Issue Brief #387

Introduction and executive summary

More than five years have passed since the federal minimum wage was raised to its current level of $7.25 per hour. Over that time, the value of a minimum-wage income has fallen nearly 10 percent due to rising prices. Yet this decline is small in comparison to the drop in value of the minimum wage over the past four decades. After rising in line with economy-wide productivity in the three decades following its inception in 1938, the federal minimum wage has been raised so inadequately and so infrequently since the late 1960s that today’s minimum-wage workers make roughly 25 percent less in inflation-adjusted terms than their counterparts 45 years ago. Indeed, a full-time, full-year minimum-wage worker with one child is paid so little that income from her paycheck alone leaves her below the federal poverty line.1

This failure to adequately raise the wage floor has contributed strongly to the stagnation of wage growth at the bottom of the wage distribution. This wage stagnation has, in turn, been the single greatest impediment to making rapid progress in poverty reduction in recent decades. Indeed, all of the decline in poverty in recent decades can be accounted for by safety net and income-support programs (Bivens et al. 2014). In fact, managers at some of the largest and most profitable corporations in the United States today actively encourage their employees to seek public assistance to supplement meager paychecks (Eidelson 2013). All of this has led many to conclude that American employers are too often dodging their responsibilities as partners in the social contract—the understanding that Americans who work hard should be paid enough to make ends meet. Instead, too many low-wage employers are leaving both taxpayers and, more importantly, low-wage workers themselves to pick up the slack.

Recent protests calling for higher wages at many of these companies have highlighted this widening rift between what businesses are paying and what workers need to survive. Among the protesters’ demands is that employers begin paying workers adequately, instead of relying upon public funds to give their workers a decent standard of living even as corporate profits reach record highs.

This issue brief examines the use of public assistance programs by low-wage workers and assesses how raising the federal minimum wage to $10.10 over three years—as proposed by the Fair Minimum Wage Act of 2014, a bill introduced by Sen. Tom Harkin (D-Iowa) and Rep. George Miller (D-Calif.)—could affect utilization rates, benefit amounts, and government spending on these programs.

The key findings are:

- About half of all workers in the bottom 20 percent of wage earners (roughly anyone earning less than $10.10) receive public assistance in the form of Medicaid and the six primary means-tested income-support programs, either directly or through a family member. These programs include the Earned Income Tax Credit (EITC); the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps; the Low Income Home Energy Assistance Program (LIHEAP); the Supplemental Nutrition Program for Women, Infants, and Children (WIC); the Section 8 Housing Choice Voucher program; and the Temporary Assistance for Needy Families program (TANF) or equivalent state and/or local cash assistance programs.

- Workers in the bottom 20 percent of wage earners receive over $45 billion in government assistance each year from the six primary means-tested income-support programs.2

- Roughly half of all public assistance dollars from means-tested income-support programs that go to working individuals go to workers with wages below $10.10.

- If the minimum wage were raised to $10.10, more than 1.7 million American workers would no longer rely on public assistance programs.

- Raising the minimum wage to $10.10 would reduce government expenditures on current income-support programs by $7.6 billion per year—and possibly more, given the conservative nature of this estimate. This would allow these funds to be repurposed into either new programs or expansions of existing programs to further leverage the poverty-fighting impact of this spending.3

- Safety net programs would save 24 cents for every additional dollar in wages paid to workers affected by a minimum-wage increase to $10.10.

The research in this issue brief is part of a forthcoming report that examines the relationship between raising wages for low-wage workers and reliance on public assistance programs in greater detail.

