EPI Briefing Paper #239

The recovery package in action

Economy is already benefitting, but full force of stimulus is yet to come

By John Irons and Ethan Pollack

In response to a rapidly deteriorating economy, Congress passed and the president signed a recovery package last February designed to stimulate the economy over two years by putting people back to work, boosting demand, and restoring confidence. It has now been six months since the American Recovery and Reinvestment Act (ARRA) was passed, and while the economy continues to experience high unemployment, there are signs that the recovery act is beginning to have an impact.

This research report, which will be updated regularly, summarizes the basic facts about the implementation of the recovery act and assesses its impact. In particular, it highlights what is in the recovery package, when the funding is scheduled to be implemented, how quickly the investments are actually getting into the economy, and how that fiscal impact (i.e., money going out into the economy, either through spending or tax cuts) is boosting economic growth and job creation.

The main findings of this report include:

• The stimulus has already been integral to keeping the economy from a full-blown nose dive, with the effects of the direct spending—and the indirect economic activity it has spurred—already being reflected in the economic indicators:

◦ The economic contraction in the second quarter of 2009 was just 1% compared to the 6.4% annual rate of contraction in the first quarter and the 5.4% contraction experienced in the final quarter of 2008.

◦ Estimates from prominent economic forecasters indicate that GDP growth in the second quarter of 2009 would have been 2 to 3 percentage points worse without the economic stimulus.

◦ This impact is consistent with saving somewhere between 500,000-750,000 jobs over this three-month period.

◦ Job losses in the second quarter of 2009 were 1.3 million, down from 2 million jobs lost in the first three months of the year.

• Of the total amount designated by the ARRA to be spent, about 14% ($114 billion of the $787 billion package) has hit the economy.

• The fiscal impact ramped up in the second quarter of 2009, and will be sustained through mid-2010.

• Aid to states has been the quickest part of the package to be spent by the federal government, while spending in some other areas, such as research and infrastructure, are largely still to come.

• In the second quarter of 2009, $22.5 billion was provided to assist state and local governments; $27 billion was paid to individuals in the form of unemployment insurance, food stamps, social security, and other aid; $37 billion was provided in tax cuts; and $5 billion was spent on infrastructure and other areas.

• While most of the tax cuts will have found their way to consumers this fall, a majority of the spending—which provides more economic benefits per dollar than tax cuts—will hit the economy in late 2009 and early 2010.

Size and composition

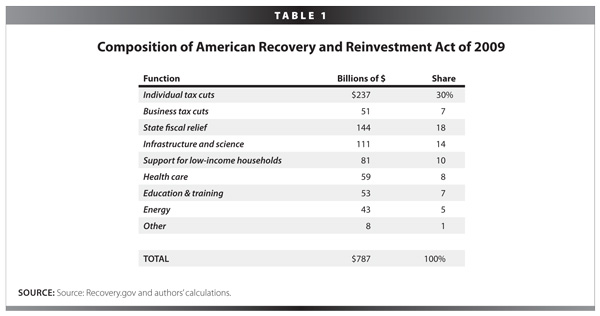

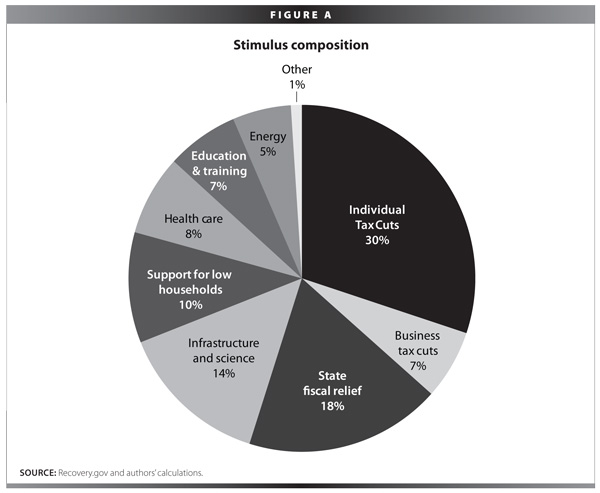

The recovery act includes a number of provisions designed to increase economic growth and to create or save jobs. The package includes aid to state governments to prevent layoffs and cuts in service, both of which would exacerbate the recession. It provides support for low-income households and individual tax cuts and refundable credits, which will both put money in the hands of those most likely to spend it back into the economy as well as help those suffering the most from the recession. Finally, it provides investment in our nation’s transportation and energy infrastructure, which creates jobs and promotes the sustainability and global competitiveness of the economy.1 A more complete breakdown is given in Table 1 and Figure A.

