The new year brings higher wages for 4.3 million workers across the country

At the start of the new year, 19 states increased their minimum wages, lifting the pay of over 4.3 million workers.[i] This is the largest number of states ever in a given year to increase their minimum wages absent an increase in the federal minimum wage. In seven of these states (Alaska, Florida, Missouri, Montana, New Jersey, Ohio, and South Dakota) the increases were due to inflation indexing, where the state minimum wage is automatically adjusted each year to match the growth in prices, thereby preventing any erosion in the real value of the minimum wage. The increases in the remaining 12 states were due to legislation or ballot measures approved by voters.

The table below shows the values of the minimum wage increases and the number of workers directly affected in each state. Due to relatively low inflation in 2016, small inflation-linked increases of only 5 cents will occur in four states (Alaska, Florida, Missouri, and Ohio). The largest increases were the result of ballot measures passed in Arizona (a $1.95 increase) and Washington (a $1.53 increase). In these and other states instituting legislative increases, a significant portion of the wage-earning workforce will directly benefit from the increase in the minimum wage: Arizona (11.8 percent), California (10.7 percent), Washington (10.7 percent), Massachusetts (9.2 percent), and Connecticut (7.6 percent). It should be noted that these estimates likely understate the total numbers of affected workers, because they do not include workers who are paid just above the new minimum wage. Many of these workers will also receive a wage through “spillover effects,” as employers adjust their overall pay ladders.

As the table shows, these increases will provide more than $4.2 billion in additional wages to nearly 4.3 million affected workers over the course of the year. This increase in wages will make a real, although modest, difference in the lives of workers and their families.

States with minimum wage increases effective January 1, 2017

| States with minimum wage increase | Amount of wage increase | New wage on Jan. 1, 2017 | Reason for change | Directly affected workers* | Share of state’s wage-earning workforce | Total increase in annual wages |

|---|---|---|---|---|---|---|

| Alaska | $0.05 | $9.80 | Inflation adjustment | 6,000 | 2.1% | $1,962,000 |

| Arizona | $1.95 | $10.00 | Legislation | 328,000 | 11.8% | $648,000,000 |

| Arkansas | $0.50 | $8.50 | Legislation | 54,000 | 4.5% | $38,800,000 |

| California | $0.50 | $10.50 | Legislation | 1,726,000 | 10.7% | $1,481,965,000 |

| Colorado | $0.99 | $9.30 | Legislation | 141,000 | 5.7% | $160,221,000 |

| Connecticut | $0.50 | $10.10 | Legislation | 119,000 | 7.6% | $60,558,000 |

| Florida | $0.05 | $8.10 | Inflation adjustment | 187,000 | 2.2% | $38,739,000 |

| Hawaii | $0.75 | $9.25 | Legislation | 28,000 | 4.7% | $22,422,000 |

| Maine | $1.50 | $9.00 | Legislation | 38,000 | 6.9% | $56,698,000 |

| Massachusetts | $1.00 | $11.00 | Legislation | 291,000 | 9.2% | $366,992,000 |

| Michigan | $0.40 | $8.90 | Legislation | 188,000 | 4.5% | $113,483,000 |

| Missouri | $0.05 | $7.70 | Inflation adjustment | 39,000 | 1.4% | $8,941,000 |

| Montana | $0.10 | $8.15 | Inflation adjustment | 11,000 | 2.7% | $2,679,000 |

| New Jersey | $0.06 | $8.44 | Inflation adjustment | 98,000 | 2.4% | $39,721,000 |

| New York** | $0.70 | $9.70 | Legislation | 515,000 | 6.2% | $473,364,000 |

| Ohio | $0.05 | $8.15 | Inflation adjustment | 158,000 | 3.2% | $25,268,000 |

| South Dakota | $0.10 | $8.65 | Inflation adjustment | 8,000 | 2.1% | $2,528,000 |

| Vermont | $0.40 | $10.00 | Legislation | 10,000 | 3.3% | $6,736,000 |

| Washington | $1.53 | $11.00 | Legislation | 332,000 | 10.7% | $631,819,000 |

| Total | 4,277,000 | $4,180,896,000 |

* Directly affected workers will see their wages rise because the new minimum wage rate exceeds their current hourly pay. This does not include additional workers who may receive a wage increase through "spillover" effects, as employers adjust overall pay scales.

** New York's minimum wage increase took effect on December 31, 2016.

Note: Totals may not sum due to rounding. "Legislation" indicates that the new rate was established by the legislature or through a ballot measure. "Inflation adjustment" indicates that the new rate was established by a formula, reflecting the change in prices over the preceding year.

Source: EPI analysis of Current Population Survey 2015Q4-2016Q3

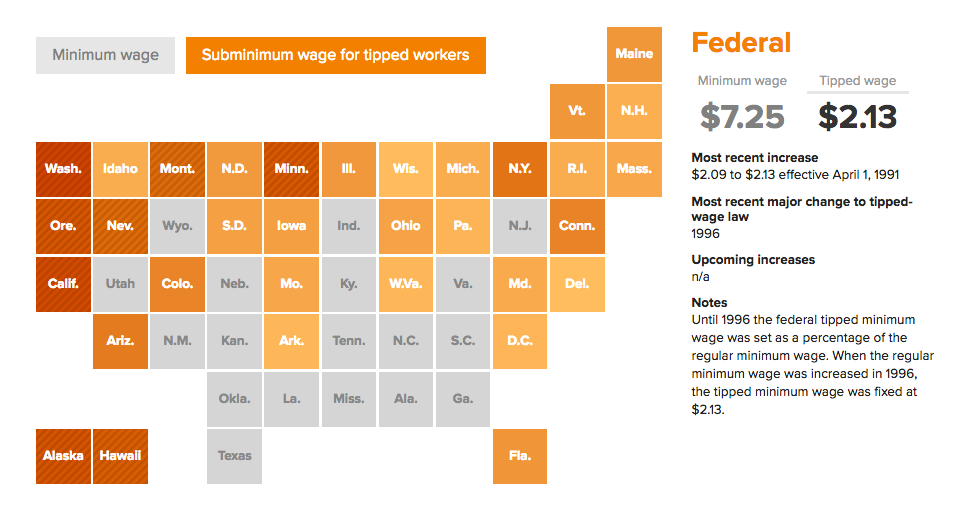

There are now 29 states and the District of Columbia that have a minimum wage higher than the federal minimum wage. Below the state level, 35 localities have adopted minimum wages above their state minimum wage.

Some policymakers have argued that minimum wage policy should be left to the states. Unfortunately, in the absence of a federal increase, many states are unlikely to take action. Wyoming and Georgia have not raised their state minimum wages since 2001. Alabama, Louisiana, Mississippi, South Carolina, and Tennessee have no state minimum wage whatsoever, meaning that if the federal minimum wage did not exist, workers in these states could literally be paid next to nothing. At the same time, state lawmakers in several of these states have actively blocked cities and other local governments from establishing minimum wages above the state minimum wage, leaving low-wage workers in high-cost cities struggling to make ends meet.

Increasing the federal minimum wage would undo the erosion in value of the minimum wage and help reverse the growth in wage inequality between low- and middle-wage workers. Indexing to inflation, as many states have done, would ensure that the purchasing power of a minimum wage income would remain constant going forward. Given the growth in our economy over the last several decades, we can afford a higher federal minimum wage, and Congress should follow the example of states that have led the way in improving the economic security low-wage workers and their families.

[i] New York’s minimum wage increase took effect on December 31st, while the others took place on January 1st.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.