Key background: The erosion of the inflation-adjusted value of the minimum wage

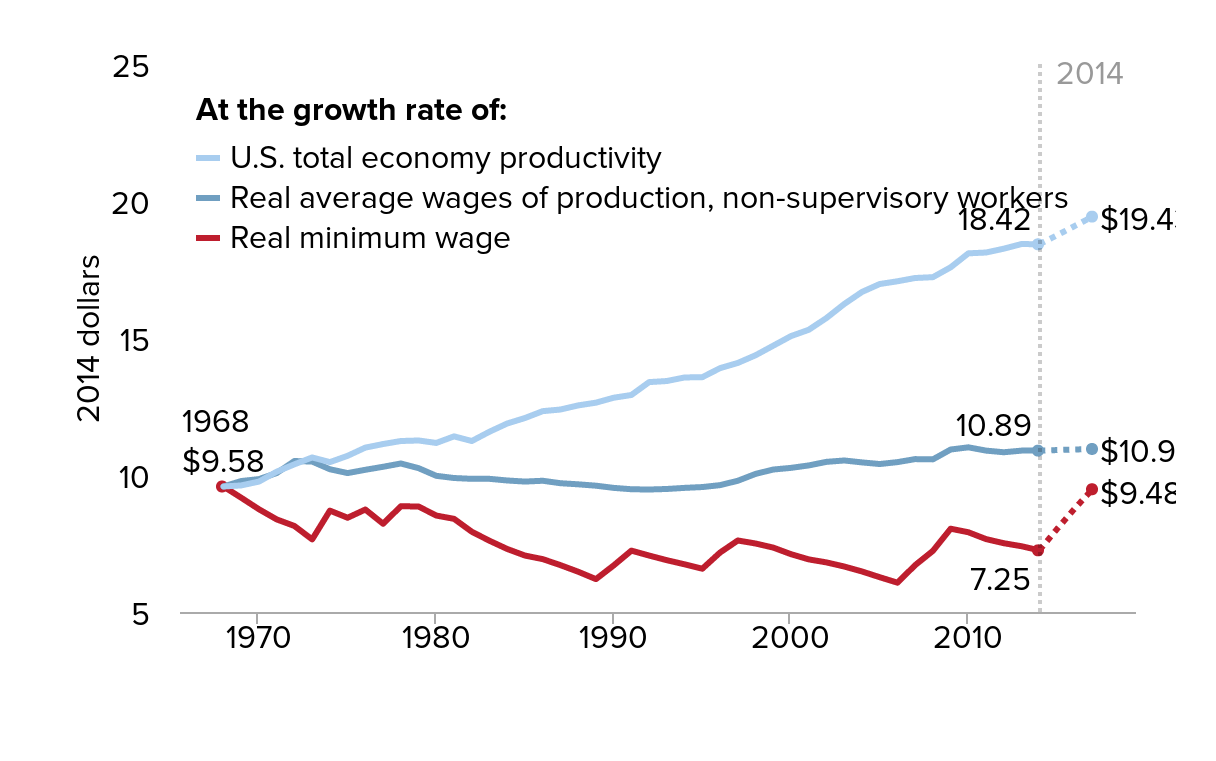

Every year that the minimum wage is not raised, inflation slowly erodes its real (i.e., inflation-adjusted) value, meaning that minimum-wage workers cannot afford to buy as much as they could in previous years. As shown in Figure A, the current minimum wage of $7.25 is worth roughly 25 percent less than the minimum wage in 1968, when it equaled $9.58 in today’s dollars.

Real value of the federal minimum wage, 1968–2014 and 2014–2017 under an increase to $10.10 by 2017, compared with its value had it grown at the rate of various benchmarks

| Year | Real minimum wage | Real minimum wage (projected) | Real average wages of production, non-supervisory workers | Real average wages of production, non-supervisory workers (projected) | U.S. total economy productivity | U.S. total economy productivity (projected) |

|---|---|---|---|---|---|---|

| 1968 | 9.58 | 9.58 | 9.58 | |||

| 1969 | 9.17 | 9.78 | 9.62 | |||

| 1970 | 8.75 | 9.85 | 9.76 | |||

| 1971 | 8.38 | 10.07 | 10.12 | |||

| 1972 | 8.14 | 10.51 | 10.39 | |||

| 1973 | 7.65 | 10.49 | 10.64 | |||

| 1974 | 8.70 | 10.21 | 10.47 | |||

| 1975 | 8.44 | 10.07 | 10.70 | |||

| 1976 | 8.74 | 10.19 | 11.00 | |||

| 1977 | 8.22 | 10.30 | 11.13 | |||

| 1978 | 8.86 | 10.42 | 11.24 | |||

| 1979 | 8.85 | 10.25 | 11.26 | |||

| 1980 | 8.52 | 9.97 | 11.17 | |||

| 1981 | 8.40 | 9.89 | 11.41 | |||

| 1982 | 7.93 | 9.86 | 11.24 | |||

| 1983 | 7.60 | 9.86 | 11.58 | |||

| 1984 | 7.30 | 9.80 | 11.88 | |||

| 1985 | 7.06 | 9.76 | 12.08 | |||

| 1986 | 6.93 | 9.79 | 12.33 | |||

| 1987 | 6.71 | 9.70 | 12.39 | |||

| 1988 | 6.47 | 9.66 | 12.54 | |||

| 1989 | 6.20 | 9.61 | 12.64 | |||

| 1990 | 6.70 | 9.53 | 12.82 | |||

| 1991 | 7.24 | 9.48 | 12.92 | |||

| 1992 | 7.06 | 9.47 | 13.39 | |||

| 1993 | 6.89 | 9.49 | 13.43 | |||

| 1994 | 6.74 | 9.53 | 13.56 | |||

| 1995 | 6.58 | 9.56 | 13.57 | |||

| 1996 | 7.17 | 9.63 | 13.90 | |||

| 1997 | 7.61 | 9.79 | 14.09 | |||

| 1998 | 7.50 | 10.04 | 14.37 | |||

| 1999 | 7.35 | 10.20 | 14.72 | |||

| 2000 | 7.11 | 10.26 | 15.07 | |||

| 2001 | 6.92 | 10.35 | 15.30 | |||

| 2002 | 6.81 | 10.48 | 15.73 | |||

| 2003 | 6.66 | 10.53 | 16.24 | |||

| 2004 | 6.48 | 10.46 | 16.68 | |||

| 2005 | 6.27 | 10.40 | 16.97 | |||

| 2006 | 6.07 | 10.47 | 17.07 | |||

| 2007 | 6.71 | 10.58 | 17.19 | |||

| 2008 | 7.23 | 10.57 | 17.22 | |||

| 2009 | 8.04 | 10.93 | 17.58 | |||

| 2010 | 7.91 | 11.01 | 18.09 | |||

| 2011 | 7.66 | 10.89 | 18.12 | |||

| 2012 | 7.51 | 10.83 | 18.26 | |||

| 2013 | 7.40 | 10.89 | 18.43 | |||

| 2014 | 7.25 | 7.25 | 10.89 | 10.89 | 18.42 | 18.42 |

| 2015 | 8.03 | 10.91 | 18.75 | |||

| 2016 | 8.78 | 10.93 | 19.09 | |||

| 2017 | 9.48 | 10.95 | 19.43 |

* Real minimum-wage projection from 2014 to 2017 assumes a minimum-wage increase to $10.10 by 2017. Productivity and average wage projections from 2014 to 2017 do not include the effects of a minimum-wage increase.

Note: Dollars are deflated using CPI-U-RS and CBO inflation projections. 2014 values reflect average of the first half of 2014. Projected wage values are based on CBO inflation projections, average wage and productivity growth from 2002 to 2006 (the last full regular business cycle), and, in the case of the "real minimum wage" line, the Harkin-Miller proposal to raise the federal minimum wage to $10.10 over three years.

