Cutting off the $600 boost to unemployment benefits would be both cruel and bad economics: New personal income data show just how steep the coming fiscal cliff will be

Key takeaways:

- The Bureau of Economic Analysis (BEA) released data today on personal income showing that the extra $600 in weekly unemployment insurance (UI) benefits—set to expire at the end of July—boosted incomes by $842 billion in May (expressed at an annualized rate).

- We estimate that extending the $600 UI benefits through the middle of 2021 would provide an average quarterly boost to gross domestic product (GDP) of 3.7% and employment of 5.1 million workers.

- The economy’s growth will continue to be tightly constrained by insufficient demand for goods and services, and cutting off a policy support that helps households maintain spending is a terrible idea, both for these households’ welfare and for macroeconomic stabilization.

Congress passed the CARES Act in March to provide relief and recovery from the economic effects of the coronavirus. By far the best part of the CARES Act was a significant expansion of the unemployment insurance (UI) system, which included a $600 per week boost to UI benefits. Congress settled on a flat $600 top-up to weekly benefits because the antiquated state UI administrative capacity could not handle more tailored ways to increase UI benefit generosity, and giving everybody an extra $600 guaranteed that most workers would receive at least as much in UI benefits as they did from their previous employment.

In normal times, economists and policymakers have focused a lot of attention (almost surely too much) on the incentive effects of UI benefits. If these benefits were too generous, the worry was that this would blunt workers’ incentives to actively search for new jobs. The negative economic impacts of these incentive effects have always been exaggerated, but these effects become truly trivial during times when the economy’s growth is clearly constrained by insufficient aggregate demand (spending by households, businesses, and governments).

When growth is demand-constrained, there are more potential workers than available jobs, so hounding these potential workers into more intense job-searching by making UI benefits less generous doesn’t result in more jobs being created, it just results in more frustrated job searches. This logic became even more compelling during the first phase of the economic collapse caused by the coronavirus. Not only were there not enough jobs to employ willing workers, for public health reasons we didn’t want enough jobs to employ these workers, as the shutdown in economic activity and employment was the point of lockdown measures. Even as official lockdowns ease in coming months (often prematurely), jobs will be sharply constrained by demand, not workers’ incentives.

Further, when the economy’s growth is demand-constrained, anything that keeps households from cutting back on spending actually supports growth. UI benefits are by definition laser-targeted on households that have suffered a severe shock to income by losing their job. Research shows definitively that spending falls much further in those households afflicted by job loss when they do not receive UI benefits. In the current crisis, UI benefits have kept the cutback in spending in closed sectors from leading more catastrophically to cutbacks in spending in other sectors. For example, as restaurant and airline employees lost their jobs early in the coronavirus crisis due to social distancing measures, UI benefits provided income to spend in still-going sectors like grocery stores, and contained some of the economic collapse.

In past recessions, UI benefits have been among the most efficient sources of support for aggregate demand, with each dollar spent on these benefits boosting economywide spending by as much as $2. But compared with other policy efforts to support aggregate demand, UI has been relatively small simply because we didn’t spend all that much in providing these benefits, both because each individual benefit was relatively stingy (replacing on average about half of a worker’s previous salary) or because eligibility criteria were stringent and only a small share of all unemployed workers received benefits.

The CARES Act UI expansions, however, have boosted the macroeconomic impact of the UI system enormously, particularly the extra $600 weekly payment (though the expanded eligibility requirements are also helping enormously). The last payment of the extra $600, however, will be for the week ending July 25. (The CARES Act states that the extra $600 applies to weeks of unemployment “ending on or before July 31, 2020,” which is a Friday. Since, in the UI world, weeks typically end on Saturday, the last payment will be for the week ending July 25.) Currently, unemployment rate forecasts for the third quarter of this year (July, August, and September) indicate that unemployment will still be higher than it was during the worst months of the Great Recession in 2008–2009. In coming months, the economy’s growth will continue to be tightly constrained by insufficient aggregate demand, and cutting off a policy support that helps households maintain spending is a terrible idea, both for these households’ welfare and for macroeconomic stabilization.

