BEA) will release data showing the growth rate of gross domestic product (GDP) in the third quarter of 2020. GDP is the broadest measure of the nation’s economic activity, and this is the last major data release before the presidential election, so it would be a big deal even in normal years.

But it’s obviously not a normal year, and the GDP data released on Thursday will be for a quarter following the single fastest contraction of GDP in history, when the economy shrank at an annualized rate of 31.4% in the second quarter of 2020 due to the COVID-19 shock. The third-quarter data will show historically fast GDP growth—it could conceivably even see growth at a 31.4% annualized rate, for example. Some might be tempted to take too much solace in this rapid growth, and if growth in the third quarter looks to match the pace of contraction in the second quarter, some might even be tempted to declare the economic crisis nearly over.

This post highlights some reasons to temper enthusiasm (some that overlap with points made in this excellent Vox post), even in the face of a very large third-quarter growth number. There are five main reasons that I detail further below:

- The enormous contraction of GDP in the second quarter means any growth in the third quarter is coming off of a significantly smaller base of GDP.

- The COVID-19 shock caused rapid contraction of the economy even in the first quarter of 2020—so it’s not just the record-setting contraction of the second quarter that needs to be clawed back.

- It’s not just the level of pre-shock GDP that needs restored to make labor markets healthy; it’s the level this GDP would be at if it had continued to grow at its pre-shock rate.

- Because the COVID-19 shock has been so centered in low-wage sectors, any given dollar value of GDP lost translates into far more people who have lost jobs.

- Third-quarter growth was driven by the momentum of economic reopening and occurred with the tailwind of the generous recovery measures included in the CARES Act. Neither of these boosts will help in the future, absent radical policy change.

Fact-checking resources for the 2020 presidential debates

Before the candidates take the stage for the 2020 presidential debates, EPI has compiled resources that could be helpful in fact-checking the economic and political claims that are made. We’ve broken down our research into several themes and have highlighted some of our most important research in each area:

Workers most hurt by COVID-19

- Black workers face two of the most lethal preexisting conditions for coronavirus—racism and economic inequality

Persistent racial disparities in health status, access to health care, wealth, employment, wages, housing, income, and poverty all contribute to greater susceptibility to the virus—both economically and physically. - Latinx workers—particularly women—have faced some of the most damaging economic and health effects of the coronavirus

As a group, Latinx workers face a double bind: They are the least likely to be able to work from home to avoid coronavirus exposure and the most likely to have lost their job during the COVID-19 recession.

The passage of California’s Proposition 22 would give digital platform companies a free pass to misclassify their workers

On November 3, Californian voters will decide the fate of the Protect App-Based Drivers and Services Act, more commonly known as Proposition 22. This ballot measure would exempt “gig” or “digital platform” workers from Assembly Bill (AB) 5, a recently enacted law aimed at combatting the misclassification of workers. Instead of complying with the law, digital platform companies—namely Uber, Lyft, DoorDash, Postmates, and Instacart—have contributed over $184 million to ensure the passage of Proposition 22.

How a worker is classified has serious implications and high costs for workers. Most federal and state labor and employment protections are granted to employees only, not independent contractors. This includes basic employment protections such as a minimum wage, overtime pay, and access to unemployment insurance (as shown in Table 1).

With millions of people out of work, the Senate’s inaction is not only cruel, it’s bad economics

Another 1.1 million people applied for unemployment insurance (UI) benefits last week. That includes 787,000 people who applied for regular state UI and 345,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.1 million who applied for UI last week was a decline of 47,000 from the prior week’s revised figures (revisions from prior weeks were substantial due to California having completed its pause in the processing of initial claims and updating its numbers).

Last week was the 31st straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims—because we didn’t have PUA in the Great Recession—initial claims last week were still well over three times their pre-recession levels.)

Most states provide 26 weeks (six months) of regular benefits, and October marks the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by more than a million, from 9.40 million to 8.37 million.

The Trump administration was ruining the pre-COVID-19 economy too, just more slowly

- Long before the COVID-19 pandemic the Trump administration was squandering the pockets of strength in the American economy it had inherited.