Source: EPI analysis of Total Economy Productivity data from the Bureau of Labor Statistics Labor Productivity and Costs program, Bureau of Labor Statistics Current Employment Statistics, Current Population Survey Outgoing Rotation Group public-use microdata, and U.S. Department of Labor Wage and Hour Division (2013)

The figure also depicts what the minimum wage would have been had it risen in tandem with two other relevant benchmarks. If the minimum wage had grown at the same pace as the average wage for typical U.S. workers, it would be $10.89 today and likely close to $11 per hour by 2017. Had it grown at the same rate as productivity—i.e., how much we can produce, on average, from an hour’s worth of work—it would be more than $18 per hour today, and over $19 per hour by 2017 (under reasonable expectations for productivity growth). The dotted red line shows what the minimum wage would be (in 2014 dollars) under an increase to $10.10 by 2017. Such an increase would restore most of the value of the minimum wage lost to inflation over the past four decades—certainly a worthwhile improvement. However, as illustrated by the other two hypothetical scenarios, it would still be far lower than what the economy could sustain, given economic growth and technological progress over that time.

Renegotiation of the social contract

In failing to adequately raise the minimum wage, or to adopt policies to raise wages more generally, policymakers have allowed, if not encouraged, a steady renegotiation of the social contract that has benefited employers at the expense of workers and taxpayers. For generations of Americans, there was an understanding and expectation that with full-time work—regulated by reasonable labor standards and backed by a robust safety net that guarded against unexpected hardship—ordinary Americans would have the resources they need to achieve at least a modest yet decent standard of living. Unfortunately, the experience of millions of struggling American workers today suggests that this expectation is no longer a reality.

A large share of Americans work full time, or close to it, yet are not paid enough by their employers to support themselves or their families. Consequently, they often rely upon government support programs as regular supplements to their incomes. In fact, of all the workers receiving means-tested government assistance either directly or through their families, nearly half work full time.4 There are other workers receiving benefits whose inadequate labor earnings stem from a lack of available work. Others receive benefits as a result of circumstances that prevent them from working full time, such as the need to care for a family member, and/or a lack of adequate work supports that would allow them to work full time (such as access to child care, paid leave, or flexible work schedules).

Yet for many workers, their hourly rate of pay is simply too low to provide adequate income to meet their basic needs.

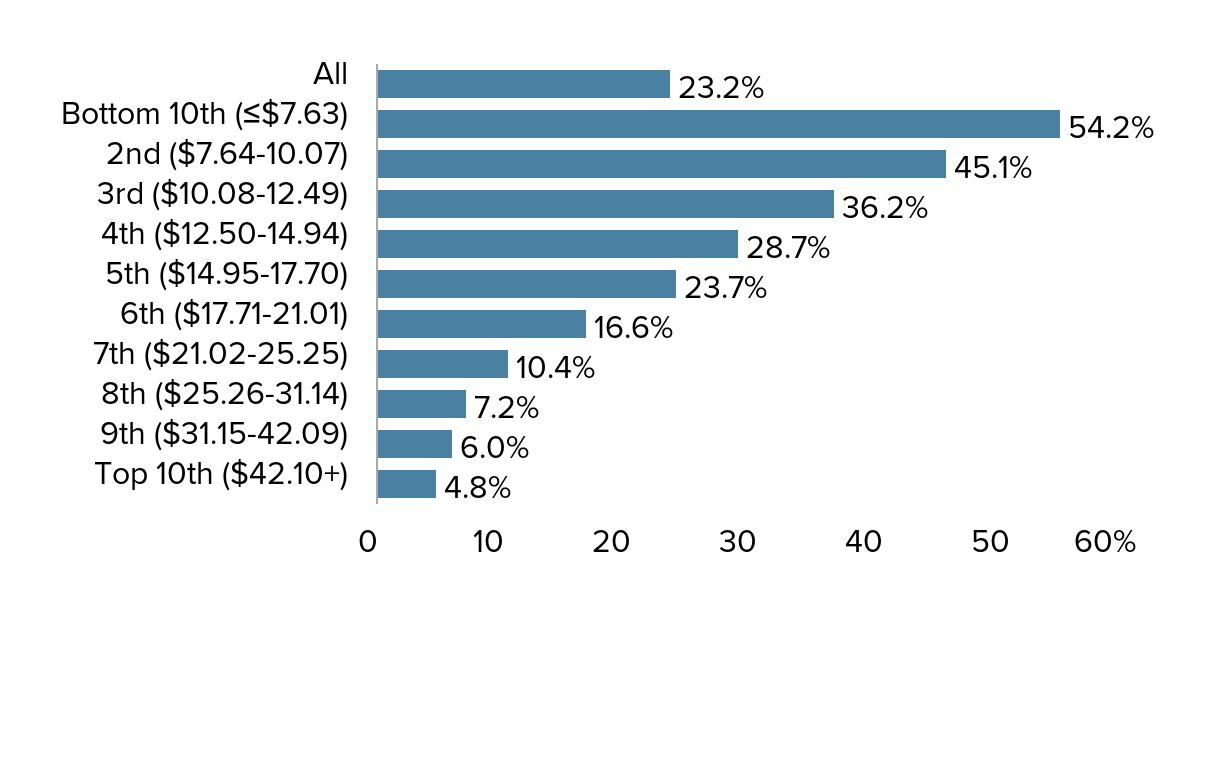

Figure B shows the share of all wage earners within each wage decile whose families receive benefits from at least one of the seven primary means-tested public assistance programs: the Earned Income Tax Credit (EITC); the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps; the Low Income Home Energy Assistance Program (LIHEAP); the Supplemental Nutrition Program for Women, Infants, and Children (WIC); the Section 8 Housing Choice Voucher program; Medicaid; and the Temporary Assistance for Needy Families program (TANF) or equivalent state and/or local cash assistance programs.5 Overall, about 23 percent of all wage earners receive some form of public assistance from these programs, either directly or through a family member. Yet as the figure shows, more than half (54.2 percent) of workers in the bottom decile of wage earners (workers with wages at or below $7.63 per hour) receive assistance, and another 45.1 percent of workers in the second decile (with wages between $7.64 and $10.07) receive assistance.6 Workers earning less than $10.10 per hour are almost all found in the bottom two wage deciles. Among these workers, approximately half rely upon at least one of these public assistance programs.

