Briefing Paper #196

The continuing integration of the rich United States with a far poorer global economy has provoked much anxiety among American workers. Because it is well-known that basic economic theory predicts that global integration leads to gains for all nations, this anxiety is often treated as a political puzzle. A once again fashionable explanation for this puzzle is that globalization’s benefits are huge but diffuse (primarily, lower prices for imported goods), while its costs are small but concentrated (workers displaced by imports); hence, the gains are hard to see, but the losses are all too visible.1

This Briefing Paper reexamines what conventional economics actually predicts about the effects of integrating the rich United States and poor global economies. Contrary to popular rhetoric, there is no puzzle to be explained: conventional economic theory argues that American workers will indeed be harmed by this integration—and their anxiety is well-founded.

The paper also provides rough empirical estimates of integration’s effect on American wages and inequality. Lastly, it uses some prominent forecasts about the future potential reach of service-sector offshoring to make a very rough guess as to the future wage implications of these forecasts.

The key findings indicate:

• In 2006, the impact of trade flows increased the inequality of earnings by roughly 7%, with the resulting loss to a representative household (two earners making the median wage and working the average amount of (household) hours each year) reaching more than $2,000. This amount rivals the entire annual federal income tax bill paid by this household.

• Over the next 10-20 years, if some prominent forecasts of the reach of service-sector offshoring hold true, and, if current patterns of trade roughly characterize this offshoring, then globalization could essentially erase all wage gains made since 1979 by workers without a four-year college degree.

What economic theory actually teaches about globalization and wages

When people argue that economics teaches that liberalizing trade is a “win-win” proposition, what they mean (whether they know it or not) is that trade is “win-win” between countries. The great insight of comparative advantage, the cornerstone of international economics, is that even when one country can produce everything more cheaply than its trading partners, trade still provides benefits to both nations.

An important caveat, however, notes that even as globalization raises national income, it can still reduce the incomes of most workers. Global integration has at least two potential impacts on American wages. First, workers employed in industries directly in competition with low-cost imports from abroad can expect to see immediate job dislocation and/or downward wage pressures. Second, as relative prices change across industries, the return to factors of production, including different kinds of labor inputs, can be expected to change as well. A simple example can capture the essential insights of this second impact (which is almost surely the less intuitive one).

Start with a couple of assumptions about the U.S. economy. Say that the labor force of the U.S. can be divided into workers (those who supply labor) and professionals (those who also supply additional skills, capital, and credentials). Assume further that there are just two sectors in the U.S. economy, call them apparel and aircraft. Workers and professionals can work in either sector. If this sounds unrealistic, remember that this is a story about what matters over a reasonably long period of time. While people obviously do not lose an apparel job on Monday and begin working at Boeing on Tuesday, in the relatively fluid American economy, people do switch across many economic sectors throughout their working lives.

Lastly, assume that producing each $1 of apparel takes a ratio of workers to professionals twice as high as producing each $1 of aircraft—that is, apparel is the more labor-intensive business.

Now, say that falling trade costs (a tariff cut for example) reduces the price of apparel imports. Since domestic producers must compete with imports, this means that the price of domestically produced apparel falls as well. Fewer domestic producers are then willing to make apparel, as falling prices make this a less attractive business. Imports rise to replace this lost domestic production. Lastly, and importantly, aircraft exports rise as domestic investment once ploughed into apparel looks for new opportunities and as U.S. trading partners’ greater specialization in apparel leads them to demand more aircraft from the U.S.

As domestic apparel production contracts, too many workers are displaced to be absorbed in the expanding aircraft sector at the going wage for workers. Remember that the ratio of workers to professionals was higher in the apparel sector, so each $1 of apparel production abandoned releases “too many” workers relative to professionals to be absorbed by a $1 increase in aircraft production. Even after absorbing all of the professionals released from the declining apparel sector, there will still be many former apparel workers not finding work in the aircraft sector at the going wage.

