Inflation is no excuse for inaction on needed tax reforms and investments

In recent months, a number of policymakers have cited inflation concerns as the source of their opposition to budget reconciliation proposals that would raise taxes progressively and boost federal spending on public investments and social insurance. (Many of these proposals were once collected together and named the Build Back Better Act (BBBA), but since negotiations over the full BBBA faltered there has been no single name for the shifting permutations of tax and spending changes that are under debate.)

Today’s inflation is a real concern—it is running too high and is reducing households’ purchasing power. But linking fiscal policy decisions about the proper level of taxes and spending in the medium and long run to today’s inflation makes little sense. Even worse, many of these policymakers cast both the tax increases and the spending increases as potentially inflationary. This is not just unwise—it is simply economically innumerate.

In this post, we make the following points:

- The direct effect of tax increases is to slow the pace of aggregate demand growth, not increase it. This means that the tax increases included in proposed fiscal policy packages are disinflationary, full stop.

- In the medium to long run, the investments included in proposed fiscal policy packages will reduce costs that American families face for a number of crucial goods and services, from health insurance premiums and prescription drugs to energy costs and child and elder care.

- A fiscal policy package that expands social insurance and public investments—and finances these by progressive tax increases—is essentially aiming to meet pressing social needs with a moderately larger footprint of the public sector in the economy.

- Currently, the U.S. public-sector footprint is extremely small compared with other advanced economies, to the detriment of the economic security of U.S. families.

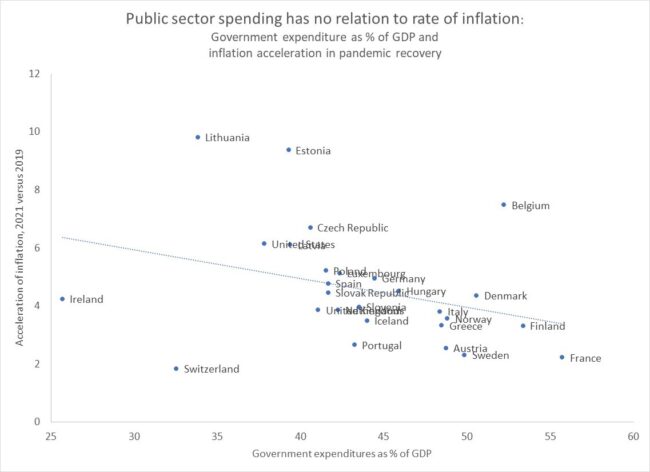

- There is nothing inflationary about this larger public footprint. Since the pandemic recession began, inflation has actually run more slowly in countries with higher spending as a share of GDP.

- Generally speaking, fiscal policymakers are uniquely ill-suited in the short run to restrain inflation that has been caused by excess growth in aggregate demand—this fact is why the Federal Reserve is generally given primary responsibility for this task.

- However, the inflation of the past year has largely not been driven simply by excess growth in aggregate demand, meaning there were some tools that fiscal policymakers could have deployed to help restrain price growth, but they were not taken up. A quickly enacted excess profits tax, for example, could have restrained the dominant source of price growth in 2021.

Taxes—even highly progressive ones—are disinflationary

The tax increases that have been proposed as part of various fiscal policy packages in recent months are extraordinarily progressive, raising the vast majority of their revenue from high-income households (or corporations). Because high-income households save so much more out of a marginal dollar of income than they spend, this means economy-wide spending and aggregate demand are affected only slightly by tax changes on these households. But, a slight effect doesn’t mean no effect: Raising taxes on high-income households will unambiguously slow aggregate demand growth.

All else equal, slower aggregate demand growth puts downward pressure on inflation. This is true even if one does not believe that today’s inflation is largely a function of aggregate demand growth rising too fast relative to the economy’s underlying productive capacity (“too much money chasing too few goods”). In short, policymakers arguing against the tax provisions of proposed fiscal policy packages on the basis of today’s too-high inflation are demonstrating extreme economic innumeracy.

Proposed public investments would help reduce costs and future inflationary pressures

While tax increases are disinflationary, it is true that public spending increases are inflationary, all else equal. But context is crucial here. For one, the spending in these proposed packages will hit the economy gradually over time. These packages are not stimulus packages like the American Rescue Plan (ARP), which injected huge amounts of spending into the economy all at once by design to stabilize a sinking economy. Instead, the fiscal packages being debated today are largely about public investments—measures that will expand the economy’s supply side. These capacity expansions will tamp down inflationary pressures as they come to fruition.

An obvious example is the proposed investments in child and elder care. These types of investments have been shown to significantly boost women’s labor force participation rate, and this labor force growth is a key addition to the economy’s capacity. For those who think today’s inflation problem is “too much money chasing too few goods,” expanding the economy’s supply-side capacity enables more goods to be produced, hence tamping down inflationary pressures.

Of course, by far the most pressing investment need facing the U.S. and global economies today is reducing carbon emissions to slow climate change. If climate change proceeds under the “business-as-usual” scenarios wherein emissions are unconstrained by policy decisions, the results for the economy’s supply side are incredibly damaging. Climate-driven supply-side contractions moving forward will be extremely inflationary (not to mention causing huge human misery often quite hidden from macroeconomic aggregates).