Share of wage earners in each hourly wage decile whose families receive means-tested public assistance

| Wage decile | Incidence |

|---|---|

| All | 23.2% |

| Bottom 10th (≤$7.63) | 54.2% |

| 2nd ($7.64–10.07) | 45.1% |

| 3rd ($10.08–12.49) | 36.2% |

| 4th ($12.50–14.94) | 28.7% |

| 5th ($14.95–17.70) | 23.7% |

| 6th ($17.71–21.01) | 16.6% |

| 7th ($21.02–25.25) | 10.4% |

| 8th ($25.26–31.14) | 7.2% |

| 9th ($31.15–42.09) | 6.0% |

| Top 10th ($42.10+) | 4.8% |

Note: Includes the EITC, SNAP, LIHEAP, WIC, housing assistance, TANF/cash assistance, and Medicaid. Wage deciles reflect imputed hourly wages from CPS-ASEC data in 2012 dollars. See endnote 6 for details.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement microdata, pooled data years 2010–2012

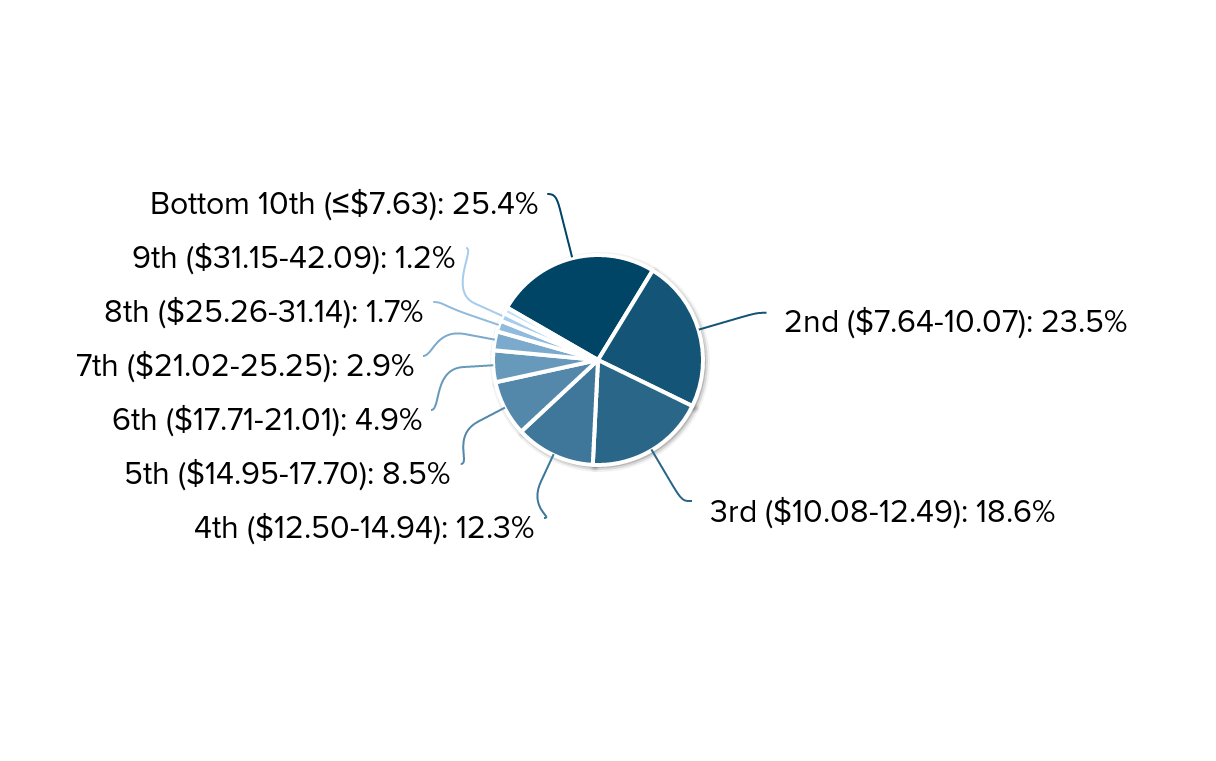

For all of these programs, eligibility is restricted to individuals with low total family incomes—often some percentage of the federal poverty line—and most programs are designed to “phase out” as family incomes rise.7 Thus, we would expect the bulk of benefit dollars going to working participants in these programs to go to workers earning low hourly wages—and indeed, they do. Figure C shows each wage decile’s share of all benefit dollars from means-tested income-support programs going to workers or their families. (Note that these figures, and all other dollar values throughout this brief, do not include the dollar value of Medicaid.8) Almost half (48.9 percent) of all income-support dollars received by workers or their families go to those in the bottom two deciles of the wage distribution—again, roughly everyone earning less than $10.10 per hour. These workers receive over $45 billion in income support each year. Over two-thirds (67.5 percent) of all income-support dollars received by workers or their families go to those in the bottom three deciles of wage earners, i.e., workers with wages less than $12.50 per hour.