If these unemployed workers want a job, they must agree to a wage cut. Further, it is not just the unemployed labor that takes a wage cut—it is all workers economy-wide. Any incumbent worker in either aircraft or apparel not agreeing to this wage cut would be replaced with those unemployed workers. The process works in reverse for professionals, with the apparel sector not shedding enough of them at the going professional wage in order to meet the demands of the expanding aircraft sector. This imbalance bids up professional wages.

Essentially, by changing the structure of what an economy produces, globalization changes the relative demand for different kinds of labor, skill, and capital. In the example above, globalization pushed the domestic economy into demanding fewer workers and more professionals by tilting the structure of domestic production away from labor-intensive apparel and towards professional-intensive aircraft.

The most well-known outcome of this process is that the gross gains for professionals outweigh the gross losses of workers, hence the national economy sees net gains from trade.2 It is these net gains (which are much smaller than either the gross gains or gross losses) that constitute the argument in favor of global integration. However, it is (obviously) the gross losses that worry many workers about globalization, and this fear is utterly rational in light of economic theory.3

It should be noted that the (slim) majority of U.S. imports come from countries that are not that much poorer than the United States. This sort of trade (call it rich/rich trade) is not necessarily inequality-inducing in the way described above. However, a significant (and the fastest growing) portion of U.S. trade is with nations that are significantly poorer than the United States, and as such, the scenario sketched out above is (and should be) a real and growing concern to U.S. workers.

| Wage Cuts Without Tariff Cuts? While it is easiest to explain in terms of falling trade costs, one can get similar wage results even without a change in trade costs. Using the previous example, if the prices of apparel and aircraft are flexible, an increase in the quantity of the factor (say labor) intensively used in a given sector (say apparel) will lead to a declining price for that sector’s output. This sparks an adjustment in the wages of workers and managers, driving down workers’ wages as before.4 This idea was initially developed for a closed economy, but one can look at it as a prediction of what will happen when labor-abundant nations (such as China and India) are integrated into the world economy, increasing the global labor pool. In this case, theory predicts that the price of labor-intensive commodities will fall as a result of the increase in the global labor pool, and these falling prices will harm labor in professional-abundant nations like the United States. To test the reasonableness of this, think of the price of DVD players, apparel, and the price of call center operations and whether or not the expansion of the global labor pool has reduced their prices. Given these price reductions, resources in the United States will move out of producing these commodities and into the production of professional-intensive goods. This move sets off the chain of causation described above, leading to a fall in labor’s wage and a rise in professional wages. Hence, wage adjustments occur even without changing trade costs —labor earnings in the United States fall resulting from the integration of labor-abundant economies into the global trading regime. This is surely one of the more intuitive aspects of the economics of globalization. |

Globalization’s real costs: not just unemployment or adjustment

Some readers may think these results are obvious. Nobody, for example, denies that, say, U.S. steel workers displaced by import competition face hardship from trade. These costs, however, are often thought to be small and manageable with temporary government assistance.

This is, however, a radical understating of globalization’s costs. Note that the above example did not take into account the adjustment cost of workers’ unemployment spell between jobs. These adjustment costs are, of course, real and should be of concern to policy makers, but they are not the first-order costs of globalization to American workers.5

Rather, the losses identified above are permanent wage-loss suffered by labor in this simple economy. Empirical studies in the trade and wages debate have generally used production and non-supervisory labor as a proxy for labor in the United States, and non-production and supervisory labor as a proxy for professionals. Occasionally, workers with a 4-year college degree stand in for professionals, with the rest of the workforce standing in for labor.

Production workers constitute roughly 75% of the entire U.S. workforce, and workers without a four-year college degree constitute roughly 70% of this workforce. Hence, while gross gains may exceed gross losses in the U.S. as global integration proceeds, it is not necessarily the case that winners outnumber losers. Global integration, in short, has the potential to inflict permanent harm to most American workers, and, as later sections of this paper demonstrate, the scale of this harm is much larger than commonly realized.

