In the next few days, the Senate is expected to take up an extension and expansion of the one-year payroll tax cut enacted last December. The scheduled expiration of the payroll tax cut is the largest of many fiscal headwinds that will slow economic growth in 2012 and reduce job growth. By reducing employees’ Social Security contributions from 6.2 percent of taxable wages and salaries to 4.2 percent for 2011, the tax cut increased disposable income by $112 billion, or 0.7 percent of GDP. (The decrease in Social Security revenue was offset with general funds, leaving the Social Security trust fund and benefits unaffected by the tax cut.) This higher disposable income translates into more consumer spending by households and therefore more jobs throughout the economy.

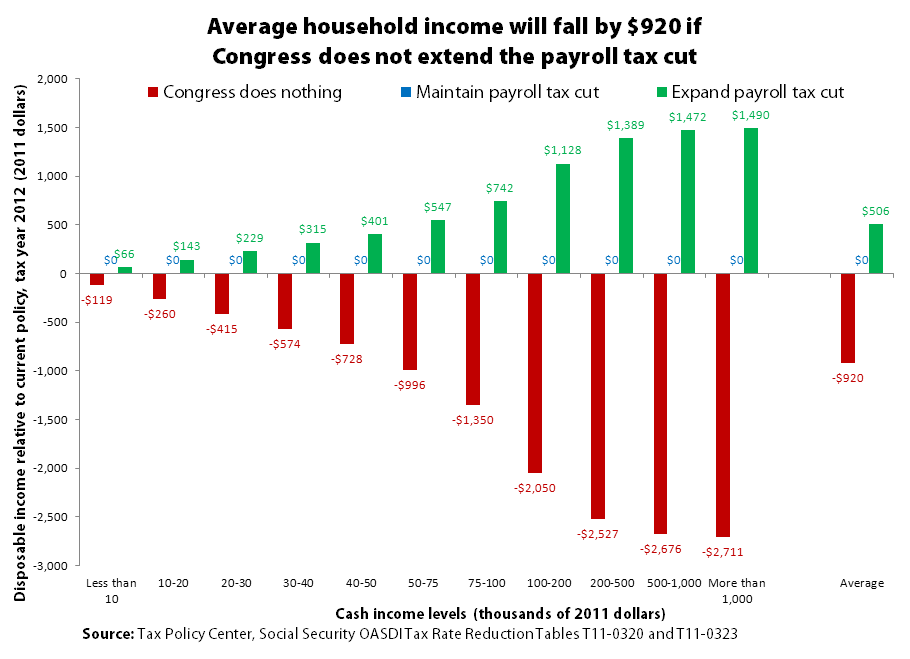

If Congress does not continue the payroll tax cut or replace it with a comparably sized temporary tax rebate, declining consumption and related economic activity will decrease employment by almost one million jobs, relative to current policy. The Tax Policy Center estimates that failure to continue the payroll tax cut would reduce the average family’s disposable income by $920 next year, again relative to current policy. Expanding the payroll tax cut to 3.1 percent of taxable wages and salaries (as proposed in the American Jobs Act and the introduced Senate bill) would boost the average household’s income by $506, as shown in the figure below. With unemployment expected to remain high throughout 2012, it is imperative that policy does not take any backwards steps—such as failing to renew the payroll tax holiday or establish an equivalent boost to spending.

(As the figure also shows, the payroll tax cut provides greater benefits to higher-income households, which are less likely to spend their increased income. So, while a payroll tax cut extension is much more progressive than further reductions in marginal income tax rates, and better than no action, it would be best to boost economic activity by replacing the payroll tax cut with a targeted tax rebate providing greater assistance to lower income households.)