Share of income-support benefit dollars received by families of working individuals, by worker hourly wage decile

| Wage decile | Total | Share |

|---|---|---|

| All | $ 67,552 | 100.00% |

| Bottom 10th (≤$7.63) | $ 17,167 | 25.41% |

| 2nd ($7.64–10.07) | $ 15,866 | 23.49% |

| 3rd ($10.08–12.49) | $ 12,546 | 18.57% |

| 4th ($12.50–14.94) | $ 8,292 | 12.28% |

| 5th ($14.95–17.70) | $ 5,764 | 8.53% |

| 6th ($17.71–21.01) | $ 3,301 | 4.89% |

| 7th ($21.02–25.25) | $ 1,964 | 2.91% |

| 8th ($25.26–31.14) | $ 1,160 | 1.72% |

| 9th ($31.15–42.09) | $ 830 | 1.23% |

| Top 10th ($42.10+) | $ 661 | 0.98% |

Note: Includes the EITC, SNAP, LIHEAP, WIC, housing assistance, and TANF/cash assistance. These data do not include the value of Medicaid. Wage deciles reflect imputed hourly wages from CPS-ASEC data in 2012 dollars. See endnote 6 for details.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement microdata, pooled data years 2010–2012

Even though Figure C shows some portion of total benefit dollars going to high wage earners, this is at least partially an artifact of the data source used in this analysis, and likely overstates the shares of benefits accruing to individuals with high hourly wages.9 Still, there may be some workers with relatively high hourly wages who worked limited hours during the year, thus resulting in total family incomes that still qualify for benefits.

Utilization of public assistance among workers likely affected by a minimum-wage increase to $10.10

The Fair Minimum Wage Act of 2014 would raise the federal minimum wage to $10.10 per hour in three incremental increases of $0.95 per year over three years. Cooper (2013) has shown that such an increase would likely raise wages for more than 27 million workers throughout the United States. This includes both the large number of workers (16.7 million) with wages below $10.10 who would directly benefit, as well as a significant number of workers with wages just above $10.10 (11.1 million) who would also likely get a raise as employers adjust overall pay ladders as a result of the increase.

As expected from the data in Figure B, workers with wages in the range likely to be affected by an increase in the federal minimum wage use public assistance programs at particularly high rates. Table 1 shows that roughly 45 percent of workers likely to get a raise from an increase in the minimum wage to $10.10 receive benefits from at least one means-tested public assistance program, either directly or through a family member. These workers report receiving more than $28 billion in public assistance each year—excluding Medicaid—with the average value of benefits received (among those receiving benefits) of $3,110. However, benefit dollars reported in the Current Population Survey (CPS), the data source used here, are known to significantly understate actual program expenditures. Researchers have been able to estimate the magnitude of this undercount in the CPS Annual Social and Economic Supplement (ASEC) for several of these programs—see Meyer, Mok, and Sullivan (2009). The last two columns in Table 1 show the estimated actual value of benefits going to these workers, after adjusting for this undercount, as well as the multiplier used to make this adjustment. After adjusting for the undercount, workers likely affected by a minimum-wage increase to $10.10 are estimated to receive nearly $39 billion in income support each year. Even with these adjustments, the values here still likely understate the true level of benefits going to these working individuals and their families because these values do not include the value of Medicaid, and because rates of underreporting have increased over time.10

Receipt of public assistance among families of workers likely affected by a minimum-wage increase to $10.10

| Type of assistance | Count | Share of workers receiving each benefit | Total benefits received (in millions) | Average value of benefits received (among those receiving each benefit) | Adjustment factor to total benefits received* | Total benefits received, adjusted for known CPS undercount (in millions)* | |

|---|---|---|---|---|---|---|---|

| Any government assistance | 9,714,000 | 44.8% | $28,348 | $3,110 | 1.37 | $38,977 | |

| Earned income tax credit (EITC) | 8,163,000 | 37.7% | $16,774 | $2,050 | 1.39 | $23,233 | |

| Energy assistance (LIHEAP) | 773,000 | 3.6% | $267 | $350 | *** | $267 | |

| Food stamps (SNAP) | 3,214,000 | 14.8% | $6,984 | $2,580 | 1.50 | $10,502 | |

| Housing assistance | 630,000 | 2.9% | $2,829 | $4,490 | *** | $2,829 | |

| Medicaid | 2,099,000 | 9.7% | ** | ** | ** | ** | |

| TANF/cash assistance | 317,000 | 1.5% | $803 | $2,530 | 1.47 | $1,183 | |

| Supplemental Nutrition for Women, Infants, and Children (WIC) | 1,342,000 | 6.2% | $691 | $510 | 1.40 | $964 |

* The CPS-ASEC survey data are known to significantly understate the rate of receipt and total income received from public assistance programs. In this analysis, we do not make any attempt to correct for this undercount in the rate of receipt. However, columns six and seven show the adjustment factor and total adjusted benefit amounts, respectively, based upon the observed underreporting of benefit dollars in the CPS-ASEC for each program as measured in Meyer, Mok, and Sullivan (2009). See endnote 2 for further details.

** Due to changes in Medicaid benefits resulting from the Affordable Care Act, the fungible value of Medicaid benefits is not included in any dollar-value calculations. This means that total and average overall assistance values are likely significantly understated.

*** No underreporting rate is available for the LIHEAP or Housing Assistance programs, so for these programs, no adjustment is made.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement microdata, pooled data years 2010–2012

The effect of raising the minimum wage to $10.10 on benefit receipt and program spending

There are two methods researchers generally use for estimating how policy changes such as an increase in the minimum wage affect family incomes and public assistance program participation: quasi-experiments and microsimulations. The first, quasi-experimental design or “natural experiments,” compare how incomes and benefit receipt change in labor markets that experienced a minimum-wage increase with similar labor markets that did not experience a minimum-wage increase—often a neighboring county across a state border. West and Reich (2014) use this approach to look specifically at the effect of past minimum-wage increases on SNAP enrollments and expenditures, finding that “a 10 percent increase in the minimum wage reduces SNAP enrollment by between 2.4 and 3.2 percent and reduces program expenditures by 1.9 percent.” Dube (2013) also uses a similar approach to examine how past minimum-wage increases have affected family incomes and poverty rates. He finds that increases in the minimum wage significantly reduce poverty rates and increase family incomes, particularly for low-income families.