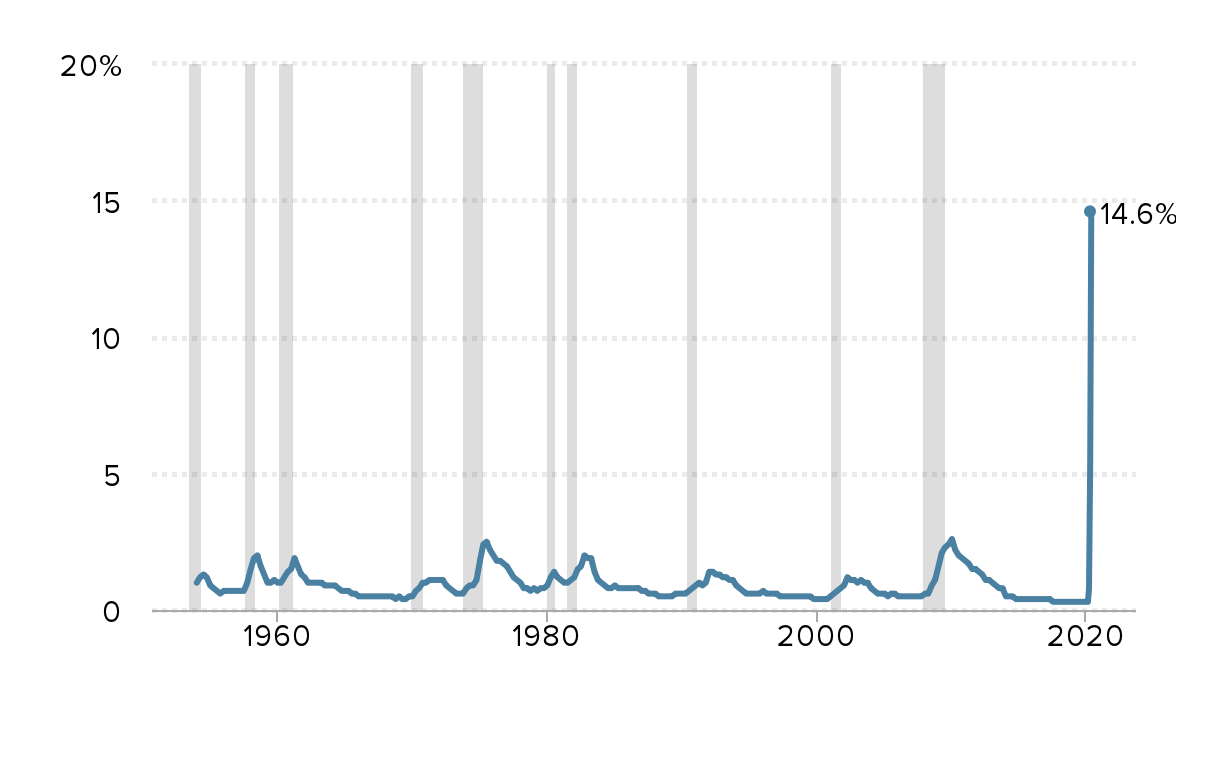

Today, the Bureau of Economic Analysis (BEA) released data on personal income showing that the $600 benefit top-up boosted incomes by $842 billion (at an annualized rate) in May. The historic nature of this boost coming from UI is shown in Figure A below, which displays total UI benefits divided by total wage and salary income. In May of 2020, UI benefits were 14.6% of total wage and salary income, several times larger than the pre-coronavirus historical high of 2.5% that was registered during 2010.

