30 weeks into the COVID-19 pandemic and workers desperately need stimulus

Another 1.3 million people applied for unemployment insurance (UI) benefits last week. That includes 898,000 people who applied for regular state UI and 373,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.3 million who applied for UI last week was roughly unchanged (a decline of 38,000) from the prior week’s figures. Last week was the 30th straight week total initial claims were far greater than the worst week of the Great Recession, and if that comparison is restricted to regular state claims—since we didn’t have PUA in the Great Recession—initial claims last week were greater than the second-worst week of the Great Recession. However, trends over time in initial claims should be interpreted with caution right now because California initial claims data are being imputed because they have temporarily paused processing initial claims to address problems in their system.

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July, so last week was the 11th week of unemployment in this pandemic for which recipients did not get the extra $600. Hope for another stimulus bill before February is waning. The House passed a $2.2 trillion relief package earlier this month, but Senate Republicans balked at the $1.8 trillion relief package Treasury Secretary Mnuchin offered to Nancy Pelosi. Senate Majority Leader Mitch McConnell announced on Tuesday that the Senate will take up a very small relief bill next week, but it seems clear that getting something done with less than 20 days until the election will be exceedingly difficult. It is looking more and more like stimulus talks will fail, which means the extra $600 is not coming back anytime soon, and the economy will also not be getting other crucial stimulus measures it needs to bounce back, including aid to state and local governments.

Most states provide 26 weeks (six months) of regular benefits, and October is the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 1.2 million, from 11.2 million to 10.0 million.

The good news is that after an individual exhausts regular state benefits, they can move on to Pandemic Emergency Unemployment Compensation (PEUC), which provides an additional 13 weeks of benefits to people who have exhausted regular state UI. In the latest data available for PEUC (the week ending September 26), PEUC rose by 818,000 to 2.8 million, offsetting the 799,000 decline in continuing claims for regular state benefits for the same week. This is what we would expect to see as workers move from regular state benefits to PEUC. That suggests that earlier glitches that were delaying workers getting on to PEUC, including workers not being told about PEUC or not being told that they have to apply for it—even though state agencies are required to notify them—may be getting smoothed out. This is good news. The bad news is that without congressional action, PEUC expires at the end of the year.