Timing

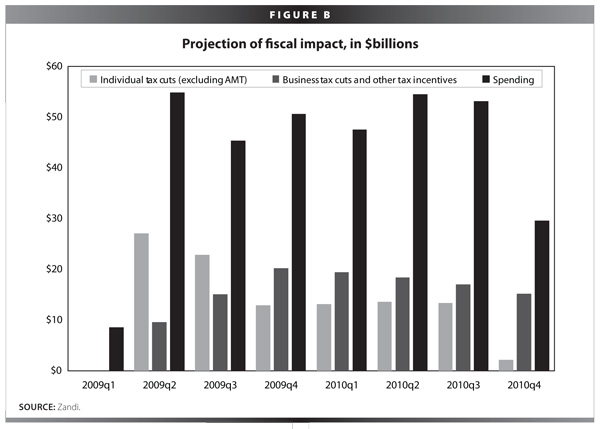

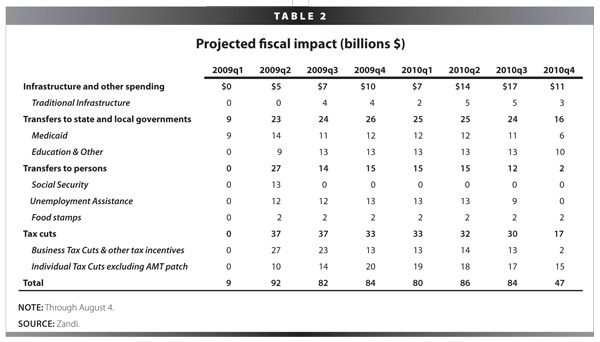

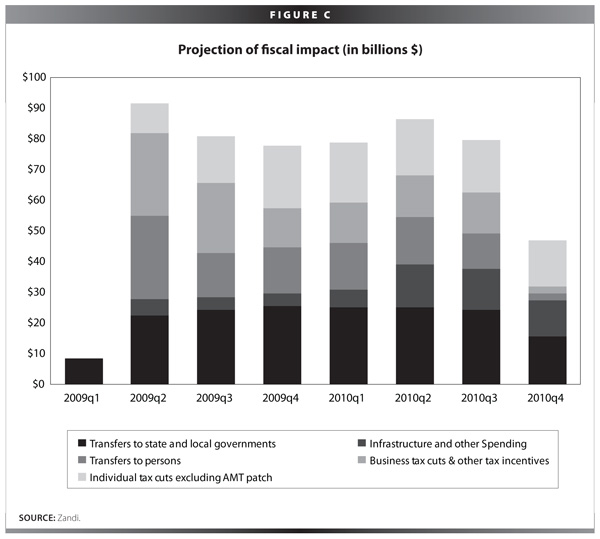

The total fiscal impact of ARRA is spread out over a number of years, with three-quarters of the package concentrated in the first two years, as estimated by the Congressional Budget Office. Figure B shows the fiscal impact of the tax and investments components of ARRA. The tax cuts in particular will have most of their fiscal impact over the first year, whereas the spending sustains its impact throughout the two-year window.

The front-loaded nature of the tax cuts is mainly due to the business tax cut components, such as the extension of special allowances for depreciation. However, while these cuts have gone out the door quickly, they will likely have little impact on the economy as businesses continue to see low profits and low levels of investment. By the fourth quarter of 2009, however, the balance of tax cuts shift to individual tax cuts (see Table 2 and Figure C), which tend to provide more economic benefit by boosting aggregate demand.2

The composition of the spending portion remains mostly stable through the end of 2010. Transfer payments—such as food stamps, unemployment benefits, and Social Security—do fall slightly after the second quarter of 2009, while infrastructure and other spending—such as on energy and health information technology—show a sustained rise through 2010. In general, the items that are just beginning to ramp up will provide much larger simulative benefits than business tax cuts or even individual tax cuts.