This basic axiom of economic theory is all too often ignored, or, even actively hidden. For example, Bradford, Greico, and Hufbauer (2005), in what they bill as a comprehensive accounting of the gains and losses attributable to trade liberalization, count only the costs of direct displacement by imports as a debit in the balance sheet of globalization, and do not even acknowledge the possibility of permanent wage losses through a broader labor market. Failing to count the largest cost of globalization is, of course, an excellent way to make the cost/benefit analysis of integration come out well to those favoring the status quo.

The impact of globalization on today’s wages…

During the trade and wages debate of the early 1990s (see text box below for more on this), Krugman (1995) used a simple computable general equilibrium (or, CGE) model to examine the issue of international trade and wage inequality. CGE models are a series of equations that capture the economic relationships between and within nations. They can be incredibly complex, consisting of hundreds of equations and needing substantial computing power to solve, or they can be quite simple, representing what Krugman (1995) calls “glorified back of the envelope estimates.”

This section uses the Krugman (1995) model to get exactly such a “back of the envelope” estimate of how much offshoring has impacted American wages and inequality to date, and how it could possibly impact it in the future. The mechanics and assumptions behind the model are described more fully in Bivens (2007).

The essential features, however, can be described as follows and follow directly from the example above. The United States is assumed to be abundant in professionals offering specialized skills, capital, and credentials relative to the rest of the world, but relatively deficient in labor. The U.S. consequently exports goods that are professional-intensive and imports goods that are labor-intensive. As labor-intensive industries are shed and replaced with professional-intensive industries in the U.S. economy, the relative demand for labor falls, while the relative demand for professionals rises, leading to greater inequality.

The relevant parameter for assessing the U.S. labor market impacts of globalization is the volume of trade conducted with lower-wage trading partners (know in the jargon as less-developed countries, or LDCs for short). This paper uses the average of imports and exports from non-OECD countries (as OECD countries are generally rich, and trade with them will not necessarily follow the predicted patterns regarding the labor-intensity of imports and exports that drives the inequality-inducing effects of trade), non-OPEC countries (as oil is not generally thought to compete with U.S. production), and Turkey and Mexico (the two poorest OECD nations) for this parameter.

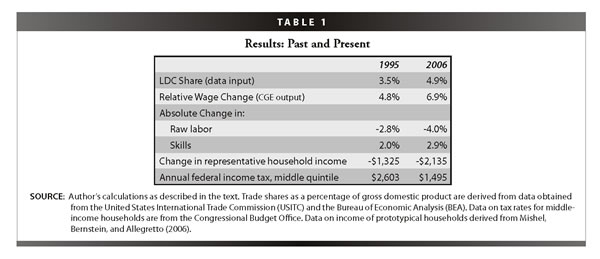

Table 1 presents the results. The first row shows this LDC import-share expressed as a percentage of GDP for 1995 and 2006. The second row shows the resulting outcome on relative wages from the Krugman (1995) CGE model.6

The third and fourth rows translate these changes in relative wages into the absolute change in earnings implied by these results in each year. Again, the mechanics behind this translation are described in some detail in Bivens (2007). The fifth row looks at the results from the perspective of a representative household consisting of a married couple each earning the median wage and working the average hours for married-couple households. Taking the average hours worked for this representative family type, globalization would have cost them over $1,000 annually by 1995.By 2006, the costs from globalization for this representative household have risen to more than $2,000.