Unemployment insurance is buffering households and the economy more than ever before: UI benefits as a percent of wage and salary income, 1954–2020

| Date | UI benefits as % of wage and salary income |

|---|---|

| Jan-1954 | 1.0% |

| Apr-1954 | 1.2% |

| Jul-1954 | 1.3% |

| Oct-1954 | 1.2% |

| Jan-1955 | 0.9% |

| Apr-1955 | 0.8% |

| Jul-1955 | 0.7% |

| Oct-1955 | 0.6% |

| Jan-1956 | 0.7% |

| Apr-1956 | 0.7% |

| Jul-1956 | 0.7% |

| Oct-1956 | 0.7% |

| Jan-1957 | 0.7% |

| Apr-1957 | 0.7% |

| Jul-1957 | 0.7% |

| Oct-1957 | 1.0% |

| Jan-1958 | 1.5% |

| Apr-1958 | 1.9% |

| Jul-1958 | 2.0% |

| Oct-1958 | 1.6% |

| Jan-1959 | 1.3% |

| Apr-1959 | 1.0% |

| Jul-1959 | 1.0% |

| Oct-1959 | 1.1% |

| Jan-1960 | 1.0% |

| Apr-1960 | 1.0% |

| Jul-1960 | 1.2% |

| Oct-1960 | 1.4% |

| Jan-1961 | 1.5% |

| Apr-1961 | 1.9% |

| Jul-1961 | 1.6% |

| Oct-1961 | 1.3% |

| Jan-1962 | 1.2% |

| Apr-1962 | 1.0% |

| Jul-1962 | 1.0% |

| Oct-1962 | 1.0% |

| Jan-1963 | 1.0% |

| Apr-1963 | 1.0% |

| Jul-1963 | 0.9% |

| Oct-1963 | 0.9% |

| Jan-1964 | 0.9% |

| Apr-1964 | 0.9% |

| Jul-1964 | 0.8% |

| Oct-1964 | 0.7% |

| Jan-1965 | 0.7% |

| Apr-1965 | 0.7% |

| Jul-1965 | 0.6% |

| Oct-1965 | 0.6% |

| Jan-1966 | 0.5% |

| Apr-1966 | 0.5% |

| Jul-1966 | 0.5% |

| Oct-1966 | 0.5% |

| Jan-1967 | 0.5% |

| Apr-1967 | 0.5% |

| Jul-1967 | 0.5% |

| Oct-1967 | 0.5% |

| Jan-1968 | 0.5% |

| Apr-1968 | 0.5% |

| Jul-1968 | 0.5% |

| Oct-1968 | 0.4% |

| Jan-1969 | 0.5% |

| Apr-1969 | 0.4% |

| Jul-1969 | 0.4% |

| Oct-1969 | 0.5% |

| Jan-1970 | 0.5% |

| Apr-1970 | 0.7% |

| Jul-1970 | 0.8% |

| Oct-1970 | 1.0% |

| Jan-1971 | 1.0% |

| Apr-1971 | 1.1% |

| Jul-1971 | 1.1% |

| Oct-1971 | 1.1% |

| Jan-1972 | 1.1% |

| Apr-1972 | 1.1% |

| Jul-1972 | 0.9% |

| Oct-1972 | 0.8% |

| Jan-1973 | 0.7% |

| Apr-1973 | 0.6% |

| Jul-1973 | 0.6% |

| Oct-1973 | 0.6% |

| Jan-1974 | 0.8% |

| Apr-1974 | 0.9% |

| Jul-1974 | 0.9% |

| Oct-1974 | 1.1% |

| Jan-1975 | 1.8% |

| Apr-1975 | 2.4% |

| Jul-1975 | 2.5% |

| Oct-1975 | 2.2% |

| Jan-1976 | 2.0% |

| Apr-1976 | 1.8% |

| Jul-1976 | 1.8% |

| Oct-1976 | 1.7% |

| Jan-1977 | 1.6% |

| Apr-1977 | 1.4% |

| Jul-1977 | 1.2% |

| Oct-1977 | 1.1% |

| Jan-1978 | 1.0% |

| Apr-1978 | 0.8% |

| Jul-1978 | 0.8% |

| Oct-1978 | 0.7% |

| Jan-1979 | 0.8% |

| Apr-1979 | 0.7% |

| Jul-1979 | 0.8% |

| Oct-1979 | 0.8% |

| Jan-1980 | 0.9% |

| Apr-1980 | 1.2% |

| Jul-1980 | 1.4% |

| Oct-1980 | 1.2% |

| Jan-1981 | 1.1% |

| Apr-1981 | 1.0% |

| Jul-1981 | 1.0% |

| Oct-1981 | 1.1% |

| Jan-1982 | 1.2% |

| Apr-1982 | 1.5% |

| Jul-1982 | 1.6% |

| Oct-1982 | 2.0% |

| Jan-1983 | 1.9% |

| Apr-1983 | 1.9% |

| Jul-1983 | 1.4% |

| Oct-1983 | 1.1% |

| Jan-1984 | 1.0% |

| Apr-1984 | 0.9% |

| Jul-1984 | 0.8% |

| Oct-1984 | 0.8% |

| Jan-1985 | 0.9% |

| Apr-1985 | 0.8% |