Implementation to date

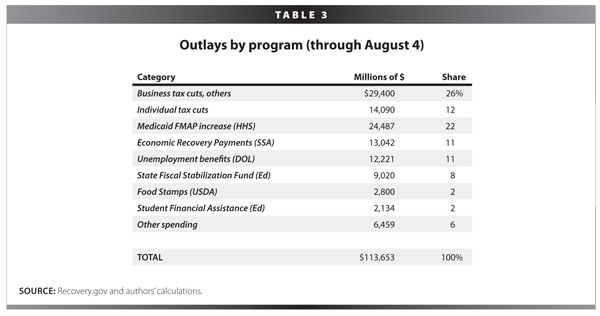

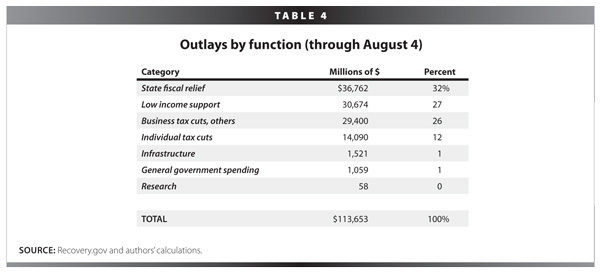

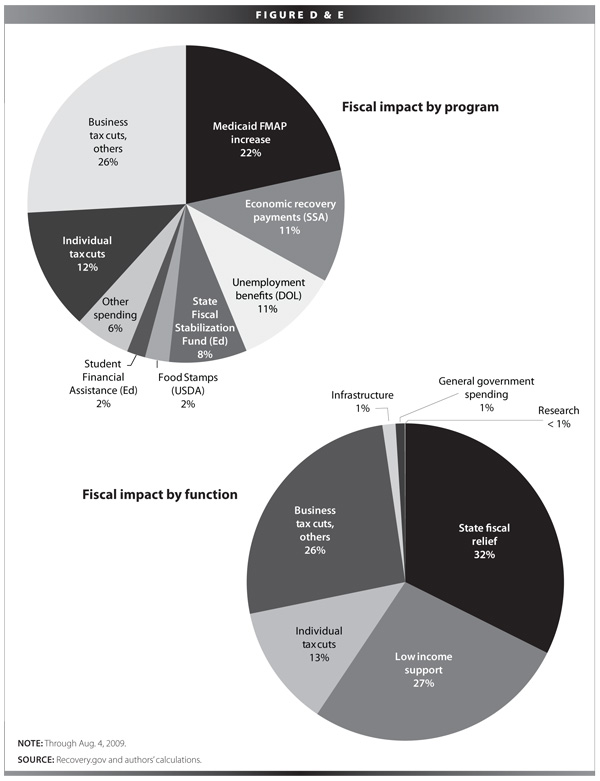

As of August 4, just under $114 billion of the Recovery Act funds had been spent, which is about 14% of the $787 billion package. The spending portion, which comprises 62% of the fiscal impact to date, is mostly made up of aid to states (via Medicaid and education formulas), Social Security transfer payments, and unemployment benefits. The tax portion, which makes up the remaining 32% of the fiscal impact, is two-thirds business tax cuts and one-third individual tax cuts (see Table 3, Table 4, Figure D, and Figure E).

Recovery act is helping the economy

Economic growth

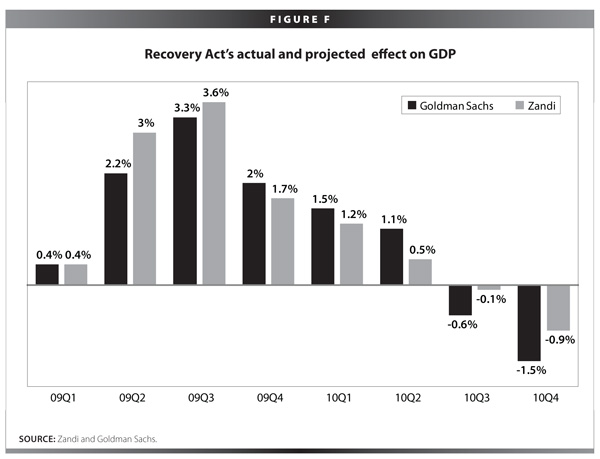

While the economy is likely still in a recession, the recovery package has significantly boosted the economy relative to what we would expect without it. Both Goldman Sachs3 and Mark Zandi of Economy.com4 estimated annualized GDP growth rates both with and without the recovery and project that ARRA has lead to substantial impact on economic growth in the second quarter of 2009, that will increase in the third quarter, see Figure F. Recently the Bureau Economic Analysis estimated that the economy shrunk by an annualized 1.0% in the second quarter. The Goldman Sachs and Zandi estimates suggested the economy would have shrunk by 3.2% and 4.0% without the ARRA.