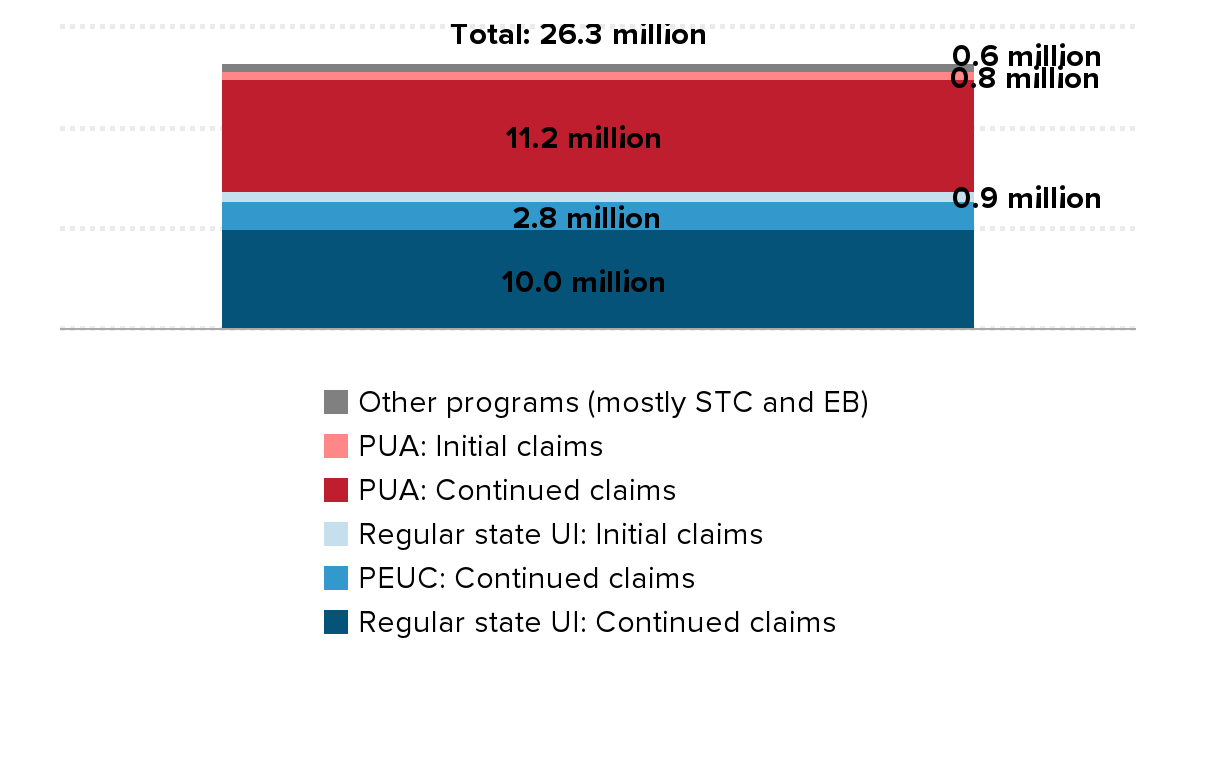

DOL data suggest that, right now, 26.3 million workers are either on unemployment benefits or have applied recently and are waiting to get approved (see Figure A). But importantly, that number is a substantial overestimate. For one thing, initial claims for regular state UI and PUA should be nonoverlapping—that is how DOL has directed state agencies to report them—but some individuals are erroneously being counted as being in both programs. An even bigger issue is that states are including retroactive payments in their continuing PUA claims, which would also lead to double-counting. All this means nobody knows exactly how many people are receiving unemployment insurance benefits right now, which is another reminder that we need to invest heavily in our data infrastructure and technology.

DOL numbers indicate that 26.3 million workers are either receiving unemployment benefits or have applied and are waiting to see if they will get benefits (as of October 10, 2020): *But caution, this is an overestimate due to reporting issues (see below)*

| Regular state UI: Continued claims | PEUC: Continued claims | Regular state UI: Initial claims | PUA: Continued claims | PUA: Initial claims | Other programs (mostly STC and EB) | Total | |

|---|---|---|---|---|---|---|---|

| Cumulative | 10,018,000 |

2,778,007 | 898,000 |

11,172,335 |

836,788 |

577,951 | 0 |

Seasonally adjusted data are used for regular state UI claims; seasonally adjusted data are not available for the other components of the chart. Regular state UI continued claims are for the week ending October 3; PEUC continued claims are for the week ending September 26; regular state UI initial claims are for the week ending October 10. PUA continued claims are for the week ending September 26; PUA initial claims are for the weeks ending October 3 and October 10. “Other programs” are continued claims in other programs for the week ending September 26. A full list of programs can be found in the bottom panel of the table on page 4 at this link: https://www.dol.gov/ui/data.pdf.

Source: Department of Labor (DOL) Unemployment Insurance Weekly Claims (News Release), retrieved from DOL, https://www.dol.gov/ui/data.pdf, October 15, 2020.