The last row of the table suggests an alternative benchmark for deciding whether or not these losses from globalization are “large” or “small”: the average federal income tax payment for families in the middle quintile of the income distribution.

| The 1990s Trade and Wages Debate A common argument in the globalization debate grants the point that trade theory argues that American workers have something to fear from global integration but minimizes the empiric al relevance of globalization’s costs. By now, all serious people concede that the United States has seen a sharp increase in inequality over the past 25 years; the de minimus argument scales the impact of trade against this wider march toward a less-equal economy. In the early 1990s a flurry of studies addressed this issue. The resulting estimates are spread widely, but most indicated that trade could account for roughly 10-40% of the total rise in inequality that occurred in the 1980s and early 1990s. The observation that “most” of the rise in inequality was generated by factors other than trade was often emphasized to allay anxieties about globalization. This is true but uncomforting; a significant minority of a very large number is a large number. (To put it another way, if I threw myself into a chasm that was “only” a fifth as deep as the Grand Canyon, I’d still be dead.) Further, findings from this first round of the trade and wages debate are now a decade old, yet are still often invoked in contemporary debates. Academic interest in the topic essentially waned after 1995 as wages for all workers began rising; a tight labor market trumped all other influences. However, this does not mean that trade stopped dragging on some workers’ wages. There are lots of determinants of wage growth, and just because the net outcome of them all is positive does not mean that all are benign. In fact, as soon as the momentum from the red-hot labor market of the late 1990s dissipated, wage growth decelerated and then turned negative. This begs another question that can be answered with a model from the earlier round of the trade and wages debate: how much has trade dragged on wages in the very recent past? |

By 2006, the costs of globalization rival those from taxation for this group. One imagines that none of these households consider federal income taxes a trivial cost (although they are much smaller for this group than commonly realized, as payroll and other taxes constitute the major taxes paid by families in the middle of the income distribution). Politicians make a lot of hay about income taxes, but these taxes purchase something useful for middle-income households: “civilization,” as Oliver Wendell Holmes memorably said. The globalization tax largely buys higher incomes for the already better-off.

It should be noted that the original Krugman (1995) results were often presented as an argument for the relatively benign impact of trade flows on American wages, as they were on the low-end of results in the first round of the trade and wages debate. A disaggregated (and much more computationally complex) version of this model was used by Cline (1997), who found that trade’s wage impacts were almost four times as great as the Krugman (1995) results.7

…and the potential impact on tomorrow’s wages?

An interesting, though still speculative issue concerns the issue of service-sector offshoring and the future of globalization’s impact on American wages. The ability of U.S. companies to import work that was traditionally considered untradeable (call center operations, software programming, and various business process services) has led to anxieties over job security spreading to a much wider swath of the American workforce. The rise of service-sector offshoring essentially gives globalization a much larger lever with which to impact U.S. labor markets. Put simply, if offshoring doubles the number of workers who are employed in industries that are now tradeable, then it will (at least roughly) double the impact globalization has on American labor markets.

In the next section of this paper, the same model used to examine globalization’s past and present impact on inequality is fed forecasts of offshoring’s future reach to assess its potential impacts on American inequality and wages. (See Offshoring: Raising the Ceiling on p. 8 for more on why economists think offshoring is big news.)

Forecasts of offshoring’s reach

Obviously, nobody knows for sure what will happen in the future. However, a number of economic researchers and observers have made forecasts as to the number of jobs that could be potentially “up for grabs” in the future, as technology, policy, and the introduction of billions of workers from China, India, and the former Eastern Bloc countries into the capitalist global economy make more jobs internationally contestable, particularly through service-sector offshoring.

The estimate with perhaps the best pedigree comes from Alan Blinder, Princeton professor and member of the Council of Economic Advisors under President Clinton. Blinder wrote in a now-famous Foreign Affairs article that offshoring’s impact could mean that “two to three times” as many jobs could be internationally contestable as are presently in the manufacturing sector (which supplies the vast majority of contestable jobs today). In a follow-up piece with substantially more data-crunching behind it, Blinder scaled back his original estimate, rating 22-29% of the U.S. workforce as potentially offshorable over roughly the next one or two decades.