It should be noted that

Figure F appears to suggest that ARRA will have its largest GDP impact in the second and third quarter, which seems questionable given that the overall fiscal impact remains fairly stable between 2009q2 and 2010q3. In fact, there is no conflict—the economy grows as the stimulus’ fiscal impact grows, but as the stimulus funding plateaus, it merely sustains the new (and higher) level of economic activity that resulted from the previous economic growth rather than contributing to new growth. The fact that the economy will even see positive growth effects from ARRA between 2009q4 and 2010q2 (despite no increases in the fiscal impact) is a function of both the change in the stimulus package’s composition (shifting from less effective tax cuts to more effective spending) as well as the lingering economic ripples from the stimulus in the prior quarters.

Jobs

The stimulus package was designed to be an effective job creator. Transfers to individuals (such as unemployment benefits and food stamps) and tax cuts put money in the hands of consumers and businesses, which boosts aggregate demand for goods and services. Aid to state and local governments, infrastructure investments, and other spending help maintain or boost public sector demand. This new demand causes businesses to hire more workers—or, at the very least, prevents layoffs.

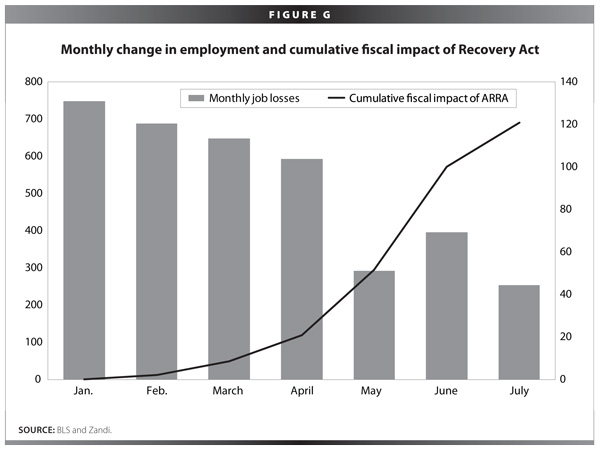

Through these mechanisms, the stimulus package has already boosted employment by hundreds of thousands of jobs, either by creating jobs or saving jobs that would otherwise have been lost. The fact that the economy is losing jobs at a much slower pace—from 2 million jobs lost in the first quarter to 1.3 million jobs lost in the second quarter of 2009—is evidence that ARRA has helped staunch the job loss. In fact, without ARRA, job losses would have been much higher: Mark Zandi estimates that job loss in the second quarter would have been worse by about 500,000 without ARRA, while EPI’s Josh Bivens estimates that, consistent with the GDP impacts noted above, job loss would have been worse by approximately 720,000. Figure G shows the monthly loss in jobs since January 2009 as well as the cumulative amount of money spent through the recovery act.

