Robert Lawrence misleads the New York Times on manufacturing

Last week, Eduardo Porter wrote in the New York Times’ Economix blog about a response he received on his recent piece on manufacturing from Robert Lawrence of the Kennedy School. Porter should have dug into the topic further because what Lawrence wrote was rather misleading. Here are Porter’s words:

“Prof. Robert Lawrence from Harvard makes an interesting point in response to my Wednesday column about our misplaced hopes in manufacturing as a source of new jobs: even if every single thing we bought was “made in America” — if we stopped multinationals from outsourcing production to China and closed our doors to imports — even then, manufacturing employment would lag.

The reason is simple: we are spending less and less on goods and more and more on services. In 1969, American consumers were allocating half of all their spending on consumption to goods. By 2010, that share had fallen to one-third.”

Lawrence clearly wants people to believe that manufacturing jobs are declining because “we” just don’t buy much manufactured stuff anymore, or, in economic terms that there’s less demand for goods now than in the past. But that’s wrong, for a couple of reasons. First, goods are not only produced for household consumption, they are also produced for business and public investment, and for export. Second, and more importantly, the prices of goods have fallen relative to other types of products, so the goods share of total nominal (not inflation-adjusted) spending might fall, but the share in real (inflation-adjusted) spending might not follow. Or, to put it simply, people might have more TVs in their homes than ever before even while the share of their total income they spend on TVs has fallen. But, nobody would describe this state as a declining demand for TVs.

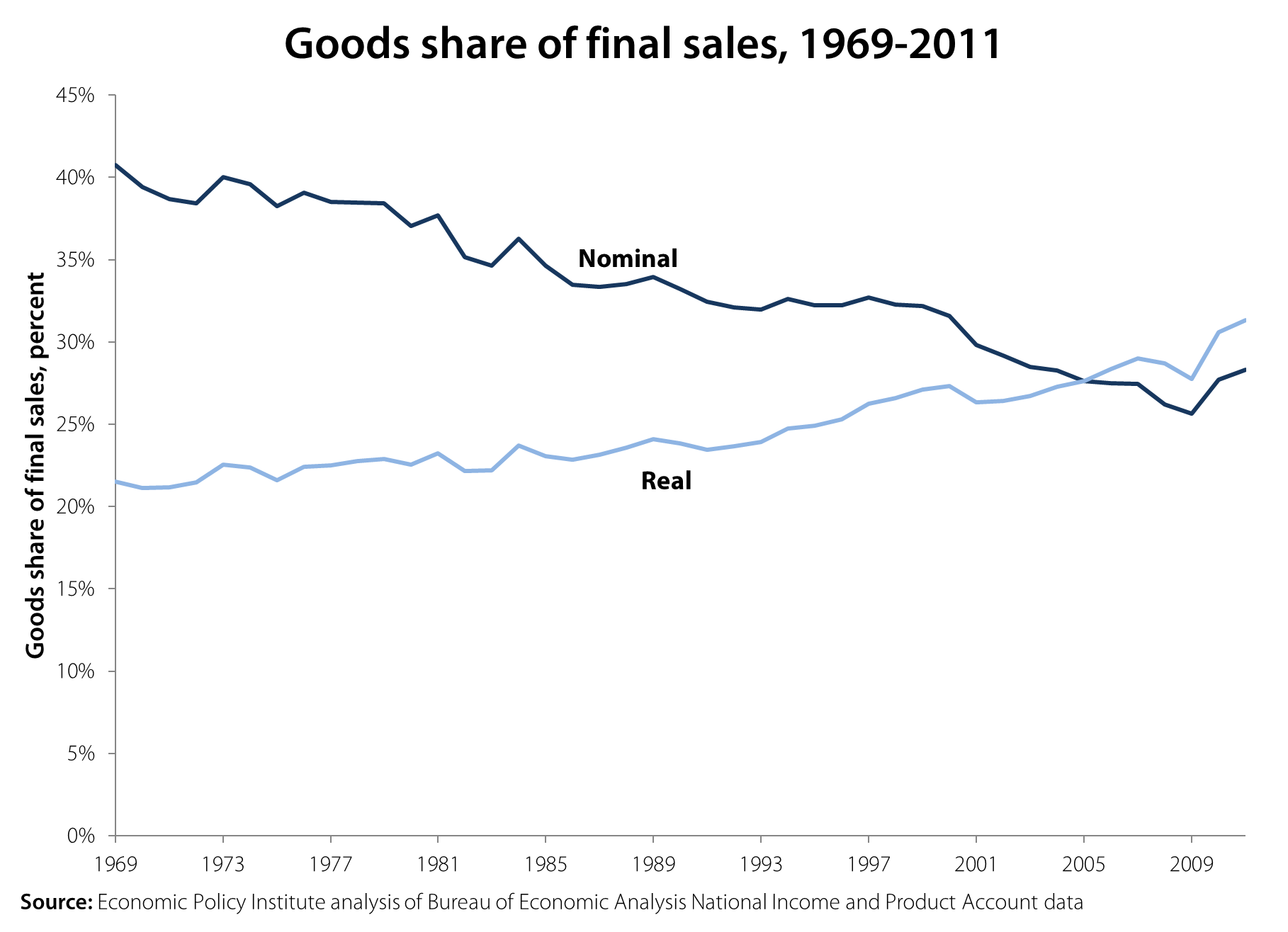

The following graph shows the share of goods in final sales of domestic products (the Bureau of Economic Analysis provides data on major types of products, dividing final sales into goods, services and structures. See NIPA Tables 1.2.5 and 1.2.6). The goods share of final sales in nominal terms did fall from 40.8 percent in 1969 to 28.3 percent in 2011, a roughly 30 percent decline in relative spending. However, the share of goods in real final sales actually rose 50 percent from 21.5 percent in 1969 to 31.3 percent in 2011. This means that the economy was even more goods-intensive in 2011 than in 1969 and that it was not a relative decline in the demand for goods that caused the shrinkage of manufacturing employment.

In the end, manufacturing employment is a horse race between demand for manufactured goods (which boosts jobs) and productivity (which, all else equal, means fewer jobs are needed in the sector). One thing that this analysis should remind us of is that even faster productivity has its upside: As prices fall because productivity rises in this sector, people demand more manufactured goods.

It should be noted, however, that neither Porter nor Lawrence denies that lowering the trade deficit would boost jobs. Rather, Porter says that even without any imports, manufacturing employment would lag. Lawrence, meanwhile, says that even without a trade deficit, goods employment would fall. In reality, closing the trade deficit would provide millions of jobs and boost the economy. For instance, my colleague Robert Scott has shown that growing trade deficits with China eliminated 2.8 million U.S. jobs between 2001 and 2010 alone, including 1.9 million jobs displaced from manufacturing. Similarly, correcting the currency imbalances with China, Hong Kong, Taiwan, Singapore, and Malaysia could add up to $285.7 billion (1.9 percent) to U.S. GDP, create up to 2.25 million jobs over the next 18 to 24 months (most in manufacturing), and reduce U.S. budget deficits by up to $71.4 billion per year.

Moreover, as Scott’s recent blog post notes, the recent recession was especially hard on manufacturing (we lost 2.3 million jobs between 2007 and Jan. 2010) and we can get those jobs back in a robust recovery.

So, sure, manufacturing employment will not return to 25 percent of employment. Nevertheless, we can gain a lot of manufacturing jobs by strengthening the recovery and through appropriate trade and currency policy. This would provide millions of good jobs, aid many communities, and be good for the nation. No head-fakes about household consumption shares should distract us from these facts.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.