Finally, many of the provisions in the fiscal packages under debate will reduce some of the most salient costs harming U.S. households. High-quality child care, for example, is extraordinarily expensive for most families today. Subsidies that cap its cost will provide huge relief to families. In the jargon of economists, this actually is not a reduction in “inflation” per se. But in the minds of the vast majority of the public, reducing the costs that pressure their family budgets is likely every bit as good as a reduction in “inflation.”

Some of these cost reductions can also happen extremely rapidly. For example, increased subsidies for health insurance purchased through the Affordable Care Act (ACA) exchanges, or reductions in prescription drug prices stemming from tougher bargaining with pharmaceutical companies in public insurance programs (like Medicare and Medicaid) can lead to near-instant cost declines.

A larger public sector is not inflationary

Essentially, the fiscal policy packages under debate aim to use a slightly larger public sector footprint in the economy to solve pressing social needs. By modestly boosting both public spending and taxes as a share of the economy, the hope is that the resources can be used in efficient and targeted ways to provide needed economic security the private sector is failing to deliver.

Some make implicit arguments that this public-sector expansion is somehow inflationary by definition. This conflates fiscal stimulus—using tax and spending policy changes to intentionally boost aggregate demand growth to spur a demand-constrained economy—with a balanced increase in the taxes and spending to deliver more public goods and services permanently. The latter does not need to be inflationary. And, while rising inflation in the wake of the COVID-19 economic shock has been universally global, it has not been any faster in those countries with larger public-sector footprints (see figure below).

It’s also worth noting that the U.S. public-sector footprint is extremely small relative to our advanced country peers. There is a lot of room for the U.S. to increase this footprint to provide greater economic security and fairness and yet remain on the low end of this measure internationally.

Congress has the wrong tools to combat too-fast inflation

The main reason Congress should not see itself as responsible for dampening outbreaks of inflation is that they are poorly equipped to do it institutionally. Put simply, fiscal policy is nowhere near nimble enough to respond to relatively sudden bursts in inflation. By the time Congress recognizes the burst, debates the proper response, compromises on a bill, navigates its signing by the President, and then sees the policy effects hit the economy, the inflationary shock is likely to have passed and the policy might well restrain growth just as the economy is already slowing.

These considerable lags are a key reason why the Federal Reserve is given the primary job of restraining inflation through throttling back on demand growth if that’s what’s needed (whether or not that is currently needed is definitely debatable).

It’s also worth noting a deep inconsistency in how too many in Congress see their role in responding to inflation. There is no advantage that Congress has over the Federal Reserve in restraining demand growth to tamp down inflationary pressures. But, there actually is a large advantage that Congress has over the Federal Reserve in boosting demand and spurring faster recovery when interest rates are near-zero. In 2008, for example, the interest rate the Fed directly controls had already hit zero and could not be cut any further even as the economy continued to collapse. This collision with the “zero lower bound” on interest rates argued strongly that fiscal policymakers should have stepped in to help pull the economy out of its depressed state.

A key indicator that such strong fiscal medicine was needed was inflation that was far below the Fed’s preferred target—a shortfall that essentially lasted a full decade. Yet during the time when fiscal policy could have helped solve a pressing problem of macroeconomic stabilization, there was no groundswell in Congress to respond forcefully and restore the inflation rate to its proper target.

Failing to act then and yet demanding action now to restore inflation to its proper rate is the kind of policy asymmetry that has harmed the U.S. economy for decades. For some reason, a surge of inflation above its target is seen as a spur to Congressional action—even when their tools for addressing it are weak and unreliable and the Fed’s tools are strong. And yet a period of extended and damaging excess unemployment was not such a spur—even when fiscal policy tools for addressing it were strong and reliable and the Fed’s tools were weak.

Inflation is no excuse for policymakers to dodge fiscal policy proposals

The fiscal policy changes under debate are not about stimulus to aid a growth-starved economy. Unemployment is low and the economy does not need stimulus. Instead, these measures under debate are about long-run questions about the proper role of the public sector in maximizing growth and fairness in the economy, and in meeting pressing social needs.

As such, the desirability of these changes does not change at all if inflation is 2% or 10%. If inflation is high because aggregate demand growth is too strong (again, a big “if”), then the Federal Reserve has much better tools to quickly tamp down this demand growth. Some in Congress today are acting as if the Fed’s tools for restraining demand-led inflation won’t work as well as fiscal contraction, or as if there’s some reason to never raise interest rates. Both are wrong. Interest rate increases work quite well to restrain aggregate demand growth (so well, in fact, that we currently face a danger of overshooting on rate hikes and causing a recession). And there’s no real reason to want interest rates to remain at near-zero levels. What’s important for U.S. households’ welfare is to ensure very low unemployment, not necessarily very low interest rates. If there comes a time when a bold fiscal policy package is passed, and it’s accompanied by low unemployment, acceptable rates of inflation, and interest rates significantly above zero, that’s not a problem at all.

In short, reining in too-fast inflation is not Congress’s job. And it’s not their job because the tools they have to do it are bad and will cause far too-steep collateral damage if they’re deployed. For example, crucially needed progressive tax increases and vital public investments might be sacrificed.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.