- Broad-based prosperity requires strength on the supply, demand, and distributive sides of the economy, and Trump administration policies were either weak or outright damaging on these fronts.

- Demand: Most of the Trump tax cuts went to already-rich corporations and households, who tend to save rather than spend most of any extra dollar they’re given.

- Supply: Business investment plummeted under the Trump administration, despite their lavishing tax cuts on corporate business.

- Distribution: The Trump administration undercut labor standards and rules that can buttress workers’ bargaining power.

You don’t have to be an economist to know how the U.S. economy is doing today: It’s an utter shambles, with tens of millions of workers unable to find the work they need to get by, and with tens of millions of families facing extreme hardship and anxiety. These terrible conditions are mostly the result of the failure to manage and contain the COVID-19 outbreak, and the failure to appropriately respond in the economic policymaking realm.

President Trump, however, clearly wants voters to see the COVID-19 outbreak and fallout as nobody’s fault, and further wants to be graded on how the economy was doing pre-COVID-19. This is obviously absurd; the administration didn’t cause COVID-19, but it is responsible for the botched response to it.

Even besides this, however, it is far from clear that the pre-COVID-19 U.S. economy was evidence of good management or policy, a fact that voters seem increasingly aware of. In fact, Trump administration policies were squandering the pockets of strength in the U.S. economy that they inherited from their predecessors by using them to disguise the rapid erosion their policies were causing to U.S. families’ economic security.

Policy solutions to deal with the nation’s teacher shortage—a crisis made worse by COVID-19

Some estimates have put the shortage of teachers relative to the number of new vacancies in classrooms across the country that go unfilled at more than 100,000—a crisis exacerbated by the pandemic. But policy changes can go a long way in addressing this shortfall.

We lay out those policy solutions in our just-released paper, A Policy Agenda to Address the Teacher Shortage in U.S. Public Schools: The Sixth and Final Report in the ‘Perfect Storm in the Teacher Labor Market’ Series. It is part of an EPI two-year long project documenting the teacher shortage faced by U.S. public schools over the last few years and explaining the multiple factors that have contributed to it.

The culmination of this research coincided with the devastating impact of the COVID-19 pandemic on the nation’s education system, which threatens to make the teacher shortage crisis even worse.

The added challenges mainly arise from three sources.

How much would it cost consumers to give farmworkers a significant raise?: A 40% increase in pay would cost just $25 per household

The increased media coverage of the plight of the more than 2 million farmworkers who pick and help produce our food—and whom the Trump administration has deemed to be “essential” workers for the U.S. economy and infrastructure during the coronavirus pandemic—has highlighted the difficult and often dangerous conditions farmworkers face on the job, as well as their central importance to U.S. food supply chains. For example, photographs and videos of farmworkers picking crops under the smoke- and fire-filled skies of California have been widely shared across the internet, and some data suggest that the number of farmworkers who have tested positive for COVID-19 is rivaled only by meat-processing workers. In addition, around half of farmworkers are unauthorized immigrants and 10% are temporary migrant workers with “nonimmigrant” H-2A visas; those farmworkers have limited labor rights in practice and are vulnerable to wage theft and other abuses due to their immigration status.

Despite the key role they play and the challenges they face, farmworkers are some of the lowest-paid workers in the entire U.S. labor market. The United States Department of Agriculture (USDA) recently announced that it would not collect the data on farmworker earnings that are used to determine minimum wages for H-2A workers, which could further reduce farmworker earnings.

This raises the question: How much would it cost to give farmworkers a significant raise in pay, even if it was paid for entirely by consumers? The answer is, not that much. About the price of a couple of 12-packs of beer, a large pizza, or a nice bottle of wine.

The latest data on consumer expenditures from the Bureau of Labor Statistics (BLS) provides useful information about consumer spending on fresh fruits and vegetables, which, in conjunction with other data, allow us to calculate roughly how much it would cost to raise wages for farmworkers. (For a detailed analysis of these data, see this blog post at Rural Migration News.) But to calculate this, first we have to see how much a typical household spends on fruits and vegetables every year and the share that goes to farm owners and their farmworker employees.