In the simulation method, researchers essentially take a snapshot of current benefit receipt, and try to estimate how those values would change if the reported hourly wages of individuals in the study were to change, holding all else constant. Giannarelli, Morton, and Wheaton (2007) use a microsimulation model of all U.S. tax, transfer, and health programs to estimate the effects of a package of labor and anti-poverty policies, including raising the federal minimum wage from $5.15—its level in 2007—to $7.25. They predicted that such an increase would decrease public assistance costs or raise federal revenues by over $2 billion (roughly $2.5 billion in 2013 dollars). Zabin, Dube, and Jacobs (2004) also used a simulation approach to estimate changes in California’s 10 major means-tested public assistance programs that would occur if the state increased its wage floor, finding that if the state raised its minimum wage from $6.75, where it stood at that time, to $8 per hour, it would save $2.7 billion ($3.3 billion in 2013 dollars).

Natural experiments are unquestionably the gold standard for assessing the direct causal effect of exogenous policy changes; however, simulations are still useful for providing some insight into the magnitude of potential policy impacts. In this section, a simulation approach is used to compare benefit receipt among low-wage workers with receipt among higher-wage workers in order to estimate how lifting wages for those in the range likely to be affected by a minimum-wage increase to $10.10 might affect utilization of public assistance programs.

Simulation results

Raising the minimum wage to $10.10 would provide nearly $32 billion in additional wages to more than 27 million workers.11 The resulting increase in family incomes would unquestionably improve living standards for millions of working families. At the same time, many families that were forced to rely on safety net programs may no longer qualify for assistance, or may see their benefit levels reduced. Most of the means-tested public assistance programs are designed such that benefits phase out gradually as incomes rise; therefore, benefit reductions are not so steep as to leave workers no better off than they were before their wage income increased. However, one could certainly argue that these results show a need to reduce the phase-out rates for public programs to provide low-wage workers the maximum income boost from legislated minimum-wage increases.

Table 2 describes how raising hourly wages is predicted to change public assistance utilization rates and benefit amounts among workers likely to be affected by a minimum-wage increase to $10.10. As the table shows, among these workers, a $1 increase in hourly wages is predicted to reduce the share receiving any government assistance by 3.9 percentage points. The share of workers receiving the Earned Income Tax Credit is expected to decline by 3.8 percentage points, and participation in SNAP is predicted to fall by 1.6 percentage points. The predicted declines in participation rates for the other public assistance programs are relatively small, but this is because even among low-wage workers, the number and shares participating in these programs are fairly small to begin with.

Effect of increasing wages on incidence and value of public assistance for families of workers likely affected by a minimum-wage increase to $10.10

| Effect on: | Effect of a $1 increase in hourly wage |

|---|---|

| Share of workers receiving: | |

| Any government assistance | -3.9 ppt*** |

| Earned income tax credit (EITC) | -3.8 ppt*** |

| Energy assistance (LIHEAP) | -0.5 ppt*** |

| Food stamps (SNAP) | -1.6 ppt*** |

| Housing assistance | -0.4 ppt*** |

| Medicaid | -0.8 ppt*** |

| TANF/cash assistance | -0.2 ppt*** |

| Supplemental Nutrition for Women, Infants, and Children (WIC) | -0.5 ppt*** |

| Total benefit dollars from: | |

| All government assistance | -$126*** |

| Earned income tax credit (EITC) | -$56*** |

| Energy assistance (LIHEAP) | -$2*** |

| Food stamps (SNAP) | -$41*** |

| Housing assistance | -$17*** |

| TANF/cash assistance | -$6*** |

| Supplemental Nutrition for Women, Infants, and Children (WIC) | -$3*** |

*** All coefficient values are significant at the P<0.01 level.

Note: Values represent the coefficient on real hourly wages from a series of linear regressions first with binary dependent variables for program participation and second for the level of benefit dollars received. Universe is wage earners who worked in the previous year with imputed wage values between $6.50 and $11.05—the group likely to be affected by an increase in the minimum wage to $10.10. All models include controls for age, age squared, age cubed, sex, race, worked part-time at any point in the previous year, marital status, family size, number of workers in the family, presence of a disabled person in the household, number of children under 18, citizenship, metropolitan status, state, major industry, and major occupation category. These values do not reflect any adjustment for the known CPS-ASEC undercounting of benefit receipt.

Source: EPI analysis of Current Population Survey Annual Social and Economic Supplement, pooled 2010–2012 data years

The results also show that a $1 hourly wage increase is expected to reduce average annual benefit dollars received from all programs by $126 per affected worker. Spending on EITC and SNAP benefits is predicted to decline by an average of $56 and $41, respectively, for all affected workers.12

Using these predicted effects, we can estimate the total reduction in participation and government spending on these programs that would result from a minimum-wage increase to $10.10. Table 3 displays these results. As previously noted, if the federal minimum wage were raised to $10.10 by 2017, over 27 million workers would get a raise—roughly one-fifth of all U.S. wage earners13—and affected workers would receive $31.8 billion in additional wages over the full phase-in period of the increase. The average affected worker would receive a raise of $1.61 per hour. Applying the predicted effects in Table 2 to this $1.61 average raise, we would expect that increasing the minimum wage to $10.10 would reduce the share of affected workers receiving public assistance by 6.3 percentage points, or more than 1.7 million workers. Similarly, the predicted effects in Table 2 imply that such a wage increase would reduce total benefit dollars from all government assistance by an average of $203 annually among all affected workers. This means that after adjusting for the noted undercount in the CPS data, increasing the federal minimum wage to $10.10 is predicted to save $7.6 billion annually in spending on income-support programs—and possibly more, given the conservative nature of this estimate. Put another way, these results imply that safety net programs would save 24 cents for every additional dollar paid by employers to workers under a minimum-wage increase to $10.10.