What’s imminent and what’s in the offing

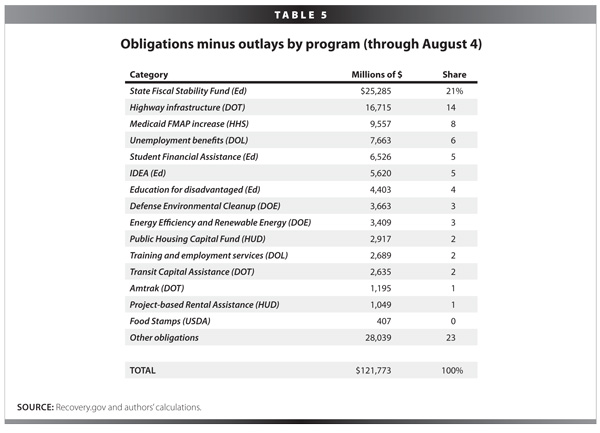

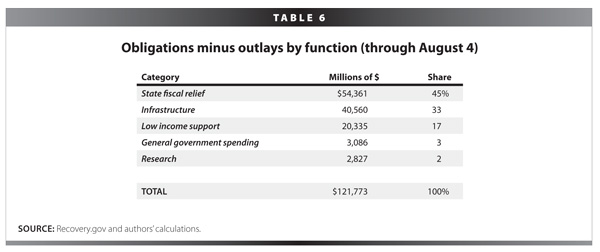

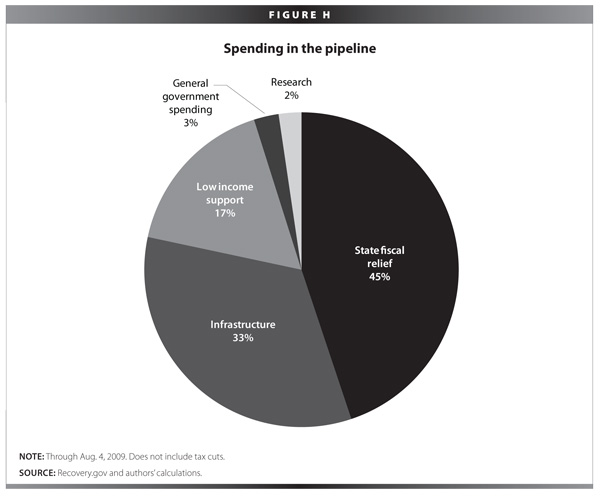

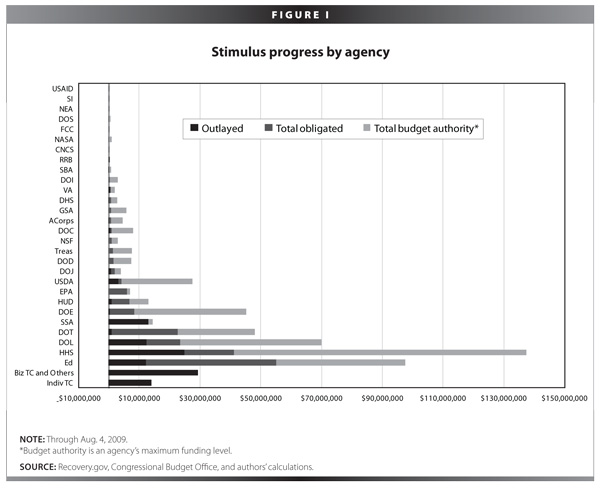

So far, $121.8 billion has been legally obligated but not yet spent into the economy.5 Looking at funds that are obligated but not yet spent as a measure of an economic impact that is imminent, we can expect state aid and infrastructure to consume a much larger share of the ARRA spending in the near future (note that this measure excludes tax cuts, which are not subject to obligation) (see Table 5, Table 6, and Figure H). Figure I shows the breakdown of spending by agency. Overall, the chart shows that there is still much stimulus in the pipeline.

Notes

1. The final size and composition of the stimulus package was the result of a legislative compromise. In many cases, less-effective tax cuts replaced the more-effective spending. For example, a last-minute Senate deal scrapped $25 billion in state aid and $20 billion in school construction to make room for a patch to the Alternative Minimum Tax, a provision that provides so little stimulus that most economists do not even consider it part of the stimulus package. Other worthy provisions, such as transit operations funding, were not even considered.

2. The business tax cuts essentially operate by deferring tax burdens, which are eventually paid back within the 10-year budget window used by the Congressional Budget Office. For this reason, while the net 10-year impact of business tax cuts is small—only 7% of ARRA—they actually represent 22% of the total fiscal impact in the first year.

3. Goldman Sachs. “Fiscal Stimulus: A Little Less in Q2, A Little More Later,” August 4, 2009.

4. Zandi, Mark. “The Shape of the Coming Recovery,” Moody’s Economy.com, July 9, 2009.

5. Before funds are spent (outlayed), they must first be obligated. Obligated funds are legally required to go to a specific recipient—it is analogous to writing a check. Obligations net outlays are thus the equivalent to uncashed checks. This measure is effective in showing what portions of the stimulus will very soon hit the economy.