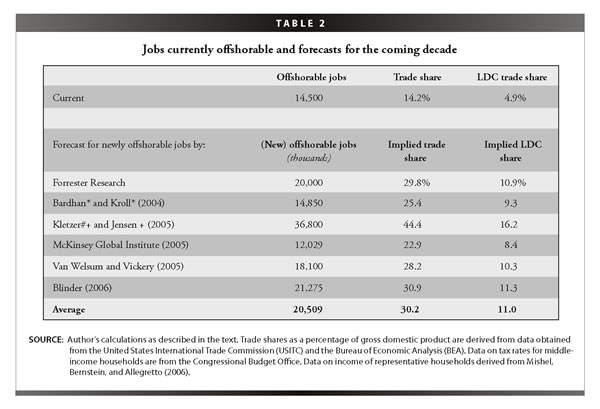

Table 2 compares many of these forecasts of offshoring’s potential reach (including Blinder’s) and also provides a rough baseline of the number of jobs potentially tradeable today.

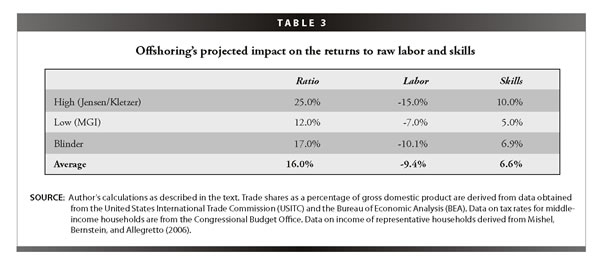

Table 3 presents results from plugging these forecasts into the same model used previously to glean the impact on the relative earnings of labor and skills. Plugging in the highest estimate of offshoring’s future reach (from Jensen and Kletzer (2005)) leads to trade flows increasing the returns to professionals vis-à-vis labor by 25% over the coming decades. The low-end estimate, from McKinsey Global Institute (2004), yields an impact of just under 12%. Results from using the Blinder forecast essentially splits the difference, with trade flows leading to a 17% increase in relative earnings.

An increase in relative earnings of 17% is, it should be noted, an amount equal to (roughly) half of the total increase in the inequality of wage incomes between college graduates and all other workers that occurred between 1979 and 2006. Offshoring, in short, has the potential to wedge apart incomes to a huge degree in a short time.

Table 3 also translates these relative income results into absolute values for changes in earnings of labor and skills. It is, again, a fundamental finding of trade theory that a country’s “scarce” factor of production (labor in the United States) loses in absolute, not just relative terms, as trade expands.

The average of the forecasts indicates that the future reach of offshoring will lead to an absolute decline of 9.4% in the returns to labor and a 6.6% increase in the return to skills. To put this into some historical perspective, earnings for workers without a college degree rose by just 2.2% between 1979 and 2005. It took the full-employment boom of the late 1990s to finally push these earnings (in 2001) above the 1979 level. The implied loss due to offshoring would push these wages well below the 1979 levels, completely undoing (and then some) the entire increase in these wages over the past three decades.

| Offshoring: Raising the Ceiling While past and present rounds of the trade and wages debate reached no firm consensus on the precise contribution of trade to rising inequality, there was widespread agreement that trade’s impact had a natural ceiling: the (relatively) low share of U.S. workers employed in tradeable industries.8 “In 1993, roughly 15 percent of American workers were employed in manufacturing. The vast majority of unskilled workers were employed producing nontraded goods, such as retail trade and various services. In such a world, it is hard to see how pressures on wages emanating from traded goods can determine wages economy-wide.” (Freeman 1995) “In particular, imports of manufactured goods from developing countries are still only about 2 percent of the combined GDP of the OECD. The conventional wisdom is that trade flows of this limited magnitude cannot explain the very large changes in relative factor prices that have occurred…” (Krugman 1995) “…when the large portion of the economy that is nontradeable and the limits of international specialization imposed by home orientation in consumption and production are taken into account, there is much more limited scope for trade to affect relative factor prices.” (Cline 1997) As these words were written roughly a decade ago, substantially fewer than 15% of American workers could be plausibly identified as being in direct competition with workers around the globe. This was still enough to have allowed trade to put downward pressure on some workers’ wages, but it did mean that there was a natural ceiling on this impact. |

