Working Americans have long complained about a middle-class squeeze, but families focused on their day-to-day financial struggles may not always see how much ground has actually been lost.

EPI data tracking income and wage patterns show that the majority of income growth has for decades gone to a startlingly small number of top earners, while other workers have suffered a persistent stagnation or even decline in real earnings. While many middle-income families have lost jobs, homes, and retirement savings during the latest recession, their economic woes date back much further.

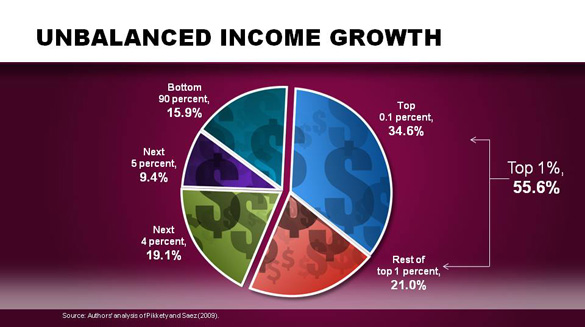

This pattern is best illustrated in the following chart, which shows that 34.6% of all income growth over the past three decades has gone to the top one-tenth of 1% of all earners. By contrast, the bottom 90% of all earners has collectively seen only 15.9% of all income growth over the same period:

The numbers are striking, but they are frequently overlooked. When EPI President Lawrence Mishel recently shared these data during a Senate hearing on the jobs crisis, Senator Tom Harkin (D-Iowa) said he was startled. “Talk about redistribution of wealth,” Harkin said. “That is a massive redistribution of wealth.”

Those data and many others that track vastly unequal patterns of wage growth are contained in The State of Working America 2008/2009, a comprehensive look at wage trends and overall quality of life for lower-and middle-income workers, which is updated every other year. When Mishel recently met with Vice President Joe Biden, who chairs the White House Middle-Class Task Force, he equated the challenge of making a living in today’s middle class to “rowing a boat in very choppy waters.”

“Even if you are a strong rower, it is difficult if not impossible to make headway,” Mishel said.

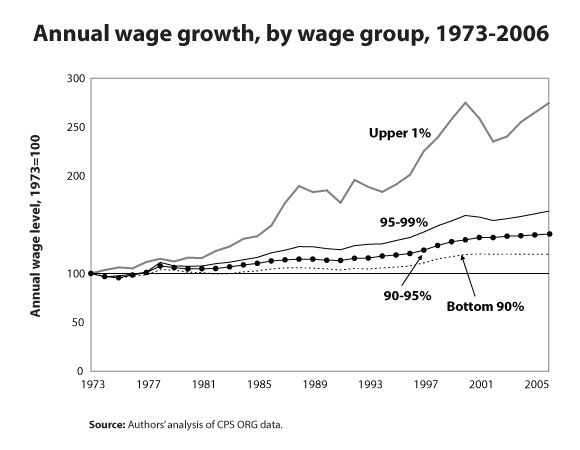

The State of Working America shows that the highest-paid workers do not just earn more, but enjoy far greater income growth than the bottom 95%:

And it shows that this general wage stagnation has occurred even as the country has enjoyed large gains in productivity:

“The benefits of this growth have not accrued to the typical worker,” said Mishel, co-author of The State of Working America, during his recent Senate testimony.

Mishel also shared how this huge inequality in income growth had contributed to the latest recession. “People were consuming based on a sense of inflated assets,” going into debt to consume, or borrowing against the inflated value of a house. “That was an unstable growth and it fell apart.”