| Jul-1985 | 0.8% |

| Oct-1985 | 0.8% |

| Jan-1986 | 0.8% |

| Apr-1986 | 0.8% |

| Jul-1986 | 0.8% |

| Oct-1986 | 0.8% |

| Jan-1987 | 0.7% |

| Apr-1987 | 0.7% |

| Jul-1987 | 0.6% |

| Oct-1987 | 0.6% |

| Jan-1988 | 0.6% |

| Apr-1988 | 0.5% |

| Jul-1988 | 0.5% |

| Oct-1988 | 0.5% |

| Jan-1989 | 0.5% |

| Apr-1989 | 0.5% |

| Jul-1989 | 0.6% |

| Oct-1989 | 0.6% |

| Jan-1990 | 0.6% |

| Apr-1990 | 0.6% |

| Jul-1990 | 0.7% |

| Oct-1990 | 0.8% |

| Jan-1991 | 0.9% |

| Apr-1991 | 1.0% |

| Jul-1991 | 0.9% |

| Oct-1991 | 1.0% |

| Jan-1992 | 1.4% |

| Apr-1992 | 1.4% |

| Jul-1992 | 1.3% |

| Oct-1992 | 1.3% |

| Jan-1993 | 1.2% |

| Apr-1993 | 1.2% |

| Jul-1993 | 1.1% |

| Oct-1993 | 1.1% |

| Jan-1994 | 0.9% |

| Apr-1994 | 0.8% |

| Jul-1994 | 0.7% |

| Oct-1994 | 0.6% |

| Jan-1995 | 0.6% |

| Apr-1995 | 0.6% |

| Jul-1995 | 0.6% |

| Oct-1995 | 0.6% |

| Jan-1996 | 0.7% |

| Apr-1996 | 0.6% |

| Jul-1996 | 0.6% |

| Oct-1996 | 0.6% |

| Jan-1997 | 0.6% |

| Apr-1997 | 0.5% |

| Jul-1997 | 0.5% |

| Oct-1997 | 0.5% |

| Jan-1998 | 0.5% |

| Apr-1998 | 0.5% |

| Jul-1998 | 0.5% |

| Oct-1998 | 0.5% |

| Jan-1999 | 0.5% |

| Apr-1999 | 0.5% |

| Jul-1999 | 0.5% |

| Oct-1999 | 0.4% |

| Jan-2000 | 0.4% |

| Apr-2000 | 0.4% |

| Jul-2000 | 0.4% |

| Oct-2000 | 0.4% |

| Jan-2001 | 0.5% |

| Apr-2001 | 0.6% |

| Jul-2001 | 0.7% |

| Oct-2001 | 0.8% |

| Jan-2002 | 0.9% |

| Apr-2002 | 1.2% |

| Jul-2002 | 1.1% |

| Oct-2002 | 1.1% |

| Jan-2003 | 1.0% |

| Apr-2003 | 1.1% |

| Jul-2003 | 1.0% |

| Oct-2003 | 1.0% |

| Jan-2004 | 0.8% |

| Apr-2004 | 0.7% |

| Jul-2004 | 0.6% |

| Oct-2004 | 0.6% |

| Jan-2005 | 0.6% |

| Apr-2005 | 0.5% |

| Jul-2005 | 0.6% |

| Oct-2005 | 0.6% |

| Jan-2006 | 0.5% |

| Apr-2006 | 0.5% |

| Jul-2006 | 0.5% |

| Oct-2006 | 0.5% |

| Jan-2007 | 0.5% |

| Apr-2007 | 0.5% |

| Jul-2007 | 0.5% |

| Oct-2007 | 0.5% |

| Jan-2008 | 0.6% |

| Apr-2008 | 0.6% |

| Jul-2008 | 0.9% |

| Oct-2008 | 1.1% |

| Jan-2009 | 1.6% |

| Apr-2009 | 2.1% |

| Jul-2009 | 2.3% |

| Oct-2009 | 2.4% |

| Jan-2010 | 2.6% |

| Apr-2010 | 2.2% |

| Jul-2010 | 2.0% |

| Oct-2010 | 1.9% |

| Jan-2011 | 1.8% |

| Apr-2011 | 1.7% |

| Jul-2011 | 1.5% |

| Oct-2011 | 1.5% |

| Jan-2012 | 1.4% |

| Apr-2012 | 1.3% |

| Jul-2012 | 1.1% |

| Oct-2012 | 1.1% |

| Jan-2013 | 1.0% |

| Apr-2013 | 0.9% |

| Jul-2013 | 0.8% |

| Oct-2013 | 0.8% |

| Jan-2014 | 0.5% |

| Apr-2014 | 0.5% |

| Jul-2014 | 0.5% |

| Oct-2014 | 0.4% |

| Jan-2015 | 0.4% |

| Apr-2015 | 0.4% |

| Jul-2015 | 0.4% |

| Oct-2015 | 0.4% |

| Jan-2016 | 0.4% |

| Apr-2016 | 0.4% |

| Jul-2016 | 0.4% |

| Oct-2016 | 0.4% |

| Jan-2017 | 0.4% |

| Apr-2017 | 0.4% |

| Jul-2017 | 0.3% |

| Oct-2017 | 0.3% |

| Jan-2018 | 0.3% |

| Apr-2018 | 0.3% |

| Jul-2018 | 0.3% |

| Oct-2018 | 0.3% |

| Jan-2019 | 0.3% |

| Apr-2019 | 0.3% |

| Jul-2019 | 0.3% |