Conclusion

These calculations allow us to go one step further and provide a measure of the magnitude of compensation that would be needed to alleviate the harm done by globalization. In debates over trade and globalization, the trade adjustment assistance (TAA) program is often mentioned as a way to compensate globalization’s victims in the United States. In 2006 TAA allocated $655 million in income supports for workers harmed by globalization, and, another $200 million for training. A key weakness of this program is that it only aids workers for a limited period of time; mainstream trade theory, conversely, teaches that the harm done by trade to incomes is permanent, as the pattern of production that holds for following global integrations leans against the labor earnings of domestic workers now in competition with similar workers around the world.

The results in Table 3 call for a hugely more ambitious response to offshoring than has been provided so far. Taking the numbers on offshoring’s potential reach seriously means that current TAA income supports would replace less than 0.2% of the potential income loss to American production workers by the end of the next couple of decades.

The potential level of redistribution caused by offshoring is vast, and so should be the policy response. The best way to fashion redistribution of the scale implied by this paper’s findings is through large-scale social insurance programs and public investments that insure a baseline level of economic security for American families: universal health care, stable pension income, disability and life insurance, and a lifetime of access to high-quality public education. Offshoring and trade are, of course, not the only rationale for such social insurance programs, but they do starkly illustrate the fundamental fact underlying the need for them: your economic lot in life is not wholly your own making, and in the new economy, it is less under your own control than ever before.

The failure of the economics profession to educate the larger public (including the policy-making and pundit-class elites) about this too-little known aspect of trade theory explains much of the chasm between elite and popular attitudes toward globalization. A serious understanding of what globalization means for the U.S. economy and its workers—and what must be done to hold the broad American working- and middle-classes whole in the face of global integration—requires this failure be corrected.

Appendix 1: Quotes on costs/benefits of globalization

“In the United States, at least, the problem is that most beneficiaries from globalization don’t really know that they are beneficiaries, or how much they benefit. Feckless congressmen and congresswomen don’t understand that the American economy is cushioned from their fiscal policy stupidities by the ability of the U.S. government to sell bonds internationally on a jaw-droppingly unbelievable scale. Home sellers in California don’t realize that they got such a good price because of financing from across the Pacific. Walmart shoppers see the “made in China” stickers, but don’t understand what a good deal they are getting because the rulers of the PRC are desperate to sell the products that their workers make at always low prices in order to stay as close as possible to full employment. The task is primarily one of making perceptions agree with reality, and only secondarily one of changing reality. ”

— J. Bradford DeLong

“While the gains from increased trade generate a permanent rise in income, the associated losses are temporary. Nevertheless, they are very real, and are concentrated on a small fraction of Americans.”

— Bradford, Grieco, and Hufbauer

Endnotes

1. See Appendix 1 for a couple of representatives of this view.

2. It is taken for granted in this paper that the arguments for expanded trade increasing national incomes are well-known and generally agreed-upon. There are, of course, exceptions to this scenario. The larger point of this paper is that even when integration of trade does indeed lead to national gains, the redistribution caused by trade can still lead to harm for the majority.

3. For those interested, it should be noted that this is a very crude formulation of the Stolper-Samuelson Theorem.

4. This is the implication of the Rybczynski Theorem (RT), an important complement to the Stolper-Samuelson Theorem.

5. Note that these adjustment costs may actually be greater for rich/rich trade, as the cost differentials between rich nations are thin, and, production may shift back and forth between rich and poor countries more readily because of this.

6. The 1995 results are slightly larger than that found by Krugman (1995), but show that the current model results are in line with past findings on trade and wages. This is a result of the LDC income share in this paper being higher— Krugman (1995) measured the LDC import share of the entire OECD, not just the United States.

