This morning the Bureau of Labor Statistics released a July report from the Job Openings and Labor Turnover Survey (JOLTS), showing that job openings increased by 59,000 to 3.2 million in July and that, according to revisions to earlier data, there were 60,000 more job openings in June than previously reported. The job openings numbers are easier to understand and interpret in relation to two benchmarks: (1) the number of unemployed workers, and (2) the number of job openings in the recovery following the recession of 2001.

The number of job openings compared with the number of unemployed workers

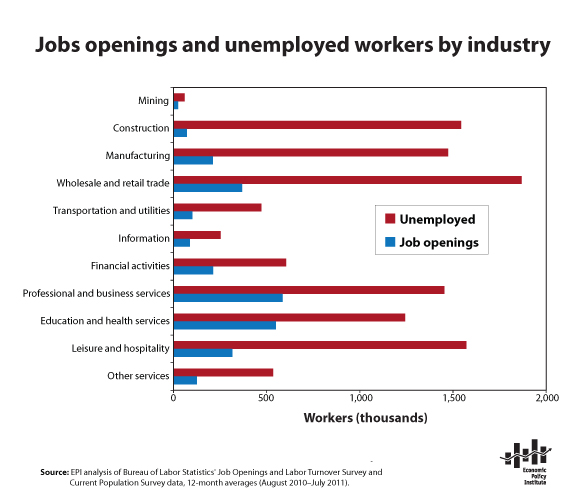

In July there were 3.2 million job openings and 13.9 million unemployed workers (unemployment data are from the Current Population Survey), resulting in a 4.3-to-1 ratio of unemployed workers to job openings. This is an improvement from the revised June ratio of 4.4-to-1. However, July marks two years and seven months—134 weeks—that the “job seeker’s ratio” has been substantially above 4-to-1, a level that means there are no jobs to be found for three out of four unemployed workers. By comparison, in December 2000 the job-seeker’s ratio was 1.1-to-1, and the highest it got in the downturn of the early 2000s was 2.8-to-1. The figure shows that unemployed workers vastly outnumber job seekers in every major industry, reflecting an across-the-board shortfall of demand for workers rather than a structural mismatch between unemployed workers and job openings.

The number of job openings now compared with the last recovery

The JOLTS survey began in December 2000, so the only other recession it captures is the one that occurred in the early 2000s. After the recession of the early 2000s, job growth was very slow. The economy shed jobs—1.1 million of them—for 21 months after the recession officially ended. Yet the current recovery has generated far fewer job openings than even the extremely weak recovery of the early 2000s. In the first 25 months of that recovery (December 2001 through December 2003), the cumulative number of job openings in the economy was 85.4 million. In the first 25 months of the current recovery (July 2009 through July 2011), the cumulative number of job openings in the economy was 68.4 million, 20 percent lower. In other words, our labor market has a significant shortfall of new job openings even when measured against the exceptionally weak recovery of the early 2000s.

As this report underscores, the key issue holding back job growth is a lack of demand. For policies that we can and should be pursuing to stimulate demand and generate jobs, see Putting America Back to Work.

With research assistance from Natalie Sabadish and Hilary Wething