| Oct-2019 | 0.3% |

| Jan-2020 | 0.3% |

| Feb-2020 | 0.3% |

| Mar-2020 | 0.8% |

| Apr-2020 | 5.3% |

| May-2020 | 14.6% |

Note: Data is quarterly for all years before 2020 and monthly for 2020 year-to-date.

Source: Author’s analysis of the Bureau of Economic Analysis (BEA), National Income and Product Accounts (NIPA) data.

In recent congressional testimony, economist Jason Furman projected how much continuation of these extra benefits would boost gross domestic product (GDP) and employment by 2022. To do this, he assumed that the relationship between the unemployment rate and total unemployment benefits would hold if the extra $600 benefit payments were extended. Furman finds that at peak levels (in the third quarter of 2020) the extra $600 top-up by itself is projected to boost GDP by 2.8% and to support just under three million jobs. In short, letting this extra $600 in UI benefits expire at the end of July would by itself cause more job loss than was seen in either of the recessions of the early 1990s or early 2000s.

Of course, it doesn’t have to play out this way. Policymakers can and should extend the extra $600 in UI benefits and allow the amount of the benefit top-up to phase down modestly over time as the unemployment rate falls and the economy begins growing faster. This estimate shows us how enormously important expanded unemployment insurance over the next year will be to aggregate demand, as new job openings are all but guaranteed to be fewer than jobless potential workers over that time, so any incentive effect in keeping workers from searching actively for work will not be the binding constraint on the economy’s growth.

Table 1 shows the potential boost to GDP and employment from extending the $600 top-up through the middle of 2021 nationally and then by state. It essentially replicates the spirit of the Furman methodology for national numbers, but uses data from the May data release on personal income from the BEA rather than projections from the Congressional Budget Office (CBO). The national estimates for personal income, GDP, and employment is then allocated to states based on each state’s share of UI claimants in May of this year. The allocation by state, shown in Figure B, is a rough estimate—as a recovery begins, it is likely to be uneven and see a change in the state distribution of joblessness. But it does seem highly likely that states disproportionately hit by the economic slowdown so far will continue to suffer more damage. The key parameter for how much states have suffered so far is the share of their total pre-coronavirus employment that was concentrated in sectors like restaurants and tourism that were the epicenter of the shutdown. It seems clear that recovery will be slowest in precisely these sectors, unless a vaccine or radically effective treatment is discovered very soon.