Estimated effect of raising the minimum wage to $10.10 by 2017 on wages of affected workers and utilization of public assistance

| Estimated number of workers likely to get a raise | 27,118,000 |

|---|---|

| Share of all U.S. wage earners | 20.5% |

| Total wage increase for all affected workers | $31.8 billion |

| Average increase in hourly wage for affected workers | $1.61 |

| Predicted change in number of workers relying on public assistance | -1.7 million |

| Predicted annual change in total benefit dollars received among affected worker families | -$7.6 billion* |

| Implied government savings from each additional dollar in wages paid to affected workers | $0.24 |

* Reflects adjustment for known undercount of transfer income receipt in the CPS-ASEC data. See endnote 2 for details. Does not include the fungible value of Medicaid benefits.

Note: Workers affected by a minimum-wage increase to $10.10, average raise in hourly pay, and total wage increase to affected workers are updated to reflect recent changes in state minimum-wage levels from Cooper (2013).

Source: EPI analysis of Cooper (2013) and Current Population Survey Annual Social and Economic Supplement microdata, pooled data years 2010–2012

Conclusion

For millions of Americans struggling to make ends meet, policies to boost incomes should always be a top priority. Yet the way we structure that boost—whether it is the result of higher wages, or of increased government assistance—is critical to how we define the social contract in America. Taxpayer-funded public assistance programs are vital components of a safety net that protects millions of families from undue material hardship, and if anything, these programs are in need of expansion. Many of the individuals and families who rely on public assistance would benefit greatly from increased investment in these programs—such as enacting the Medicaid expansion under the Affordable Care Act in all states, expanding EITC eligibility to childless adults, and increasing benefit amounts for food stamp recipients. Indeed, given the extraordinarily high rates of poverty and child poverty that persist in the wake of the Great Recession, there is every reason to think that current levels of spending on these programs are woefully inadequate to truly combat poverty and lift living standards for program participants.

Yet as American businesses achieve record profit levels, we have to question whether it is appropriate to rely more and more heavily on safety net programs as the sole policy tool to raise working individuals’ incomes, or whether we should expect more from the businesses that employ them.

Raising the minimum wage would lift incomes for millions of working Americans and their families, while providing budgetary savings in means-tested public assistance programs—savings that should be repurposed into either new programs or expansions of existing programs to further leverage the poverty-fighting impact of this spending. Raising the minimum wage is one simple and long-overdue step toward rebalancing the social contract so that the private and public sectors are more equal participants in improving living standards for American workers.

— This research is supported by contributions from The Nick and Leslie Hanauer Foundation.

About the author

David Cooper is an economic analyst with the Economic Policy Institute. He conducts national and state-level research on a variety of issues, including the minimum wage, employment and unemployment, poverty, and wage and income trends. He also provides support to the Economic Analysis and Research Network (EARN) on data-related inquiries and quantitative analyses. David has been interviewed and cited by local and national media for his research on the minimum wage, poverty, and U.S. economic trends. His graduate research focused on international development policy and intergenerational social mobility. He holds a Master of Public Policy degree from Georgetown University.

Endnotes

1. See Cooper (2013).

2. It is well known that the CPS-ASEC survey data used in this analysis significantly understate actual income received from public assistance programs. See Wheaton (n.d.) or Meyer, Mok, and Sullivan (2009) for details. Meyer, Mok, and Sullivan note that benefit receipt may be underreported for a number of reasons—such as interviewer error, a desire to shorten the interview, or the sensitivity of income information. Yet for the programs under study in this brief, they suspect that underreporting is driven by an increasing stigma associated with receipt of public assistance. Researchers will sometimes adjust the CPS-ASEC data to achieve consistency with administrative data that show actual program expenditures that are significantly higher. In this analysis, we do not make any attempt to correct for this undercount in the rate of receipt. Where noted, we do adjust the total benefit dollars in each program based upon the rate of underreporting for each program as measured in Meyer, Mok, and Sullivan (2009). Because we do not have rates of underreporting specifically for the data years used in this analysis, we use the average rate of underreporting across all available years for each available program. However, the authors find that rates of underreporting have grown over time—meaning that our adjustments are likely too conservative. For WIC, Meyer, Mok, and Sullivan provide the rate of underreporting only in the Survey of Income and Program Participation (SIPP), not the CPS-ASEC. Because the SIPP generally has higher reporting rates than the CPS-ASEC—i.e., there is less of an undercount—WIC benefit dollars are adjusted based upon the underreporting rate in the SIPP under the assumption that this is likely a conservative estimate of underreporting in the CPS-ASEC.

3. See the previous endnote.

4. Cooper (forthcoming, 2014)

5. This report does not include any data on participation or costs in the National School Lunch Program, the only other major means-tested public assistance program.

6. The wage deciles reported in this brief reflect imputed wage values from the Current Population Survey Annual Social and Economic Supplement (CPS-ASEC) microdata. They may not align perfectly with wage distributions from other sources. The CPS-ASEC describes respondents’ annual incomes and income sources over the preceding year. Respondents are also asked to report the number of weeks they worked during that year, and the usual number of hours they worked each week for those weeks. With these three pieces of information, we can impute each individual’s implied hourly wage for the time they were working—although these implied hourly wages are not the most robust sources of hourly wage information, as discussed further in Cooper (forthcoming). Nevertheless, the CPS-ASEC data are one of the only public datasets with information on income from means-tested public assistance programs, and while not ideal, we believe the implied hourly wages in the ASEC data are adequate for this type of analysis.