Updated state-level unemployment claims data: Workers across the country need Congress to increase unemployment benefits

The most recent unemployment insurance (UI) claims data released today show that another 1.3 million people filed for UI benefits last week. However, trends over time should be interpreted with particular caution right now because California data are being imputed since they have temporarily paused their processing of initial claims.

For the past 11 weeks, workers have gone without the extra $600 in weekly UI benefits—which Senate Republicans allowed to expire—and are instead typically receiving around 40% of their pre-virus earnings. This is far too meager, in any state, to sustain workers and their families through lengthy periods of joblessness.

The president’s early August executive memo, intended to give recipients an additional $300 or $400 in UI, instead resulted in reduced benefits and extreme delays—and left many workers ineligible. In some states, even this inadequate additional benefit is still unavailable to workers. For example, New Jersey workers won’t be able to collect additional benefits until October 19. The mixed messages coming from the White House continued last week when President Trump announced, via Twitter, the end of stimulus negotiations with Democratic leaders. When the stock market declined sharply in response, the president backtracked.

These half-measures and empty promises simply will not do when we are facing a massive jobs deficit and an initial recovery that has already slowed substantially. The UI benefits cuts were the first big gash of austerity that will slow the economy’s recovery. The second will be the cutbacks to state and local government spending and employment that will occur without already long-overdue federal fiscal aid. To ensure a strong recovery, Congress must pass a substantial stimulus bill that goes well beyond the meager bill announced by Senate Majority Leader Mitch McConnell on Tuesday. The stimulus must include a sizeable increase to UI benefits and aid to state and local government.

30 weeks into the COVID-19 pandemic and workers desperately need stimulus

Another 1.3 million people applied for unemployment insurance (UI) benefits last week. That includes 898,000 people who applied for regular state UI and 373,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.3 million who applied for UI last week was roughly unchanged (a decline of 38,000) from the prior week’s figures. Last week was the 30th straight week total initial claims were far greater than the worst week of the Great Recession, and if that comparison is restricted to regular state claims—since we didn’t have PUA in the Great Recession—initial claims last week were greater than the second-worst week of the Great Recession. However, trends over time in initial claims should be interpreted with caution right now because California initial claims data are being imputed because they have temporarily paused processing initial claims to address problems in their system.

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July, so last week was the 11th week of unemployment in this pandemic for which recipients did not get the extra $600. Hope for another stimulus bill before February is waning. The House passed a $2.2 trillion relief package earlier this month, but Senate Republicans balked at the $1.8 trillion relief package Treasury Secretary Mnuchin offered to Nancy Pelosi. Senate Majority Leader Mitch McConnell announced on Tuesday that the Senate will take up a very small relief bill next week, but it seems clear that getting something done with less than 20 days until the election will be exceedingly difficult. It is looking more and more like stimulus talks will fail, which means the extra $600 is not coming back anytime soon, and the economy will also not be getting other crucial stimulus measures it needs to bounce back, including aid to state and local governments.

Most states provide 26 weeks (six months) of regular benefits, and October is the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 1.2 million, from 11.2 million to 10.0 million.

Consumer Financial Protection Bureau leaders should focus on racial and economic inequality

The Consumer Financial Protection Bureau (CFPB) should explicitly re-center its antidiscrimination mandate and address itself squarely to fostering racial and economic equity.

By doing this, CFPB leadership could realize the full Dodd-Frank Act mandate to listen and be responsive to traditionally underserved communities and consumers.

The agency needs to center the voices of marginalized communities as a necessary adjunct to promoting accountability under the statute. The recognition that racial and economic justice are linked and that the pandemic is amplifying and embedding existing racial disparities, demand that we move beyond the generalities of the statutory language. Poor, rural, and immigrant communities, across racial differences, are all both underserved and poorly served by financial institutions. Black people in particular have always been excluded from the financial mainstream in this country.

I am the founder of the Consumer Rights Regulatory Engagement and Advocacy Project (CRREA Project), and in our series on how the CFPB develops policy, and the inclusion of marginalized communities’ perspectives in that policy development, we’ve talked about the vision as set forth in Dodd-Frank, the reality of how the statutory structure was implemented, and changes to the organizational chart under the Trump administration.