If the $600 weekly unemployment insurance increase is allowed to expire, how many jobs will it cost over the next year?: Jobs cost as a level and as a share of employment

| State | Jobs cost | Jobs cost, as a share of employment |

|---|---|---|

| Alabama | 43,261 | 2.1% |

| Alaska | 12,458 | 3.8% |

| Arizona | 55,566 | 1.9% |

| Arkansas | 29,984 | 2.3% |

| California | 836,142 | 4.7% |

| Colorado | 66,898 | 2.4% |

| Connecticut | 74,689 | 4.4% |

| Delaware | 14,621 | 3.1% |

| Washington D.C. | 19,611 | 2.4% |

| Florida | 244,921 | 2.7% |

| Georgia | 186,605 | 4.0% |

| Hawaii | 32,751 | 5.0% |

| Idaho | 10,049 | 1.3% |

| Illinois | 195,149 | 3.2% |

| Indiana | 59,443 | 1.9% |

| Iowa | 42,580 | 2.7% |

| Kansas | 26,089 | 1.8% |

| Kentucky | 49,751 | 2.6% |

| Louisiana | 81,945 | 4.1% |

| Maine | 18,025 | 2.8% |

| Maryland | 67,486 | 2.4% |

| Massachusetts | 157,162 | 4.2% |

| Michigan | 194,520 | 4.4% |

| Minnesota | 107,633 | 3.6% |

| Mississippi | 42,744 | 3.7% |

| Missouri | 59,410 | 2.0% |

| Montana | 11,800 | 2.4% |

| Nebraska | 15,422 | 1.5% |

| Nevada | 84,166 | 5.9% |

| New Hampshire | 26,941 | 3.9% |

| New Jersey | 147,911 | 3.5% |

| New Mexico | 29,012 | 3.3% |

| New York | 463,968 | 4.7% |

| North Carolina | 142,496 | 3.1% |

| North Dakota | 9,293 | 2.1% |

| Ohio | 129,599 | 2.3% |

| Oklahoma | 46,018 | 2.7% |

| Oregon | 115,599 | 5.9% |

| Pennsylvania | 252,642 | 4.1% |

| Rhode Island | 20,228 | 4.0% |

| South Carolina | 54,484 | 2.5% |

| South Dakota | 5,107 | 1.1% |

| Tennessee | 80,269 | 2.5% |

| Texas | 364,576 | 2.8% |

| Utah | 20,728 | 1.3% |

| Vermont | 11,831 | 3.8% |

| Virginia | 106,549 | 2.6% |

| Washington | 122,224 | 3.5% |

| West Virginia | 22,606 | 3.2% |

| Wisconsin | 65,635 | 2.2% |

| Wyoming | 4,597 | 1.6% |

Notes: We take the relationship between the unemployment rate and the boost to personal income from the extra $600 payment that held in May of 2020 and assume it continues going forward as benefits are extended past July. We apply a multiplier of 1.5 to the personal income boost provided by enhanced UI. We then divide this boost by overall GDP, and apply the resulting percentage change to the average level of employment in the first quarter of 2020 to get an implied employment boost. The numbers in the chart are the average boost to personal income, GDP, and employment between the third quarter of 2020 and the second quarter of 2021. Some quarters would see even larger effects.

Source: Author’s analysis based on data from the National Income and Product Accounts (NIPA) data from the Bureau of Economic Analysis (BEA), projections from the Congressional Budget Office (CBO), data on continuing unemployment insurance claims from the Department of Labor (DOL), and total nonfarm employment from the Bureau of Labor Statistics (BLS) Current Employment Statistics (CES).