7. Certain programs may have additional requirements, such as the presence of young children in the family, income below some percentage of the median rental cost in the person’s region, or total family assets below a certain threshold.

8. Due to changes in Medicaid resulting from the Affordable Care Act, the fungible value of Medicaid benefits is not included in any calculations throughout this brief.

9. The Current Population Survey Annual Social and Economic Supplement (CPS-ASEC) data set used in this analysis records the family’s total public assistance benefits on each individual person record, thus for families with multiple wage earners, the total family benefits were distributed equally among all wage earners within the family to avoid double-counting. However, this may lead to cases where benefit dollars are spread across separate tax units within the same household and family, such as a child living at home but not claimed as a dependent by her parents. In these cases, some benefit dollars may be inaccurately attributed to workers at wage levels that would not be expected to meet the low-income requirements of the program. Also, as noted in endnote 6, the CPS-ASEC survey records wage income only in annual totals. Hourly rates must be imputed based upon workers’ reported weeks worked per year and usual hours of work per week. This does compound measure error such that a worker receiving benefits could overstate annual wage income or understate annual hours of work, thus inaccurately falling into a wage decile above his true place in the hourly wage distribution.

10. See endnote two.

11. These numbers are updated from the original Cooper (2013) analysis to reflect changes in state minimum-wage policies since that analysis was published.

12. These declines reflect the average change in benefit dollars received as hourly wages rise, among all workers in the range likely to be affected by a minimum-wage increase to $10.10, including those workers who may not be receiving any benefits. In other words, the analysis includes workers receiving zero dollars in each program. This is necessary to predict the overall effect on aggregate spending in each program. The average effect on individual benefit dollars only for individuals who receive benefits in a particular program is larger in most cases, because the inclusion of zero values attenuates the predicted effects. This is explained in greater detail in Cooper (forthcoming). These values also do not reflect any adjustment for the known CPS-ASEC undercounting of benefit receipt explained in endnote 2.

13. Update of Cooper (2013).

References

Bivens, Josh, Elise Gould, Lawrence Mishel, and Heidi Shierholz. 2014. Raising America’s Pay: Why It’s Our Central Economic Policy Challenge. Economic Policy Institute, Briefing Paper No. 378. http://www.epi.org/publication/raising-americas-pay/

Bureau of Labor Statistics (U.S. Department of Labor) Current Employment Statistics program. Various years. Employment, Hours and Earnings—National [database]. http://www.bls.gov/ces/#data

Bureau of Labor Statistics (U.S. Department of Labor) Labor Productivity and Costs program. Various years. Major Sector Productivity and Costs and Industry Productivity and Costs [databases]. http://www.bls.gov/lpc/#data. (Unpublished data provided by program staff at EPI’s request.)

Cooper, David. 2013. Raising the Federal Minimum Wage to $10.10 Would Lift Wages for Millions and Provide a Modest Economic Boost. Economic Policy Institute Briefing Paper #371. http://www.epi.org/publication/raising-federal-minimum-wage-to-1010/

Cooper, David. Forthcoming. How Raising Wages and Strengthening Labor Standards Can Improve the Safety Net (working title).

Current Population Survey Annual Social and Economic Supplement microdata. Various years. Survey conducted by the Bureau of the Census for the Bureau of Labor Statistics [machine-readable microdata file]. Washington, D.C.: U.S. Census Bureau. http://www.bls.census.gov/cps_ftp.html#cpsmarch

Current Population Survey Outgoing Rotation Group microdata. 2013. Survey conducted by the Bureau of the Census for the Bureau of Labor Statistics [machine-readable microdata file]. Washington, D.C.: U.S. Census Bureau. http://www.bls.census.gov/cps_ftp.html#cpsbasic

Dube, Arindrajit. 2013. Minimum Wages and the Distribution of Family Income. University of Massachusetts-Amherst, unpublished working paper. https://dl.dropboxusercontent.com/u/15038936/Dube_MinimumWagesFamilyIncomes.pdf

Eidelson, Josh. 2013. “Video: McDonald’s Tells Workers to Get Food Stamps.” Salon, October 23. http://www.salon.com/2013/10/23/video_mcdonalds_tells_workers_to_get_food_stamps/

Giannarelli, Linda, Joyce Morton, and Laura Wheaton. 2007. Estimating the Anti-Poverty Effects of Changes in Taxes and Benefits with the TRIM3 Microsimulation Model. Urban Institute Technical Report. http://www.urban.org/UploadedPDF/411450_Estimating_Effects.pdf

Meyer, Bruce, Wallace K.C. Mok, and James X. Sullivan. 2009. The Under-Reporting of Transfers in Household Surveys: Its Nature and Consequences. NBER Working Paper No. 15181. http://www.nber.org/papers/w15181

U.S. Department of Labor, Wages and Hours Division. 2013. “History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, 1938-2009” [chart]. http://www.dol.gov/whd/minwage/chart.htm

West, Rachel, and Michael Reich. 2014. The Effects of Minimum Wages on SNAP Enrollments and Expenditures. Center for American Progress. http://www.americanprogress.org/issues/economy/report/2014/03/05/85158/the-effects-of-minimum-wages-on-snap-enrollments-and-expenditures/

Wheaton, Laura. n.d. “Under-Reporting of Means-Tested Transfer Programs in the CPS and SIPP.” The Urban Institute.

Zabin, Carol, Arindrajit Dube, and Ken Jacobs. 2004. The Hidden Public Costs of Low-Wage Jobs in California. Center for Labor Research and Education, U.C. Berkeley. http://laborcenter.berkeley.edu/pdf/2004/workingpoor.pdf