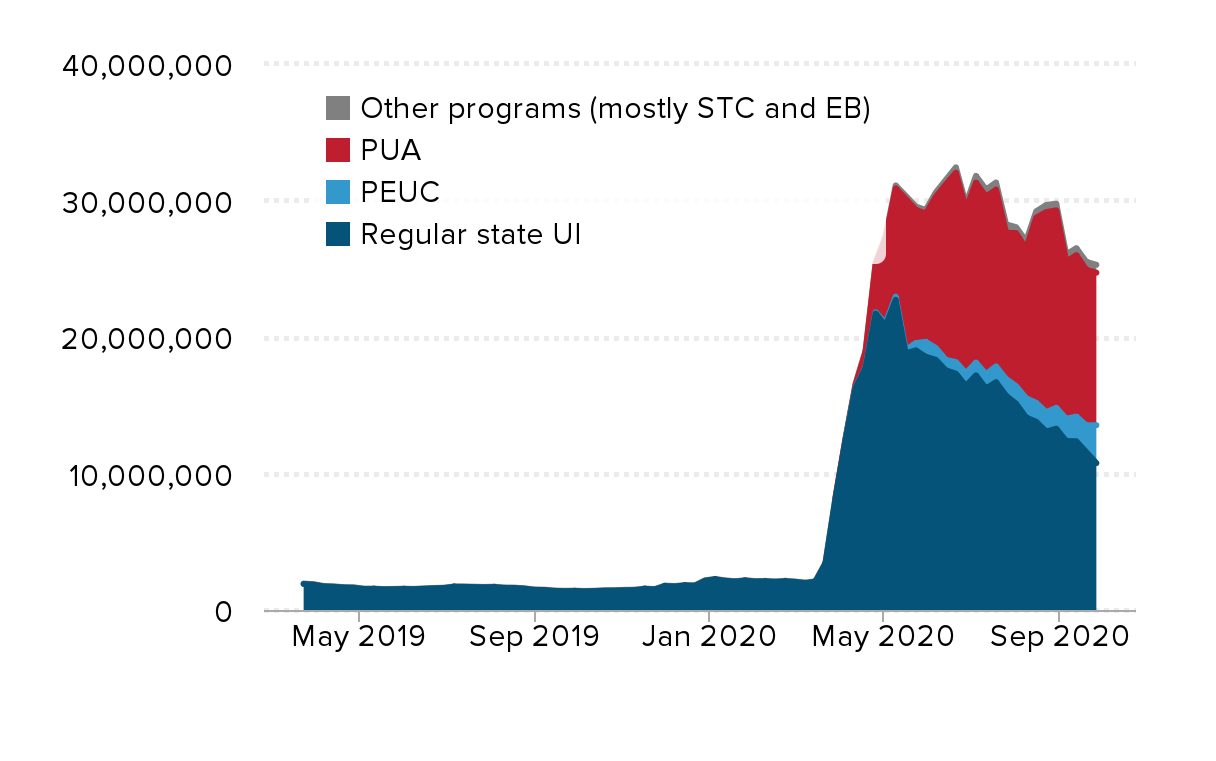

Figure B shows continuing claims in all programs over time (the latest data are for September 19). Continuing claims are nearly 24 million above where they were a year ago. However, the above caveat about continuing PUA claims applies here too, which means the trends over time in PUA claims may be distorted.

Continuing unemployment claims in all programs, March 23, 2019–September 26, 2020: *Use caution interpreting trends over time because of reporting issues (see below)*