7. The Cline (1997) results were often reported as finding wage impacts only twice as large as the Krugman (1995) results. This was because the benchmark the wage impacts were compared to was different than the one Krugman (1995) used. Based on the more commonly-used benchmark cited in Krugman (1995), Cline’s results indicated that trade could explain almost 40% of the rise in relative earnings throughout the 1980s and early 1990s. See Bivens (2007) for more detail on this point.

8. Note that these quotations are not meant as illustrations of myopia on the part of the authors: these were (and are) some of the smartest authors writing on trade’s labor market impacts. What they illustrate is the sea change in perceptions about trade’s potential impact on the U.S. economy in the era of offshoring.

References

Bardhan, Ashok Deo, and Cynthia A. Kroll (2003). The New Wave of Outsourcing, Research Report, Fisher Center for Real Estate and Urban Economics, University of California at Berkeley, Fall.

Bivens, L. Josh. 2007. Globalization, American Wages, and Inequality. Economic Policy Insti

tute Working Paper. Washington, D.C.: EPI.

Blinder, Alan. 2006. Offshoring: The next Industrial Revolution. Foreign Affairs magazine.

Blinder, Alan. 2007. How Many U.S.Jobs Might Be Offshorable? Unpublished Working Paper.

Bradford, S., and P. Grieco and C. Hufbauer. 2005. “The Payoff to America from Global Integration.” In Bergsten and the Institute for International Economics (IIE), eds., The United States and the Global Economy: Foreign Economic Policy for the Next Decade. Washington, D.C.: IIE Press.

Cline, William. 1997. Trade and Income Distribution. Washington, D.C.: Institute for International Economics.

DeLong, Brad. 2006. Comment to Martin Wolf forum on Financial Times blog, available at: http://www.rgemonitor.com/blog/setser/144955/

Freeman, Richard B. 1995. Are your wages set in Beijing? Journal of Economic Perspectives, Vol. 9, No 3. Summer, pp. 15-32.

Forrester Research. 2004. 3.3 Million U.S. Services Jobs To Go Offshore. Research Brief.

Jensen, J. Bradford, and Lori Kletzer. 2005. Tradable Services: Understanding the Scope and Impact of Services Offshoring,” in Lael Brainard and Susan M. Collins, eds. Brookings Trade Forum 2005, Offshoring White-Collar Work—The Issues and the Implications Forthcoming.

Kirkegaard, Jacob. 2004. Outsourcing—Stains on the White Collar? Institute for International Economics, available at: http://www.iie.com/publications/papers/kirkegaard0204.pdf

Krugman, Paul. 1995. Growing World Trade: Causes and Consequences. Brookings Papers on Economic Activity, Volume I. Washington, D.C.: Brookings Institute.

McKinsey Global Institute. 2003. Offshoring: Is it a win-win game?

Mishel, Lawrence, Jared Bernstein, and Sylvia Allegretto. 2006. The State of Working America 2006/2007. An Economic Policy Institute Book. Ithaca, N.Y.: ILR Press an imprint of Cornell University Press.

Rodrik, Dani. 1992. The Rush to Free Trade in the Developing World: Why So Late? Why Now? Will It Last? National Bureau of Economic Research (NBER) Working Paper #3947. Cambridge, Mass.: NBER.

Rogoff, Kenneth. 1995. “Paul Samuelson’s Contributions to International Economics.” Prepared for volume in honor of Paul Samuelson’s 90th birthday, ed. Michael Szenberg. Avaiable at: http://www.economics.harvard.edu/faculty/rogoff/papers/Samuelson.pdf

Samuelson, Paul. 2004. Where Ricardo and Mill rebut and confirm mainstream economists supporting globalization. Journal of Economic Perspectives. Volume 18(3).

Van Welsum, D. and G. Vickery. 2005. New Perspectives on ICT Skills and Employment. Organization of Economic Cooperation and Development (OECD) Information Economy Working Paper.