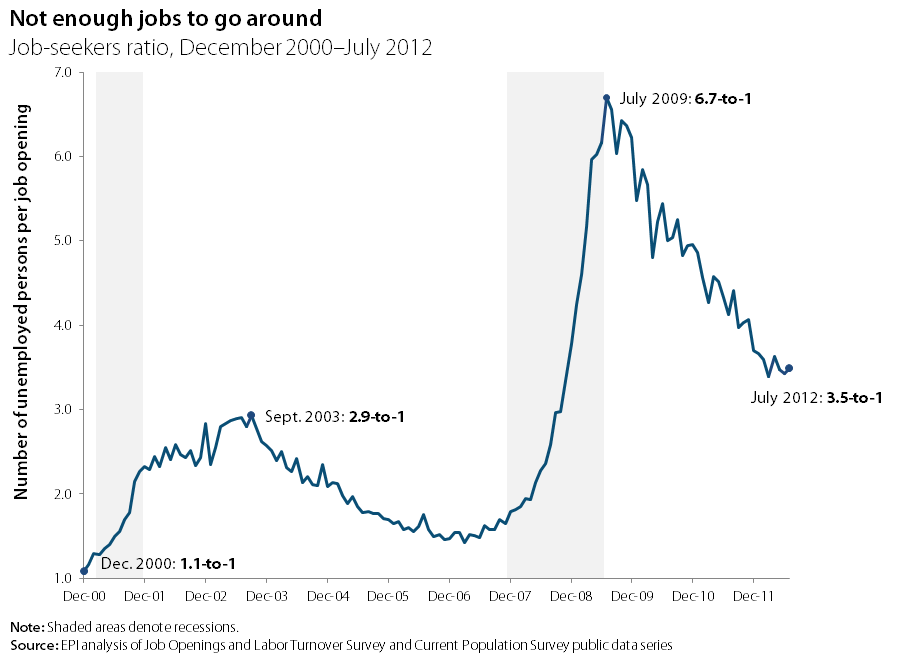

The July Job Openings and Labor Turnover Survey (JOLTS), released today by the Bureau of Labor Statistics, underscores the slow nature of the recovery. At 3.7 million, job openings in July were little changed from June. The number of unemployed workers in July was 12.8 million (unemployment data are from the Current Population Survey and can be found here), meaning that the “job-seekers ratio”—the ratio of unemployed workers to job openings—was 3.5-to-1. This is a slight increase from the 3.4-to-1 ratio in June.

MORE: State of Working America graphs with latest data on job openings and labor turnover

As the figure below shows, there is a substantial amount of month-to-month variability in the job-seekers ratio, and it is unlikely that the small increase in July means the labor market is deteriorating. Instead, it points to the lack of truly robust growth.

While the ratio has been generally improving since reaching its peak of 6.7-to-1 in summer 2009, the odds are still stacked strongly against job seekers; the job-seekers ratio has been at 3-to-1 or above since September 2008. A job-seekers ratio above 3-to-1 means that there are simply no jobs for more than two out of three unemployed workers.

Furthermore, unemployed workers far outnumber job openings in every sector. This underscores that by far the main cause of today’s persistent high unemployment is a broad-based lack of demand for workers—and not, as is often claimed, available workers lacking the skills needed for the sectors with job openings. (For more documentation of the fact that today’s persistent high unemployment is not “structural,” see this report.)

Layoffs dropped by 207,000 in July to 1.55 million, the lowest level since the survey began in December 2000. Voluntary quits increased by 27,000, also good news since increased voluntary quits signal that workers are better able to find good outside job opportunities. Voluntary quits are on a general upward climb, having increased 34.6 percent since their low in September 2009, but they have a long way to go; voluntary quits are still 24.9 percent below their 2007 average.

Hires fell in July by 55,000, though hires are also generally on a slow upward climb. They are up 14.9 percent since the official start of the recovery in June 2009, but hiring still has a long way to go before it returns to healthy levels. For example, hiring is still 18.5 percent below its 2007 average. Low hiring means unemployment durations remain extremely high. If emergency unemployment compensation (EUC) benefits are allowed to lapse (as is currently scheduled to happen at the end of this year), only around a quarter of all unemployed workers would be receiving UI benefits, the lowest share on record. Given the weakness of the labor market, this would be premature and destructive, and would likely cost about 430,000 jobs. Continuing emergency unemployment insurance benefits should be part of the continuing appropriations legislation that congressional leaders are currently negotiating.

—With research assistance from Natalie Sabadish and Hilary Wething