| Date | Regular state UI | PEUC | PUA | Other programs (mostly STC and EB) |

|---|---|---|---|---|

| 2019-03-23 | 1,905,627 | – | – | 31,510 |

| 2019-03-30 | 1,858,954 | – | – | 31,446 |

| 2019-04-06 | 1,727,261 | – | – | 30,454 |

| 2019-04-13 | 1,700,689 | – | – | 30,404 |

| 2019-04-20 | 1,645,387 | – | – | 28,281 |

| 2019-04-27 | 1,630,382 | – | – | 29,795 |

| 2019-05-04 | 1,536,652 | – | – | 27,937 |

| 2019-05-11 | 1,540,486 | – | – | 28,727 |

| 2019-05-18 | 1,506,501 | – | – | 27,949 |

| 2019-05-25 | 1,519,345 | – | – | 26,263 |

| 2019-06-01 | 1,535,572 | – | – | 26,905 |

| 2019-06-08 | 1,520,520 | – | – | 25,694 |

| 2019-06-15 | 1,556,252 | – | – | 26,057 |

| 2019-06-22 | 1,586,714 | – | – | 25,409 |

| 2019-06-29 | 1,608,769 | – | – | 23,926 |

| 2019-07-06 | 1,700,329 | – | – | 25,630 |

| 2019-07-13 | 1,694,876 | – | – | 27,169 |

| 2019-07-20 | 1,676,883 | – | – | 30,390 |

| 2019-07-27 | 1,662,427 | – | – | 28,319 |

| 2019-08-03 | 1,676,979 | – | – | 27,403 |

| 2019-08-10 | 1,616,985 | – | – | 27,330 |

| 2019-08-17 | 1,613,394 | – | – | 26,234 |

| 2019-08-24 | 1,564,203 | – | – | 27,253 |

| 2019-08-31 | 1,473,997 | – | – | 25,003 |

| 2019-09-07 | 1,462,776 | – | – | 25,909 |

| 2019-09-14 | 1,397,267 | – | – | 26,699 |

| 2019-09-21 | 1,380,668 | – | – | 26,641 |

| 2019-09-28 | 1,390,061 | – | – | 25,460 |

| 2019-10-05 | 1,366,978 | – | – | 26,977 |

| 2019-10-12 | 1,384,208 | – | – | 27,501 |

| 2019-10-19 | 1,416,816 | – | – | 28,088 |

| 2019-10-26 | 1,420,918 | – | – | 28,576 |

| 2019-11-02 | 1,447,411 | – | – | 29,080 |

| 2019-11-09 | 1,457,789 | – | – | 30,024 |

| 2019-11-16 | 1,541,860 | – | – | 31,593 |

| 2019-11-23 | 1,505,742 | – | – | 29,499 |

| 2019-11-30 | 1,752,141 | – | – | 30,315 |

| 2019-12-07 | 1,725,237 | – | – | 32,895 |

| 2019-12-14 | 1,796,247 | – | – | 31,893 |

| 2019-12-21 | 1,773,949 | – | – | 29,888 |

| 2019-12-28 | 2,143,802 | – | – | 32,517 |

| 2020-01-04 | 2,245,684 | – | – | 32,520 |

| 2020-01-11 | 2,137,910 | – | – | 33,882 |

| 2020-01-18 | 2,075,857 | – | – | 32,625 |

| 2020-01-25 | 2,148,764 | – | – | 35,828 |

| 2020-02-01 | 2,084,204 | – | – | 33,884 |

| 2020-02-08 | 2,095,001 | – | – | 35,605 |

| 2020-02-15 | 2,057,774 | – | – | 34,683 |

| 2020-02-22 | 2,101,301 | – | – | 35,440 |

| 2020-02-29 | 2,054,129 | – | – | 33,053 |

| 2020-03-07 | 1,973,560 | – | – | 32,803 |

| 2020-03-14 | 2,071,070 | – | – | 34,149 |

| 2020-03-21 | 3,410,969 | – | – | 36,758 |

| 2020-03-28 | 8,158,043 | – | 52,494 | 48,963 |

| 2020-04-04 | 12,444,309 | 3,802 | 68,897 | 64,201 |

| 2020-04-11 | 16,249,334 | 31,392 | 210,939 | 89,915 |

| 2020-04-18 | 17,756,054 | 59,760 | 1,088,281 | 116,162 |

| 2020-04-25 | 21,723,230 | 86,972 | 3,498,790 | 158,031 |

| 2020-05-02 | 20,823,294 | 171,580 | 6,226,074 | 175,289 |

| 2020-05-09 | 22,725,217 | 232,057 | 7,929,418 | 216,576 |

| 2020-05-16 | 18,791,926 | 233,288 | 11,095,269 | 226,164 |

| 2020-05-23 | 19,022,578 | 534,958 | 9,761,879 | 247,595 |

| 2020-05-30 | 18,548,442 | 1,093,338 | 9,392,718 | 259,499 |

| 2020-06-06 | 18,330,293 | 867,226 | 11,067,905 | 325,282 |

| 2020-06-13 | 17,552,371 | 769,155 | 12,853,484 | 336,537 |

| 2020-06-20 | 17,316,689 | 850,461 | 13,870,617 | 392,042 |

| 2020-06-27 | 16,410,059 | 936,726 | 12,008,146 | 373,841 |

| 2020-07-04 | 17,188,908 | 940,001 | 13,179,377 | 495,296 |

| 2020-07-11 | 16,221,070 | 1,055,778 | 13,008,659 | 513,141 |

| 2020-07-18 | 16,691,210 | 1,155,692 | 12,956,006 | 518,584 |