Average boost to personal income, GDP, and employment from extending $600 UI benefit, August 2020 to July 2021

| Personal income (millions) | GDP | Jobs supported | |

|---|---|---|---|

| U.S., total | $508,619 | 3.7% | 5,083,197 |

| Alabama | 4,898 | 3.2% | 43,261 |

| Alaska | 1,245 | 3.4% | 12,458 |

| Arizona | 5,619 | 2.3% | 55,566 |

| Arkansas | 3,060 | 3.4% | 29,984 |

| California | 72,959 | 3.5% | 836,142 |

| Colorado | 6,597 | 2.5% | 66,898 |

| Connecticut | 7,031 | 3.7% | 74,689 |

| Delaware | 1,336 | 2.7% | 14,621 |

| District of Columbia | 1,821 | 1.9% | 19,611 |

| Florida | 27,655 | 3.8% | 244,921 |

| Georgia | 19,233 | 4.7% | 186,605 |

| Hawaii | 3,390 | 5.2% | 32,751 |

| Idaho | 1,394 | 2.6% | 10,049 |

| Illinois | 19,119 | 3.2% | 195,149 |

| Indiana | 6,328 | 2.5% | 59,443 |

| Iowa | 4,422 | 3.4% | 42,580 |

| Kansas | 2,613 | 2.3% | 26,089 |

| Kentucky | 5,786 | 4.0% | 49,751 |

| Louisiana | 8,156 | 4.6% | 81,945 |

| Maine | 3,045 | 6.8% | 18,025 |

| Maryland | 6,473 | 2.3% | 67,486 |

| Massachusetts | 15,243 | 3.8% | 157,162 |

| Michigan | 23,719 | 6.6% | 194,520 |

| Minnesota | 10,609 | 4.2% | 107,633 |

| Mississippi | 4,511 | 5.7% | 42,744 |

| Missouri | 6,439 | 2.9% | 59,410 |

| Montana | 1,283 | 3.7% | 11,800 |

| Nebraska | 1,600 | 1.9% | 15,422 |

| Nevada | 8,930 | 7.5% | 84,166 |

| New Hampshire | 2,758 | 4.7% | 26,941 |

| New Jersey | 14,839 | 3.5% | 147,911 |

| New Mexico | 2,731 | 3.9% | 29,012 |

| New York | 46,137 | 4.0% | 463,968 |

| North Carolina | 14,581 | 3.7% | 142,496 |

| North Dakota | 803 | 2.1% | 9,293 |

| Ohio | 15,784 | 3.4% | 129,599 |

| Oklahoma | 3,902 | 2.8% | 46,018 |

| Oregon | 7,213 | 4.3% | 115,599 |

| Pennsylvania | 24,454 | 4.5% | 252,642 |

| Rhode Island | 2,151 | 5.1% | 20,228 |

| South Carolina | 5,986 | 3.6% | 54,484 |

| South Dakota | 568 | 1.6% | 5,107 |

| Tennessee | 8,357 | 3.3% | 80,269 |

| Texas | 33,556 | 2.7% | 364,576 |

| Utah | 2,106 | 1.7% | 20,728 |

| Vermont | 1,273 | 5.5% | 11,831 |

| Virginia | 10,350 | 2.8% | 106,549 |

| Washington | 16,529 | 4.1% | 122,224 |

| West Virginia | 2,325 | 4.5% | 22,606 |

| Wisconsin | 7,277 | 3.1% | 65,635 |

| Wyoming | 429 | 1.6% | 4,597 |

Note: We take the relationship between the unemployment rate and the boost to personal income from the extra $600 payment that held in May of 2020 and assume it continues going forward as benefits are extended past July. We apply a multiplier of 1.5 to the personal income boost provided by enhanced UI. We then divide this boost by overall GDP, and apply the resulting percentage change to the average level of employment in the first quarter of 2020 to get an implied employment boost. The numbers in the chart are the average boost to personal income, GDP, and employment between the third quarter of 2020 and the second quarter of 2021. Some quarters would see even larger effects.

Source: Author’s analysis based on data from the National Income and Product Accounts (NIPA) data from the Bureau of Economic Analysis (BEA), projections from the Congressional Budget Office (CBO), and data on continuing unemployment insurance claims from the Department of Labor (DOL).

Enjoyed this post? Sign up for the Economic Policy Institute’s newsletter so you never miss our research and insights on ways to make the economy work better for everyone.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.