| 2020-07-25 | 15,700,971 | 1,223,255 | 10,717,042 | 609,328 |

| 2020-08-01 | 15,112,240 | 1,289,125 | 11,212,827 | 433,416 |

| 2020-08-08 | 14,098,536 | 1,407,802 | 10,957,527 | 549,603 |

| 2020-08-15 | 13,792,016 | 1,393,314 | 13,550,916 | 469,028 |

| 2020-08-22 | 13,067,660 | 1,422,483 | 14,656,297 | 523,430 |

| 2020-08-29 | 13,283,721 | 1,527,166 | 14,467,064 | 490,514 |

| 2020-09-05 | 12,373,201 | 1,631,645 | 11,510,888 | 529,220 |

| 2020-09-12 | 12,363,489 | 1,806,241 | 11,828,338 | 510,610 |

| 2020-09-19 | 11,561,158 | 1,959,953 | 11,394,832 | 589,652 |

| 2020-09-26 | 10,762,032 | 2,778,007 | 11,172,335 | 577,951 |

Data are not seasonally adjusted. A full list of programs can be found in the bottom panel of the table on page 4 at this link: https://www.dol.gov/ui/data.pdf.

Source: U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from Department of Labor (DOL), https://oui.doleta.gov/unemploy/docs/persons.xls and https://www.dol.gov/ui/data.pdf, October 15, 2020.

Senate Republicans’ blocking of additional stimulus is deeply cruel. Without the extra $600, workers on UI must get by on benefits that are typically around 40% of their pre-virus earnings. Of course, most people can’t exist on 40% of prior earnings for very long without experiencing a sharp drop in living standards and enormous pain. Research shows that there is nowhere a worker can afford to live on unemployment insurance alone. Further, not extending the $600 is terrible economics. The spending made possible by the $600 was supporting millions of jobs. Cutting that $600 means cutting those jobs—it means the workers who were providing the goods and services that UI recipients were spending that $600 on lose their jobs. The map in Figure B of this blog post shows how many jobs will be lost by state because of the expiration of the $600.

Not providing aid to state and local governments will also cost millions of jobs. The labor market is still more than 12 million jobs below where we would be if the recession hadn’t happened, and job growth is slowing. Now is not the time for Senate Republicans to block stimulus. Blocking more stimulus also means no additional housing and nutrition assistance, no COVID-related health and safety measures for workers, no aid to the Postal Service during this critical time, and no additional support for virus testing, tracing, and isolation measures or virus treatment and support for hospitals and other health providers. All of these things would have helped our economy and the people in it recover from the COVID-19 crisis.

Not doing more stimulus is also exacerbating racial inequality. Due to the impact of historic and current systemic racism, Black and Latinx communities have seen more job loss in this recession and have less wealth to fall back on. The lack of stimulus hits these workers the hardest. Further, workers in this pandemic aren’t just losing their jobs—an estimated 12 million workers and their family members have lost employer-provided health insurance due to COVID-19.

But what about, for example, the supposed work disincentive effect of the extra $600? Rigorous empirical studies show that any theoretical work disincentive effect of the $600 was so minor that it cannot even be detected. Further, there are 6.6 million more unemployed workers than job openings, meaning millions will remain jobless no matter what they do. Letting the $600 expire has not incentivized people to get jobs that are not there.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.